MA1 has just announced the record date for a 30% cash dividend for 2023 (VND 3,000/share). The ex-dividend date is August 22, and with approximately 5.3 million shares outstanding, the company will need to pay out nearly VND 16 billion in dividends. The payment date is set for September 4, 2024.

Since 2019, MA1 has been consistently paying cash dividends to its shareholders, maintaining a 10% dividend ratio for three years from 2019 to 2021, before increasing it to 20% in 2022 and 30% in 2023, the highest ratio to date.

Moreover, according to the resolutions of the Annual General Meeting of Shareholders, MA1 shareholders approved the issuance of an additional 4.76 million shares as dividends for 2023, equivalent to a ratio of 90% (owning 100 shares will receive 90 new shares). The issuance is expected to take place in 2024, after obtaining approval from the State Securities Commission, with the specific timing to be decided by the Board of Directors. Following the issuance, the company’s charter capital will increase to over VND 100.5 billion.

As a result, the total dividend ratio for 2023 of MA1 reaches 120% (including 30% in cash and 90% in shares), requiring a total payout of nearly VND 63.5 billion.

In terms of business performance, from 2010 to 2023, MA1 consistently generated revenue in the hundreds of billions of VND every year, except for 2011 and 2021 when it fell short of this mark. The company’s average net profit reached VND 16 billion per year, with the highest profit of VND 42 billion in 2023, breaking the previous record of VND 31 billion in 2022.

It is understandable that MA1 decided to pay out a substantial dividend for 2023 following a record-breaking year in terms of profit. After allocating funds to various reserves and paying dividends, the company’s retained earnings amount to VND 33 billion.

| Business Results of MA1 from 2010 to 2023 |

Joint Stock Company of Equipment (MA1), established in 2006, primarily engages in the leasing of offices, factories, warehouses, and wholesale trading of various commodities. The company is headquartered in Mo Lao Ward, Ha Dong District, Hanoi, and employed 39 people as of the end of 2023.

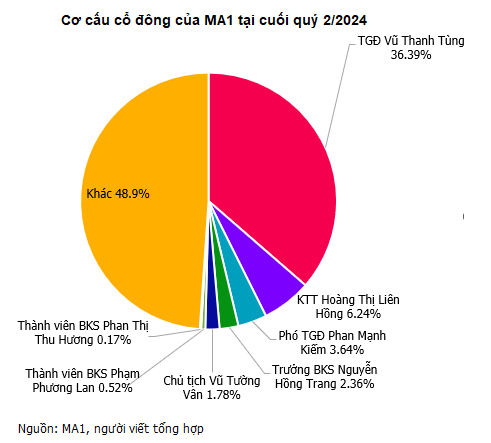

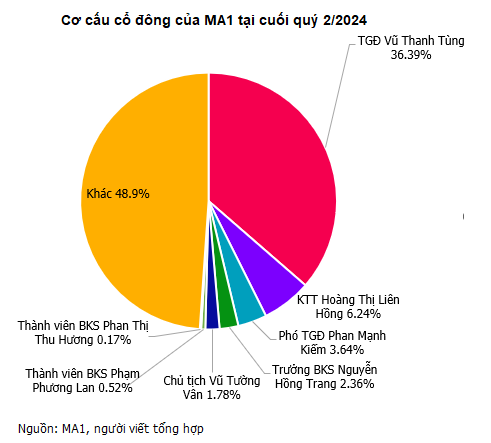

MA1‘s charter capital currently stands at nearly VND 53 billion. In terms of major shareholders, the family of General Director Vu Thanh Tung holds over 2.13 million shares (40.83% stake), with Mr. Tung personally owning 36.39% of MA1. Meanwhile, Chief Accountant Hoang Thi Lien Hong holds a 6.24% stake.

Additionally, several MA1 executives also hold a significant number of shares, ranging from a few thousand to a few hundred thousand. Notably, Deputy General Director Pham Manh Kiem owns over 193,000 shares (3.64% stake), and his wife, Bach Hong Que, holds 0.83% of MA1‘s capital.

Other key shareholders include Chief Inspector Nguyen Hong Trang with a 2.36% stake, Chairman of the Board Vu Tuong Van with a 1.78% stake, Board Supervisor Pham Phuong Lan with a 0.52% stake, and Board Supervisor Phan Thi Thu Huong with a 0.17% stake.

The concentrated shareholder structure has resulted in minimal trading activity for MA1 shares, except for two sessions on July 30 and May 15, which saw a sudden surge in matched orders of 22,000-25,000 shares. Since the end of July, MA1‘s share price has remained unchanged at VND 31,300 per share, the highest level since its listing on the UPCoM exchange in late 2020, representing a nearly 96% increase compared to the beginning of the year.

| Share Price Movement of MA1 since the Beginning of 2024 |