The VN-Index showed a decent recovery pace, but selling pressure emerged as negative news hit the market, causing the index to enter a correction phase starting July 10, 2024. By the end of July, the VN-Index slightly increased by 6.19 points (+0.5%) compared to June 2024.

According to the strategic report by BIDV Securities (BSC), foreign investors’ net selling pressure continued amid a slowdown in domestic individual investors’ cash flow. Although the VND/USD exchange rate tension eased, it remained at a high level.

BSC also assessed that the Q2/24 business results of enterprises were reflected in stock prices but lacked the momentum to push the market to impressive gains, given the lack of supportive positive news.

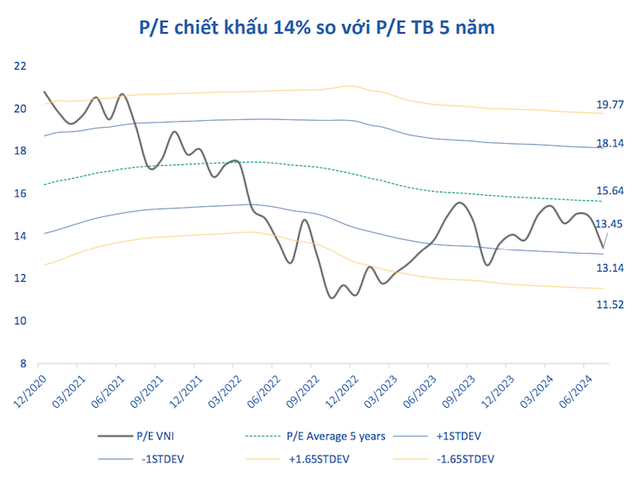

As per BSC, the VN-Index’s P/E ratio at the end of July 2024 was 13.45, a 14% discount to the 5-year average P/E and near the -1 standard deviation region. The July P/B ratio stood at 1.71 times. “The July correction brought the VN-Index’s P/E ratio back to a more attractive valuation region compared to June, offering an opportunity for medium-term investment portfolio accumulation,” the report emphasized.

BSC Research forecasts three scenarios for the VN-Index in 2024. In the negative scenario, the VN-Index approaches 1,200 points. In the base case scenario, the VN-Index reaches 1,298 points. In the positive scenario, the VN-Index targets 1,425 points, with the VN-Index’s P/E ratio expected to move within the 14.5 – 15.25 range.

Regarding liquidity, the average trading value on all three exchanges in July 2024 reached VND 19,368 billion/session, a 26.52% decrease compared to June. The sharp correction at the end of June made investors more cautious, leading to a decline in market liquidity in July 2024.

BSC stated that individual investors continued to net buy in July while foreign investors maintained consecutive net selling. The low-interest rate environment remained an attraction for individual investors’ cash flow into the market, absorbing foreign investors’ selling pressure.

BSC analysts noted that July 2024 was the sixth consecutive month of net selling by foreign investors this year, with a value of VND 8,282 billion. The total net selling value since the beginning of the year on the three exchanges reached VND -60,904 billion. Although the net selling pace has narrowed compared to June, there are no signs of it stopping. “In the context of the market adjusting to an attractive valuation region, along with expectations of positive signals in the stock market upgrade process by the management agency, this will create momentum for the return of foreign investors,” the report stated.

In terms of sector performance, Healthcare and Oil & Gas were the sectors with the highest performance in July 2024. On the other hand, Telecommunications adjusted after strong gains in previous months. Meanwhile, Real Estate, Banking, and Information Technology were the sectors that attracted individual investors’ cash flow in July. For foreign investors, Healthcare and Personal & Household Goods were the sectors with the most significant investment.