On September 18, Saigon Beer Joint Stock Company – Central Region (code SMB) will finalise the list of shareholders to implement the second 2024 interim cash dividend of 20% (equivalent to 2,000 VND per share). SMB expects to make dividend payments on October 3, 2024.

With nearly 30 million shares circulating, SMB is expected to spend 60 billion VND to complete the dividend payment to shareholders.

SMB specialises in brewing, distilling, and beverage production in the Central Highlands and South Central Coastal regions of Vietnam. The company has four subsidiaries, including manufacturing plants and trading companies in the provinces of Daklak, Binh Dinh, and Phu Yen. As of June 30, 2024, the Saigon Beer, Alcohol and Beverage Joint Stock Corporation (Sabeco, code SAB) is SMB’s largest shareholder, holding 9.6 million shares, equivalent to a 32% stake. Thus, Sabeco will receive approximately 19 billion VND in dividends.

SMB listed its shares on the UPCoM in September 2010 and later transferred to the HoSE in 2018. Since its listing on the stock exchange, this beer company has never failed to pay cash dividends to its shareholders. In June, the company paid an interim dividend for the first half of 2024 at a rate of 15%. With the completion of the second dividend, SMB shareholders have received a total cash dividend for 2024 of 35% – meeting the plan approved at the 2024 Annual General Meeting of Shareholders.

In terms of business performance, SMB’s revenue for the second quarter of 2024 reached approximately 364 billion VND, slightly lower than the same period last year. However, after-tax profit increased by 7% to over 60 billion VND.

For the first six months of the year, SMB recorded revenue of 691 billion VND and after-tax profit of over 84 billion VND, an increase of about 18% compared to the same period in 2023.

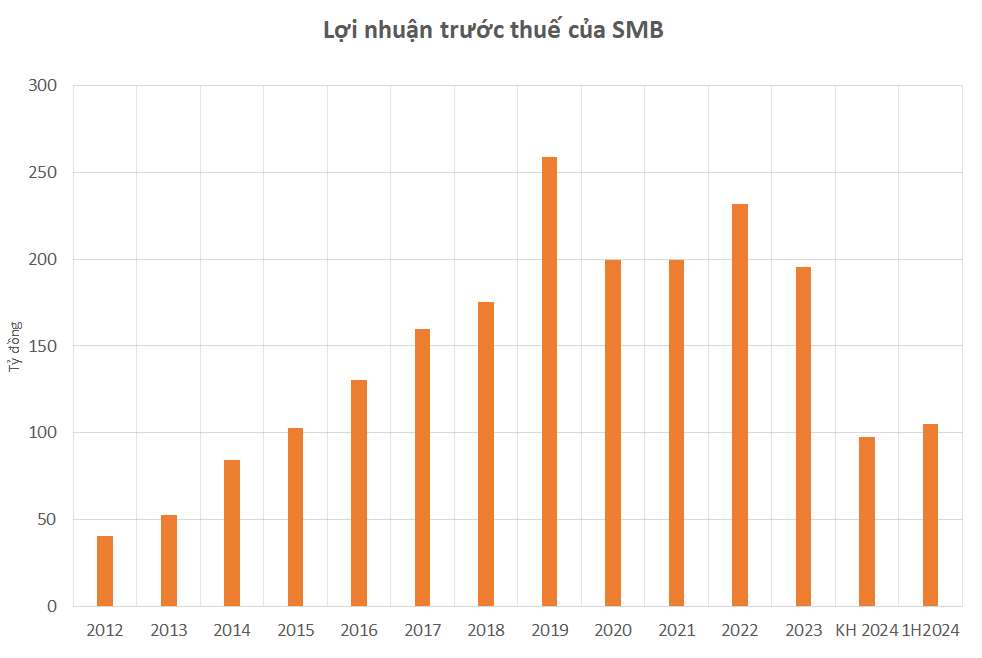

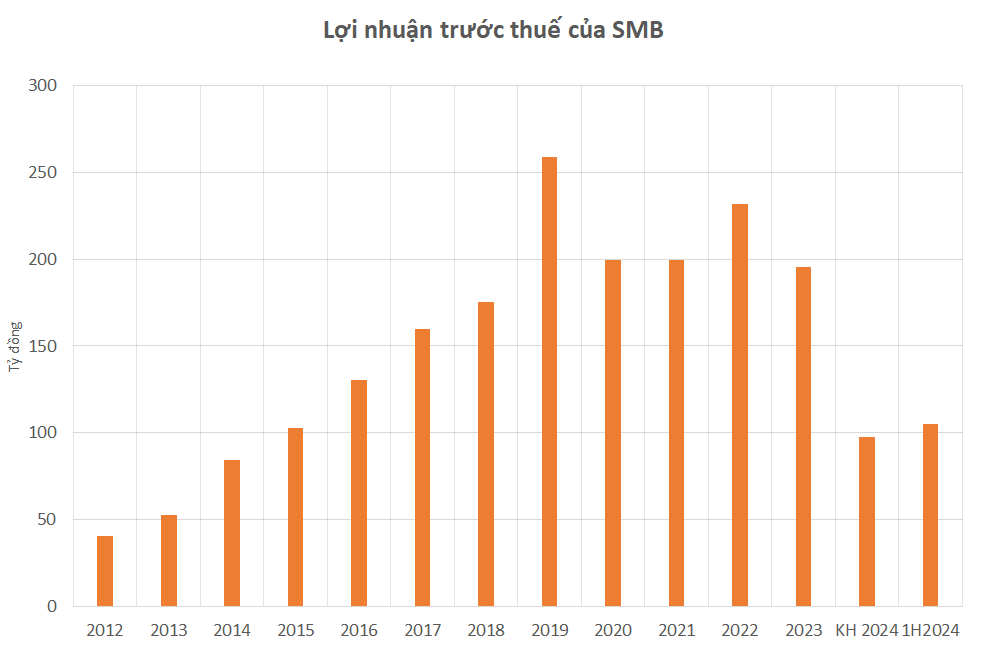

SMB typically sets conservative profit targets but consistently outperforms these goals. For 2024, the company aims for a total revenue of 1,379 billion VND, a 12% increase from the previous year. The profit before tax target is set at 97 billion VND, a decrease of nearly 48% from 2023. Thus, after six months, the company has achieved 50% of its revenue target and surpassed the profit goal.

As of the market close on August 8, SMB’s share price stood at 36,800 VND per share.