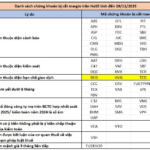

The Ministry of Finance has proposed a tax on all alcoholic beverages, fermented foods made from fruits and grains, and cocktails in their draft amendments to the Law on Special Consumption Tax submitted to the Government. Two options for calculating the special consumption tax for beer and liquor were proposed.

Option 1: The special consumption tax on beer and liquor above 20 degrees will increase from 2026 to 70%; 75% in 2027 and increase consecutively by 5% each year until 2030 to 90%. For liquor below 20 degrees, the tax will increase to 40% in 2026 and increase consecutively by 5% each year until 60% in 2030.

Option 2: The special consumption tax on beer and liquor above 20 degrees will increase to 80% in 2026 and increase by 5% each year until 100% in 2030. For liquor below 20 degrees, the tax will increase to 50% in 2026 and increase by 5% each year until 70% in 2030.

At a workshop on the “Draft Amended Law on Special Consumption Tax and the Beverage Industry” held by the Vietnam Chamber of Commerce and Industry (VCCI) in coordination with the Vietnam Beer-Alcohol-Beverage Association (VBA), VCCI’s Deputy Secretary General and Head of the Legal Department, Dau Tuan Anh, said that most enterprises agree with the obligation to pay taxes, but how the tax is imposed should be linked to the production and business situation of the enterprises. Therefore, the drafting agency and the National Assembly need to consider the context and the current difficulties faced by the beverage industry. A suitable roadmap for taxation is necessary.

According to Ms. Bui Thi Viet Lam, Country Representative of the US-Vietnam Business Council, the objective of the special consumption tax is not only to generate revenue for the state budget to ensure resources for socio-economic development goals but also to orient production and consumption and protect people’s health.

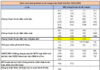

Speaking at the workshop, Ms. Tran Ngoc Anh, Senior Director of External Affairs of Heineken Vietnam, cited the World Bank’s 2024 Doing Business report, which projected that GDP growth in an optimistic scenario would reach 6.5% by 2026.

“Thus, we can see that four years after normalization following the COVID-19 pandemic, GDP growth has not reached the pre-pandemic level of 7.02% in 2019,” Ms. Anh said.

Accordingly, Heineken proposed that the tax rate for beer should be stable at 65% in the first three years from the effective date of the amended Law on Special Consumption Tax, and then increase by 3-5% every three years.

“We estimate that in 2026, with Option 1, when the tax rate increases by 5% higher than the current regulation, the selling price will increase by 10%. With Option 2, when the tax rate increases by 15% higher than the current regulation, the product price will increase by 20%. Therefore, any price increase in the current difficult period will lead to a decrease in output and a loss of state budget revenue,” Ms. Anh analyzed.

In addition, according to Heineken’s representative, based on the Laffer Curve theory, when the tax rate exceeds the optimal point, the goal of increasing state budget revenue will be seriously affected due to a significant drop in sales.

For example, in Belgium, in November 2015, the government increased the special consumption tax on spirits by more than 40%, expecting to collect an additional 128 million EUR in the first six months of 2016. However, due to a 33% drop in sales volume when the prices of spirits products increased by more than 20%, the government’s revenue did not increase. At the same time, consumers turned to buying spirits in Luxembourg and northern France. Sales in these areas doubled.

Similarly, in the UK, at the beginning of 2023, the government increased the tax on liquor. Liquor sales fell by 20%, and tax revenue from liquor decreased by 108 million GBP in just six months. By the end of 2023, the UK had stopped raising taxes. Australia also expected a loss of 170 million AUD in revenue when increasing the tax on liquor.

“We believe that the amended special consumption tax policy needs to refer to international experience,” Ms. Anh suggested.

From an international perspective, Ms. Bui Thi Viet Lam said that alcoholic beverages worldwide are taxed using different methods. When comparing special consumption tax rates in different countries, it is challenging to consider the tax rate and its proportion of the retail price due to variations in tax bases and other factors such as economic conditions, socio-cultural factors, people’s income, management policies, legal drinking age, import taxes, and informal products.

Therefore, depending on the conditions and circumstances, countries need to choose an appropriate method that is easy to apply, effective, and achieves the desired objectives. One factor to consider when increasing taxes is the situation of illegal alcohol in the world, the region, and countries close to Vietnam, which has led to budget shortfalls, health risks for consumers, and negative impacts on the business of legal enterprises.

According to Ms. Lam, it is necessary to comprehensively assess the impacts on direct and indirect objects and the economy and society to avoid negative, unintended, or even counterproductive consequences. In reality, increasing taxes will widen the gap between the benefits of formal and informal products, creating incentives for smuggling.

“It is recommended to carefully consider the impact of high and sudden tax increases, which can shock the market, severely affect businesses, the economy, and society, and potentially increase illegal products,” said Ms. Bui Thi Viet Lam.

Tax shocks occur when individuals or businesses face sudden changes in tax policies, significantly affecting their finances. This is an important issue in economics and public policy. The causes of tax shocks can arise when the government makes unexpected tax changes, such as increasing taxes, reducing tax exemptions, or changing regulations related to taxes.

Malaysia experienced tax shocks in 2014 and 2015 when the country consecutively increased the special consumption tax. The high and sudden tax increases in Malaysia did not help the government achieve its goals but instead created negative domino effects, resulting in a loss of government revenue, the closure of legal factories, and job losses for local workers.

In addition to the tax tool, it is necessary to accompany other tools such as strengthening anti-smuggling efforts, monitoring compliance with the law, and promoting consumer education.

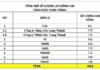

Craft Beer Shutdown Costs Quang Nam Province $20 Million in Annual Revenue

The closure of the Heineken plant in Quang Nam province will result in a significant loss of revenue for the region, according to local authorities. The province stands to lose an estimated 500 billion VND ($21.5 million) annually due to the plant’s shutdown. This development underscores the economic impact that large-scale manufacturing facilities can have on their surrounding areas, and highlights the importance of sustainable industrial policies and diversification strategies to mitigate such risks.