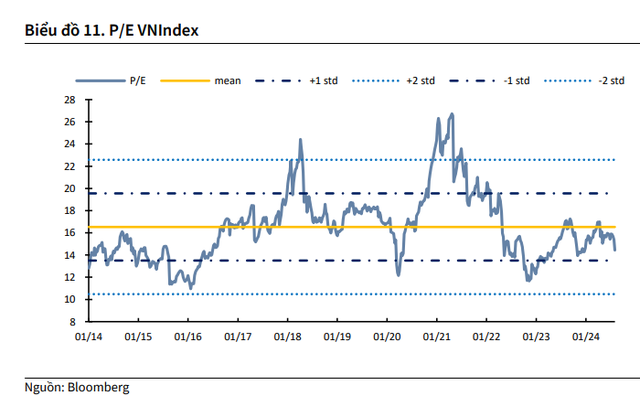

In its latest report, KBSV Securities noted that the current P/E ratio of the VN-Index is approximately 14 times (according to Bloomberg data), significantly lower than the two-year average of 14.9.

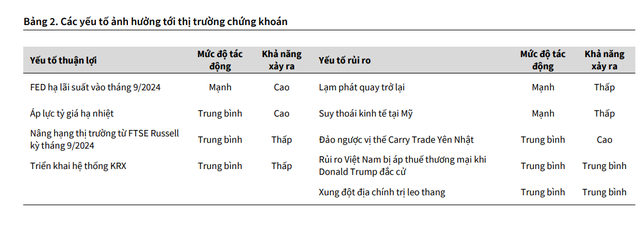

From a positive perspective, KBSV believes that maintaining low-interest rates will be a crucial supportive factor for domestic production, industry, investment, and consumption to recover. In the short term, the latter half of Q3 will be a vital period for establishing new expectations for the stock market.

According to KBSV, the macroeconomic data for July 2024 and Q2 2024 demonstrated the economy’s resilience, with many indicators showing promising signals, such as GDP growth, export turnover, IIP, and PMI. Correspondingly, corporate profits in Q2 recorded a healthy growth rate of around 12.4% year-over-year.

Additionally, Vietnam has taken more concrete steps to address issues in the FTSE Russell’s upgrade trajectory. However, the continuous delay in operating the KRX system could cause the Vietnamese stock market to miss the upcoming September evaluation.

How do external risks affect the Vietnamese stock market?

Regarding market risks, the analysis team evaluates that notable risk factors are external, such as the escalating conflict in the Middle East, which may negatively impact oil supply and freight rates, increasing the risk of a return to inflation.

Moreover, some weakening macroeconomic data in the US is deteriorating faster than expected, possibly indicating an early sign of a recession in that country. Specifically, the latest unemployment data showed an increase to 4.3% (above the expected: 4.1%) and reached its highest level since 2022. In this context, US consumer spending has not improved as anticipated, and the financial performance of large corporations (especially tech stocks) is disappointing investors, indicating a slowdown in the US economy.

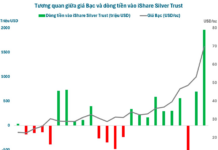

On another note, the surge in the Japanese Yen after the BOJ’s policy rate hike to 0.25% and the expected FED rate cut weakened the US dollar, triggering a position reversal (liquidation) among investors, who sold off their entire asset portfolio to repay Yen-denominated loans. Margin calls could increase the demand for the Yen to supplement margin requirements, creating a vicious cycle that further pushes up the Yen and triggers more margin calls.

Assessing the impact of these risk factors on the Vietnamese stock market, while geopolitical factors currently lack a solid basis for prediction, assessing the risk of a US recession will take more time. This is because the high unemployment rate is attributed to an increase in Americans joining the workforce and the July data being affected by Hurricane Beryl on the West Coast, according to many economists.

Furthermore, while a mild recession in the US would impact Vietnam’s export sector, it would positively affect the stock market in terms of exchange rates and the State Bank’s policy management.

“Lastly, the reversal of global investors’ Carry trade positions in the Japanese Yen, although it does not directly affect the Vietnamese stock market, as capital inflows from Japan to Vietnam are mainly through ODA funding, direct FDI, or strategic investments in financial institutions, the indirect impacts and psychological effects will need to be considered,” the strategic report stated.