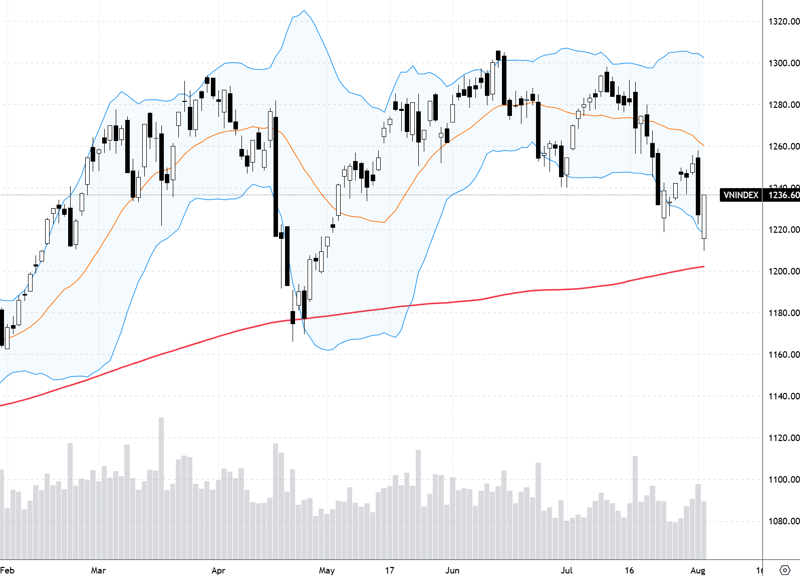

The Vietnamese stock market last week was heavily impacted by the turmoil in global asset markets. The 3.92% drop on August 5th was the biggest fluctuation in 2024, second only to the 4.7% drop on April 15th. The main cause of these fluctuations did not originate from internal factors.

Last week, investors were overwhelmed by negative information, especially analyses related to carry-trade activities in the Yen and the reversal of Japan’s interest rate policy. The violent sell-off reaction of various assets caused a sharp decline in global financial markets. Domestically, although foreign investors are not a major trading entity and the scale of net selling is not abnormal, a sell-off also occurred.

According to experts, the domestic market is in a phase without any particular information, and the buying of second-quarter business results has ended. So, when such unexpected information arises, the concern will naturally be very high. The initial strong reactions are believed to be due to investors not knowing what is actually happening and the impact of carry-trade positions is long-lasting or not.

The calmness of the global stock market in the following sessions helped the domestic market recover quite strongly. Experts also acknowledged that the panic selling on August 5th also had a positive effect, as a large number of stocks were cut losses, and margin decreased.

Although there is a fairly unanimous opinion that the biggest troubles affecting the psychology of the Vietnamese market have ended, there is still no consensus on the possibility of a bottom formation. Some cautious opinions still hold that the short-term technical recovery may last a little longer, and the market is still likely to adjust to test the bottom again. This adjustment phase is determined to be a great opportunity to accumulate stocks for the last months of the year.

Nguyen Hoang – VnEconomy

Global asset markets were shaken last week with sharp declines, reportedly due to the closure of Yen carry-trade positions as the currency appreciated. This is an abnormal phenomenon because all assets, from stocks to cryptocurrencies, gold, and oil, plummeted. How large is the scale of Yen carry-trade that it could have such a significant global impact? Has this pressure ended yet?

In my opinion, the session on August 5th was a washout session to get rid of margin and the panic situation of many investors who sold at a loss. Although liquidity was not really huge, it was almost 20% higher than the average volume of the last 20 sessions, along with a strong decline, so it also satisfied a washout session.

Nguyen Viet Quang

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Joint Stock Company

Yen carry-trade transactions have been accumulated for nearly 13 years and have increased rapidly in the last 2-3 years when the Fed raised interest rates while the Bank of Japan (BOJ) maintained negative interest rates. Up to now, it is estimated that carry-trade transactions could have reached 500 billion USD and are recognized as one of the largest transactions in the world, spanning into investment items worldwide, from real estate, stocks to the currencies of emerging countries.

Also, according to data from the Bank for International Settlements, cross-border Yen loans reached a record high of 1 trillion USD in April 2024. The influence of the US dollar has expanded significantly worldwide in recent years, being the main factor shaking the financial market in recent weeks.

However, at the moment, I think the liquidation pressure has somewhat eased when the estimates recorded nearly 40% of the positions have been closed in the last few weeks. In addition, the latest statements from BOJ said that it would not raise interest rates and continue to maintain an easing monetary policy if the financial markets are not stable. These factors will help ease the panic psychology of the financial market in the coming sessions.

Nevertheless, we also cannot deny that the risks in the financial market are increasing, especially geopolitical risks. Therefore, it is necessary to manage the portfolio cautiously at the moment when the market trend is not clear.

Nguyen Viet Quang – Director of Business Center 3 Yuanta Hanoi

It is impossible to determine the exact scale of carry-trade. Unlike stock transactions, currency transactions are not monitored centrally on an exchange. We can only estimate the scale of this activity. According to James Malcolm, a macro strategist at UBS bank, the USD-Yen carry-trade is estimated to have reached 500 billion USD at its peak. He estimated that about 200 billion USD of carry-trade reversed in the last 2-3 weeks, and the adjustment of the interest rate differential will continue. This will have some impact on the market in the coming time.

Le Duc Khanh – Director of Analysis, VPS Securities

Many investment funds and professional investors participating in the Japanese and American markets and worldwide have taken advantage of the low-interest rate period in Japan to borrow and invest in the US market. The scale of Yen carry-trade is quite large and has a significant impact, not only on stock trading activities but also on the psychology of stock selling in many developed stock markets, as seen in the early sessions of the previous week. I think this pressure may still exist in the US and Japanese markets but will not affect the Vietnamese market much when the positive outlook is still the dominant trend.

Nguyen The Hoai – Director of Dong Nai Branch, Rong Viet Securities

This is a big and broad issue, so it is difficult to assess fully and accurately, but we can evaluate it this way: The Yen fell to a very low level in 38 years (160 Yen/USD), causing the BOJ to raise interest rates. The Japanese stock market, consisting mostly of exporting enterprises, will be vulnerable. This double impact caused the Japanese stock market to plunge. Meanwhile, the Vietnamese stock market is dominated by the banking, real estate, and consumer sectors, and most of Japan’s investments in Vietnam are long-term FDI, so Japan’s interest rate hike has very little impact on Vietnam.

Nguyen Hoang – VnEconomy

The Vietnamese stock market is said to be not directly affected by the above fluctuations – the net selling of foreign investors is normal – and the shocking reaction only happened on the first day of the week when the VN-Index dropped by 3.92%. The next four sessions, the market gradually balanced. Could the first session be determined as a washout session, getting rid of margin, when liquidity was not too abnormal?

Nguyen Viet Quang – Director of Business Center 3 Yuanta Hanoi

In my opinion, the session on August 5th was a washout session to get rid of margin and the panic situation of many investors who sold at a loss. Although liquidity was not really huge, it was almost 20% higher than the average volume of the last 20 sessions, along with a strong decline, so it also satisfied a washout session. The fact that liquidity was not too strong is understandable when I assessed that the small and medium investors’ margin usage phase was not high recently.

Nguyen The Hoai – Director of Dong Nai Branch, Rong Viet Securities

I think many investors may have lowered their margin to manage risks when witnessing the strong volatility in the global and domestic markets. But from there, I also see that there is money waiting to buy when the market panics and stocks become attractive.

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Joint Stock Company

The market had a shocking drop at the beginning of the week, with a decrease of nearly 4%. I think this sharp drop was due to the combination of many factors, mainly from the negative developments of the world market, along with the index losing the psychological threshold of 1200 points and MA200, triggering a sell-off from investors, pushing the psychology to extreme panic with a series of floor stocks. The pressure to force margin liquidation was there, but I think it was not too much when the market trend in the last 2 months has not been favorable for investors to use a lot of margin.

I tend to think that the market will once again return to the April bottom (or break it). This recovery trend may last for 1-2 weeks, and now it has passed 1 week.

Nguyen Thi My Lien

Le Duc Khanh – Director of Analysis, VPS Securities

In my opinion, the factor affecting the Vietnamese stock market at the moment is the psychology of investors influenced by information and news. VN-Index has formed a bottom of 1200 – 1220 points and is likely to recover towards the area of 1250 – 1260 points in the next trading week. The deep drop session at the beginning of the previous week was also the bottom of this adjustment phase, and VN-Index will accumulate and gradually go up in the next phase. I assess that there will be no washout session in the next week when the psychology gradually stabilizes in the Vietnamese stock market, and the buying force will increase more than the selling force.

Nguyen Hoang – VnEconomy

The deepest drop of the session on August 5th brought VN-Index close to the April 2024 bottom. The subsequent recovery sessions repeated very low liquidity, reminiscent of the technical recovery sessions at the end of July. What do you think about the chance of bottom formation at this time? Is there a risk that the market will test the April bottom again?

Nguyen Viet Quang – Director of Business Center 3 Yuanta Hanoi

This recovery phase is different from the recovery phase in July: After the session dropped by 1.82%, the market had 6 consecutive recovery sessions but could not exceed the 1.82% drop candle. In this phase, after the session dropped sharply by 3.92%, it only took 4 sessions for the market to recover beyond the strong drop candle. This shows that the recovery momentum in this period is much stronger than in July.

The market usually forms a bottom in two ways: forming a 2-3 bottom model or a V-shaped bottom recovery, then accumulating and going up. In the last 2 years, I have noticed that the market’s bottom-forming phases always recover in a V-shape and then accumulate and go up. Currently, I assess that the probability of a V-shaped recovery is very high, so the possibility of “testing” the April bottom will be low.

Le Duc Khanh – Director of Analysis, VPS Securities

VN-Index has formed a bottom and confirmed the deepest bottom at the beginning of the previous week. The technical recovery sessions will then adjust in a narrow range again, possibly in the area of 1240 – 1260 points, and it will be difficult to drop to the area of 1200 – 1220.

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Joint Stock Company

I tend to think that the market will once again return to the April bottom (or break it). The market is recovering quite well after the sharp drop on August 5th. However, I think it is only a technical recovery after the market psychology fell into extreme panic, and the weak buying force, reflected in the low volume, supports this possibility. This recovery trend may last for 1-2 weeks, and now it has passed 1 week. Investors should pay attention to the possibility of large fluctuations in the coming week if the index continues to advance to the resistance area of 1240-1260.

VN-Index has formed a bottom and confirmed the deepest bottom at the beginning of the previous week.

Le Duc Khanh

Nguyen The Hoai – Director of Dong Nai Branch, Rong Viet Securities

I think the market can still test the old bottom, but the possibility is not high. If this happens, it will be a great opportunity to accumulate stocks for the last 6 months of the year.

Nguyen Hoang – VnEconomy

Last week’s fluctuations did not originate from the internal factors of the Vietnamese stock market but had a significant negative impact on stock prices. This shows that investors are strongly influenced by a lot of information from the outside, which the domestic market has ignored for a long time. Why did investors’ psychology suddenly have such a large correlation? In your opinion, what should investors do at this time?

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Joint Stock Company

I think it is understandable that investors are cautious about observing the developments in the world market when the business results season has passed, and the market has fallen into an information gap. Moreover, the reality is that the information from the outside world is indeed very heavy and widespread. We can see that in the past week, from the Asian market to Europe and the US, they all went in the same downward trend.

Information related to policies and geopolitics will directly and indirectly affect most economic activities in general and the foreign investors’ capital flow in particular. Vietnam is also going through a leadership transition period in the context of a tense world. Therefore, in my opinion, investors should maintain a cautious attitude, maintain a high cash ratio, and limit buying.

There is a bright spot, in my opinion, which is the government’s determination to continuously introduce supportive policies for the economy, from increasing the basic salary to reducing interest rates by the State Bank recently. Therefore, I believe the market will soon find a balance in the coming time, possibly around the level of 1160 – 1180 points.

At this point, we should focus on finding stocks with growing business performance in the second half of the year, attractive valuations, and allocate a reasonable ratio between cash and stocks (50% cash and 50% stocks, for example)

Nguyen The Hoai

Nguyen Viet Quang – Director of Business Center 3 Yuanta Hanoi

The phase of reporting second-quarter business results did not positively affect the general market, and this phase, the market entered a