Once a specialty of Saigon, the intense flavor of Phuc Long tea has now become a “misstep” in the bubble tea market of the 2010s. During that time, foreign brands such as Royal Tea, Dingtea, and Gong Cha dominated the scene, with long lines of customers waiting to get their hands on sweet cups of tea, creamy foam, and tapioca pearls.

In the early days of bubble tea, few could have imagined that this colorful drink, once labeled as “full of chemicals” and a mere passing fad, would evolve into a nearly $3.7 billion market in Southeast Asia by 2022, according to Momentum Works.

Like many other F&B trends, the era of ubiquitous bubble tea shops in the 2010s has passed. However, another “underground” wave seems to be emerging in the market.

People are talking about how young people flock to Tong Dan Street in Hanoi, lining up as early as 4 am to indulge in Phê La’s tea—a brand that ignited the fever for strong-flavored tea. La Boong, a year-old tea brand, has already opened nearly 100 branches.

The pioneer of this strong-flavored tea trend is actually Phuc Long, which has been in the business for almost two decades. Around 2022, this renowned Saigon tea brand finally caught the attention of the Masan food empire. The corporation, owned by billionaire Nguyen Dang Quang, invested $280 million to acquire 85% of Phuc Long’s shares, making it the most prominent M&A deal in the domestic F&B market.

“Starting as a brand that sold tea and coffee ingredients, Phuc Long’s venture into the F&B industry to boost its core business inadvertently led to success,” said F&B expert Nguyen Thai Binh, COO of HT House, a company that manages and develops mid-range and high-end restaurant chains.

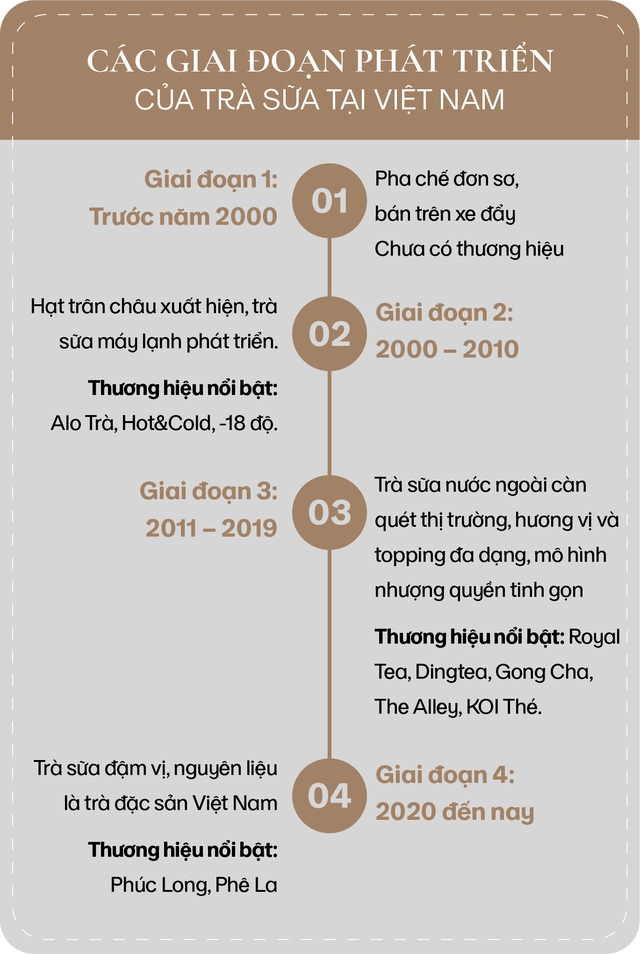

When the topic of bubble tea is brought up, Mr. Binh, an 8x generation born and raised in Ho Chi Minh City, reminisces about the pre-2000s. The early days of bubble tea in Vietnam were quite simple, sold from street carts.

In the early 2000s, along with the wave of Taiwanese idol dramas, tapioca pearls were introduced to the market and gradually became popular, leading to the development of domestic brands. This marked the transition of bubble tea from the streets to air-conditioned shops.

“Students of the 8x generation would hang out in these shops, not just for the tea but also as a gathering place during lunch breaks before afternoon classes. Notable brands at that time included Alo Tra, Hoa Huong Duong, Hot&Cold, -18 Degrees, and H2T,” Mr. Binh recalled.

However, a severe incident in 2008 significantly impacted the bubble tea market. The melamine-tainted milk scandal in China raised concerns about food safety, making consumers more cautious and attentive to the ingredients in their bubble tea.

Consequently, bubble tea shops became deserted, forcing many to close down or barely survive. Mr. Binh believes that the second phase of bubble tea development in Vietnam ended around 2010.

Bubble tea made its comeback around 2011, and this time, it swept through the beverage market, creating a frenzy not only in major cities but across the country.

Famous foreign brands, mainly from Taiwan, joined the market and gradually dominated it. Notable names include Royal Tea, Dingtea, Gong Cha, KOI Thé, Boba Pop, The Alley, and Tiger Sugar. With more diverse and appealing flavors than the previous phase, young people fell into a “sweet addiction” to bubble tea.

Toppings also became a crucial factor, creating a unique selling point for each brand and making it hard for customers to “kick the habit.” Royal Tea is synonymous with its creamy cheese foam, KOI Thé with its golden tapioca pearls, and The Alley with its trendsetting brown sugar tapioca pearls.

In addition to shaping consumers’ palates and making them accustomed to drinks blended from tea leaves, fruit, and milk, these foreign brands introduced the modern chain model to the market. They opened numerous small branches to optimize costs and develop width-wise, placing shops in shopping malls.

2017 can be considered the pinnacle of the third phase of bubble tea development in Vietnam.

According to media reports in October 2017, within a one-kilometer radius of major universities in Hanoi, such as Hanoi National University, Hanoi University of Education, and the Academy of Journalism and Propaganda, there were 30 bubble tea shops of various brands. Ho Chi Minh City also formed “bubble tea streets” on Huynh Thuc Khang, Ngo Duc Ke, and Ho Tung Mau.

Each cup of bubble tea cost between 40,000 and 80,000 VND, significantly more expensive than a cup of coffee, yet customers patiently queued at famous shops. Bubble tea had elevated its status in consumers’ minds, no longer just a “teen drink” but also a “tea time” habit for many office workers.

However, since 2018, after a period of rapid growth with thousands of bubble tea shops sprouting up everywhere, the market became saturated.

“Customers grew tired of the homogeneity in bubble tea flavors, as they were all sourced from the same imported ingredients and prepared similarly. Aside from tea, brands only competed based on convenience by opening more outlets and offering various toppings,” observed expert Nguyen Thai Binh.

Foreign bubble tea brands gradually scaled down, and many shops had to vacate their premises as customer footfall decreased on bubble tea streets. The third phase of bubble tea development was almost over by 2019.

It seemed like Covid had indirectly ended the bubble tea craze, similar to how it affected “sidewalk lemon tea” or “seven-level spicy noodles.” But this turned out to be just an intermission before the market entered a new “addiction” called strong-flavored oolong tea.

“All changes and innovations in R&D (research and development) primarily aim to address operational issues. During the research process, products are tested with customers, stabilized, and then added to the menu. For prominent brands, they shape trends in the market.

A trend cannot be sustained for just 1-2 years. For a product to become a trend, it has already been extensively researched and then commercialized over time,” said Mr. Binh.

To explain why many bubble tea shops now add the words “strong flavor” to their slogans, the expert traced back to 2005 when the Phuc Long brand opened one of its first beverage stores on Mac Thi Buoi Street in Ho Chi Minh City. This marked Phuc Long’s official entry into the F&B retail industry, shifting from solely selling tea and coffee ingredients.

By 2010, this store started selling bubble tea, but with a unique preparation method compared to the market. “Phuc Long used strongly brewed tea kept in a thermos. When a customer placed an order, the staff would take out the tea concentrate and froth it with an espresso machine’s frother, blending it with syrup, milk powder, and condensed milk,” Mr. Binh explained.

This innovative preparation method, combined with high-quality “homegrown” ingredients, made Phuc Long’s bubble tea stand out from the competition. This also marked the beginning of using a frother to prepare strong-flavored bubble tea.

In addition to Phuc Long’s approach, Mr. Binh mentioned two other methods. The first is using cold-brewed tea to extend its shelf life, but still employing a frother to blend the ingredients. The second method is teapresso, or tea brewed with a machine.

“Phê La, the brand considered the ‘flashpoint’ of the strong-flavored tea craze, uses both hot and cold-brewed tea and offers four preparation methods. Phuc Long and Phê La have created a unique flavor profile for Vietnam, ushering in an era of specialty tea,” Mr. Binh assessed.

In an interview in December 2023, entrepreneur Nguyen Hanh Hoa, the founder of Phê La, shared that she started the brand with the slogan, “We sell Oolong Specialty,” as a clear and confident statement about the unique path Phê La was taking—bringing specialty oolong tea to customers. The idea for Phê La originated from her visit to the ingredient-producing region in Bao Loc, Lam Dong, which manufactures high-quality specialty teas in Vietnam, 90% of which are exported.

Now, it would be an understatement to call Phê La’s path a “niche market,” as the brown paper cups resembling Phê La, selling strong-flavored oolong tea, are becoming increasingly popular.

In Mr. Binh’s view, a trend cannot be deemed sustainable within just 1-3 years; it requires 5-10 years to prove its longevity.

“According to the natural order, a ‘trend’ will be born, expand, and then decline to make way for a new cycle. I believe that strong-flavored tea is currently in the early stages of being born and amplified,” the expert shared.

This new wave has also inspired Vu Viet Anh, an F&B entrepreneur with over a decade of experience, to embark on a new journey by establishing the La Boong oolong tea brand. “We recognized the demand for strong-flavored tea in the market after Phuc Long and Phê La shaped consumers’ palates. Vietnam also has a readily available source of tea ingredients from highland regions like Bao Loc. So, we are riding this market trend,” shared Mr. Vu Viet Anh, La Boong’s founder.

Established in July 2023, La Boong already has nearly 100 outlets and aims to reach 130-140 by the end of this year. With oolong tea as the main ingredient, La Boong’s drinks range from 25,000 to 50,000 VND, with the most popular option being 35,000 VND (excluding toppings).

According to founder Vu Viet Anh, La Boong’s competitive advantage lies in its lean business model, easy customer access, and affordability, aligning with the characteristics of bubble tea as a quick drink that is mostly taken away. The franchising model also accelerates the pace of expansion.

Sharing La Boong’s current performance, Mr. Viet Anh revealed that the chain sells approximately 15,000 cups daily, with tea consumption measured in tons per month.

Analyzing La Boong’s approach, he pointed out that oolong tea or brown sugar tapioca pearls are “keys” that unlock the bubble tea market. La Boong has chosen oolong tea as its primary “key” and develops products that cater to the market in different phases.

“Taste preferences for tea tend to change every 3-5 years. In each phase, a few brands truly stand out and rise to the top of the market, such as Dingtea and The Alley during the foreign bubble tea craze. These brands remain resilient even when the ‘trend’ cools down. Every period has its shining stars that leave a lasting impression on customers,” shared Mr. Viet Anh.

“I can confidently say that bubble tea is no longer just a ‘trend’ but has become an integral part of the market, just like coffee,” emphasized the founder of La Boong.

Bubble Tea with Shrimp Paste: A Harmful Food Trend

Milk tea mixed with shrimp paste has become a trending topic on social media, but experts warn of its potential health risks.