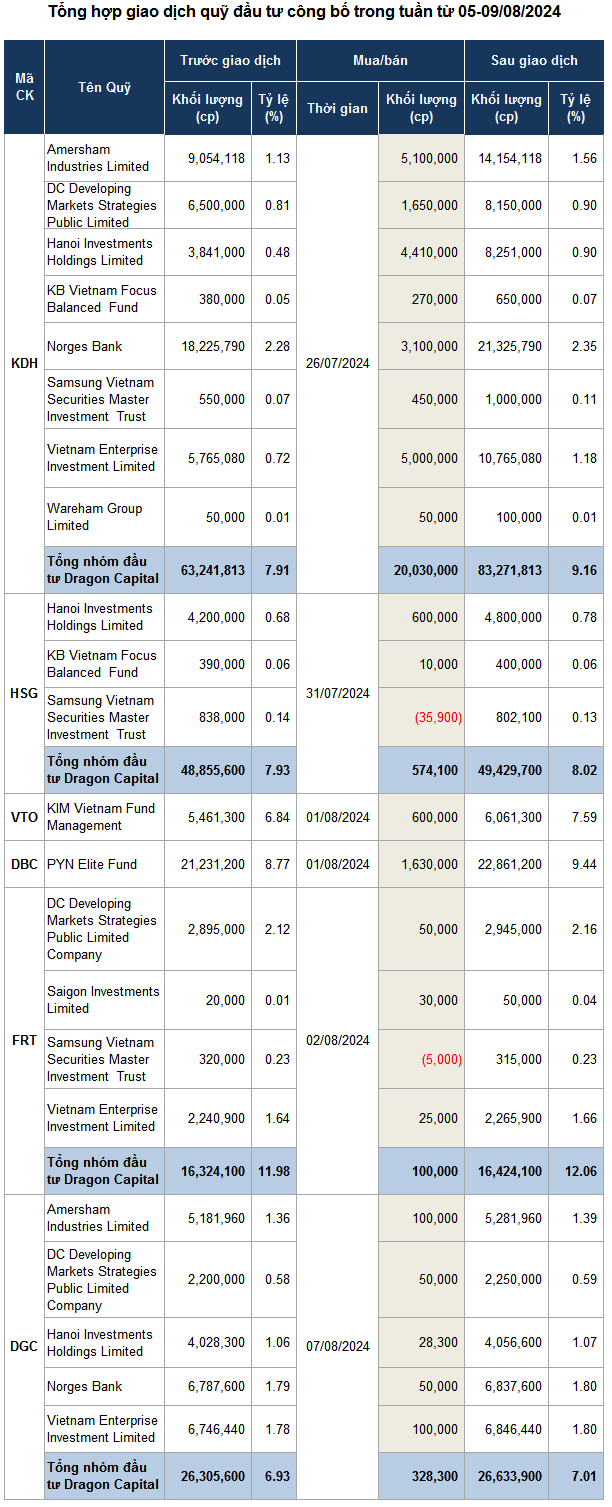

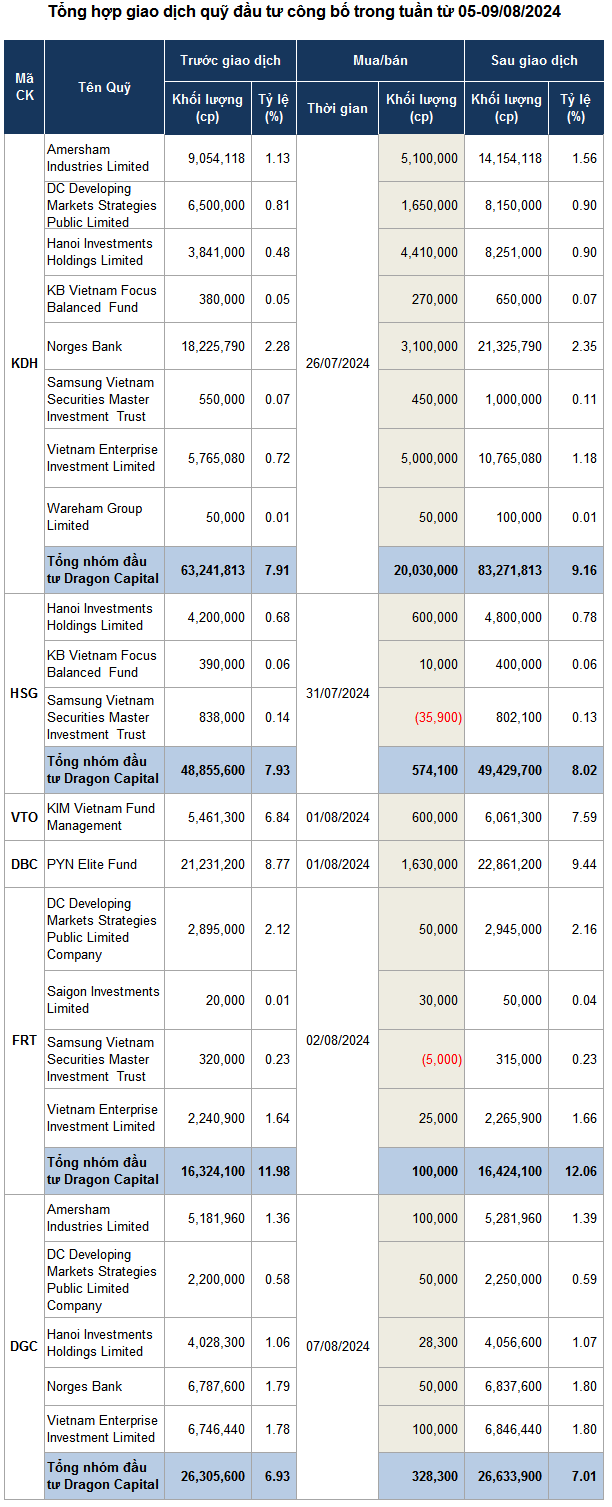

Specifically, in the August 7 session, Dragon Capital purchased an additional 328,300 DGC shares (of Duc Giang Chemical Group Joint Stock Company), bringing its total holdings to nearly 27 million shares, or over 7% of capital.

| DGC share price movement from the beginning of 2024 to the session on August 9 |

Temporarily calculated at the closing price of VND 106,000 per share on August 7, the group of funds spent approximately VND 35 billion.

At the beginning of April this year, Dragon Capital Fund purchased an additional 150,000 DGC shares, increasing its holdings to 19.1 million shares, or 5.03% of capital. As a result, Dragon Capital returned to being a major shareholder of Duc Giang Chemicals from April 9.

Since then, the foreign fund group is estimated to have net purchased more than 7.5 million DGC shares, raising its ownership above the 7% threshold.

The net buying action by the foreign fund for the shares of this chemical industry giant took place in the context that the market price of this stock has been continuously increasing since the end of April 2024 to the peak of VND 131,800 per share (session on June 21) and then faced correction pressure, bringing the price down to VND 106,500 per share (session on August 9). However, compared to the beginning of the year, DGC shares still increased by more than 12%.

Reviewing notable transactions in the previous week, Dragon Capital reported purchasing more than 20 million KDH shares (of Nha Khang Dien) in the session on July 26, and PYN Elite Fund purchased 1.63 million DBC shares (of Dabaco Vietnam Group Joint Stock Company) in the session on August 1.

| KDH share price movement from the beginning of 2024 to the session on August 9 |

The transaction of the Dragon Capital fund group was part of a private placement by Nha Khang Dien, raising its ownership to 9.16%, equivalent to 83.3 million shares.

| DBC share price movement from the beginning of 2024 to the session on August 9 |

Meanwhile, PYN Elite’s purchase of DBC shares was made via matching orders on the exchange, thereby increasing its ownership in this company to 9.45%.

Source: VietstockFinance

|

Dragon Capital Acquires Additional 3 Million HSG Shares from Hoa Sen Group

Dragon Capital has recently acquired an additional 3 million shares of HSG, increasing its ownership stake in Hoa Sen Group to over 11.3%.