The special consumption tax rate for alcoholic beverages has been continuously increasing since 2008. Specifically, the tax rate for spirits above 20 degrees has increased by 20%, from 45% to 65%. For spirits below 20 degrees, the increase was 10%, from 25% to 35%, and for beer, the tax rate went up by 20%, from 45% to 65%.

During this same period, according to statistics from the Institute of Economics and Policy Research (VEPR), the state budget tripled, and the proportion of special consumption tax in the total state budget revenue increased from 5.8% to 8.8% in 2023. This contributed significantly to sustainable budget revenue growth. As most of the special consumption tax comes from large corporations and factories, the state budget revenue is relatively concentrated and stable.

INABILITY TO CONTROL ILLEGAL ALCOHOL

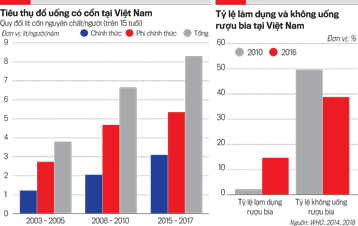

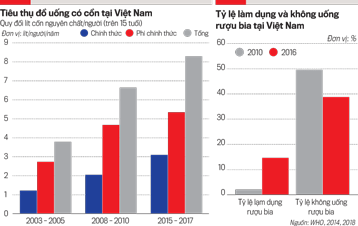

Despite the continuous increase in special consumption tax rates for alcoholic beverages, a study published by the Central Institute for Economic Management (CIEM) showed that over a ten-year period (2005–2015), the per capita consumption of alcoholic beverages doubled, and the proportion of people abusing alcohol (consuming at least 60 grams of pure alcohol at least once a month) among the total population increased tenfold.

This raises the question of whether the management policies for alcoholic beverages in general and the special consumption tax policies in particular are achieving their intended goal of regulating social consumption.

Recently, Mr. Tran Hau Cuong, Director of Hanoi Liquor and Beverage Joint Stock Company (Halico), shared that the increase in special consumption tax rates for spirits in recent years, from 30% to the current 65%, may not have the desired effect of reducing alcohol consumption and protecting consumers’ health.

“From our observations, every time the tax is increased, consumers tend to shift towards using illegal or counterfeit alcohol,” said Mr. Cuong.

During a recent market survey in the North, Halico’s management found that many private supermarkets and liquor stores were selling half-liter bottles for only VND 18,000, even though they still had labels, but not the electronic stamps issued by the General Department of Customs and the General Department of Taxation.

Halico’s leadership confessed that the biggest challenge for the alcohol industry is unfair competition between legitimate businesses that pay taxes in full and those that evade taxes.

As a long-established alcohol producer in Vietnam, with 120 years of experience and having gone through many ups and downs, Mr. Cuong believes that the current period is the most challenging for businesses in the industry, especially after the Covid-19 pandemic, as consumer spending has decreased significantly.

“Regarding the tax increase roadmap, we need to consider an appropriate timeline and adjust the increase rate accordingly. Our calculations show that by 2030, a reasonable tax rate for spirits above 20 degrees would be 80%, and for those below 20 degrees, it would be 50%, representing a 15% increase compared to the current regulations.

More importantly, the government needs to pay more attention to protecting consumers’ health. Instead of solely relying on tax increases, two immediate solutions should be implemented: enhancing quality control and intensifying education and propaganda. These measures will ensure that the alcohol produced is of higher quality, and consumers have access to standard-compliant products. Additionally, consumers should be educated about quality alcohol and encouraged to drink responsibly, ensuring their health and well-being, as well as their responsibilities to themselves, their families, and society. By doing so, the alcohol industry can achieve sustainable development in the coming years.”

Market management agency representatives also argued that the significant differences in tax rates, compliance costs, and other factors between legal and illegal alcohol create a substantial price gap between legal and illegal products. This incentivizes illegal profit-seeking activities and leads consumers to choose cheaper and more convenient options without considering quality. As a result, the situation of “bia cỏ” (low-quality, illegally produced beer) and “rượu nút lá chuối” (illegally produced liquor packaged in banana leaf-covered bottles) may reoccur.

In the first half of 2024, the General Department of Market Management (under the Ministry of Industry and Trade) handled 153 cases related to illegal alcohol, with a total fine of VND 1.5 billion and confiscated 18,671 bottles and 14,682 liters of alcohol. For illegal beer, they handled 38 cases, with a total fine of VND 587 million and confiscated 16,239 cans.

While these results are noteworthy, according to the General Department of Market Management, the inspection and supervision forces are still thin, and there is a lack of coordination among relevant agencies, allowing illegal alcohol to continue to flourish.

ASSESSING THE SHIFT TO THE INFORMAL SECTOR

Currently, there are proposals to further increase the special consumption tax on alcohol and beer according to the roadmap. In the draft Law on Special Consumption Tax (amended), the Ministry of Finance also plans to include sweetened beverages according to Vietnamese standards (TCVN) with a sugar content of more than 5g/100ml as objects subject to the special consumption tax.

Commenting on the proposal to increase the special consumption tax to a high level and continuously on alcohol and beer, as consulted by the Ministry of Finance, Ms. Nguyen Thi Cuc, a senior tax expert and Chairman of the Vietnam Tax Consultants’ Association (VTCA), said that the tax increase policy might not be as effective as the goal of the special consumption tax.

“Increasing taxes will raise prices and may curb alcohol and beer production, but it may not necessarily achieve the goal of reducing alcohol and beer consumption and limiting the harm caused by drinking to people’s health. In reality, high tax rates can lead to an increase in smuggled goods, and consumers with higher incomes may switch to drinking smuggled alcohol and beer,” Ms. Cuc assessed.

Moreover, consumers in rural areas with lower incomes are more likely to shift to self-supply and self-sufficiency, selling for profit by distilling their alcohol and mixing their drinks. They do not pay special consumption taxes and do not ensure product quality, affecting people’s health. As a result, the goal of curbing consumption and ensuring community health becomes challenging to achieve.

Regarding the proposal to include sweetened beverages in the objects subject to the special consumption tax, the Chairman of the Tax Advisory Association suggested that careful consideration is needed when including sweetened beverages in the taxable objects. It is also necessary to consider the appropriate sugar content, whether it should be 5g/100ml or 7 or 8g/100ml as practiced in some countries. Additionally, the possibility of consumers switching to other difficult-to-control products, such as syrups and milk tea, should also be taken into account…

https://postenp.phaha.vn/chi-tiet-toa-soan/tap-chi-kinh-te-viet-nam

Craft Beer Shutdown Costs Quang Nam Province $20 Million in Annual Revenue

The closure of the Heineken plant in Quang Nam province will result in a significant loss of revenue for the region, according to local authorities. The province stands to lose an estimated 500 billion VND ($21.5 million) annually due to the plant’s shutdown. This development underscores the economic impact that large-scale manufacturing facilities can have on their surrounding areas, and highlights the importance of sustainable industrial policies and diversification strategies to mitigate such risks.