Unlike public relations (PR), investor relations (IR) is not about painting a grandiose picture of a company’s image. Instead, it’s about providing investors with transparent, accurate, and timely information about the company’s current state, including both good and bad news, as well as its future prospects. In the context of a declining stock market and challenging business environment, effective IR can help companies operate more efficiently and access investment capital more easily.

EFFECTIVE CAPITAL RAISING IN THE MARKET

According to analysts, companies with strong IR practices will attract more analysts to cover their business and support their growth. Transparent disclosure of operational and governance information builds trust and a positive reputation with investors, making it easier for companies to raise capital when needed.

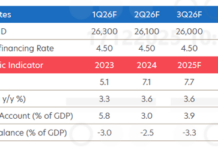

Mr. Nguyen The Minh, Director of Research and Product Development at Yuanta Securities Vietnam (YSVN), provided the following analysis: “The yield on 10-year US Treasury bonds has remained below 4% since the late 2000s, but in 2020, this indicator started to show a strong upward trend and exceeded 4.3% at the end of last year. In the long term, interest rate trends in Vietnam and the US are usually aligned.”

At the same time, companies and banks tend to prioritize capital raising in USD, so interest rates in the world’s largest economy will impact capital costs in Vietnam. Therefore, if businesses continue to rely on debt leverage and borrowed capital, they will face increasing repayment pressure.

Looking at the domestic market, the period of cheap interest rates is also coming to an end. Specifically, the overnight lending rate in the interbank market has remained stable at a high level of about 4.6% per annum over the past month. Meanwhile, the interest rate for State Bank bills and collateralized lending in the open market is 4.5%. If exchange rate pressure continues to increase in the second half of the year and system liquidity tightens, the regulator is likely to raise interest rates soon.

“Therefore, companies should prioritize raising capital in the stock market, from investors and their shareholders. This will help improve and optimize capital costs because the era of low capital costs is over,” said Mr. Minh.

MAINTAINING REGULAR IR ACTIVITIES

IR activities are difficult to quantify, but they have long-term effects and need to be carried out consistently. IR demonstrates the responsibility of listed companies in disclosing information to shareholders.

A survey conducted by the Stock Exchange of Thailand found that 75% of investors agreed that adequate information disclosure increases trust in the management, improves the company’s access to capital (63%), attracts long-term investors (60%), enhances stock prices (57%), and increases the number of analyst reports (54%).

“IR is not just about disclosing positive information and staying silent on the negatives. This activity needs to be carried out regularly, not just during certain seasons,” said Mr. Minh. “In reality, the market has witnessed cases where companies choose to remain silent when negative news arises. As a result, speculative funds and individual investors tend to sell off their shares, causing a significant decline in stock prices.”

This has been proven in many companies listed on the market. In practice, companies that focus on IR tend to have a more favorable business performance; even in times of crisis, their stock prices can recover quickly after a short decline.

A case in point is the French energy company Total Energies. In 1999, the company acquired its rival Petrofina but chose not to disclose this information to investors, opting for silence instead. This lack of transparency immediately led to a 22% drop in Total Energies’ stock price.

Learning from this experience, when the AZF plant in Toulouse exploded in 2001, Total promptly responded by communicating information from the authorities to the public and investors and taking responsibility. As a result, Total’s stock price remained unchanged, and the company’s image was not negatively affected by this tragedy.

“It takes 20 years to build a reputation and five minutes to ruin it.” – Warren Buffett

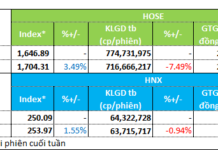

In Vietnam, with nearly 1,000 companies listed on the two stock exchanges (HSX and HNX), investors have a wide range of choices. Therefore, companies that do not prioritize IR may struggle to attract investors.

On the other hand, most companies consider IR merely uploading financial reports to their website without adequately explaining their business and investment activities. As a result, information accessibility for investors and shareholders is not optimal. Consequently, these companies experience a reduction in engagement with potential stakeholders, especially institutional investors, who have substantial financial resources and can accompany the company in the long term.

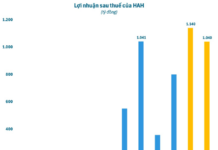

For example, a Vietnamese company that previously did not invest much in IR started allocating time and resources to improve their IR practices in May 2020. As a result, the average liquidity of their stock increased threefold after a year and is now 25 times higher. The number of shareholders is now 23 times higher than when they started focusing on information disclosure. Consequently, capital raising for investment and business development has become more accessible, and the company is less reliant on debt.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.