Buy VNM with a target price of VND 83,831/share

VCBS, a leading securities company in Vietnam, has provided a positive outlook for the country’s food and beverage industry. In the first two quarters of 2024, Vietnam’s GDP grew between 5.9-6.9% year-on-year, indicating improving consumer spending. The country’s retail sales reached VND 2,397 trillion in the first half of 2024, a 1% increase, with the fast-moving consumer goods sector growing by 1.8%. While the dairy sector saw a decline of 1.8%, this decrease is showing signs of narrowing.

Additionally, SMP milk powder prices decreased by 1-7% year-on-year, while WMP milk powder prices experienced a slight growth of 1-7% in the first seven months of 2024. VCBS predicts that milk powder prices will continue to fall due to high milk powder production in Europe.

Vietnam Dairy Products JSC (HOSE: VNM) is working diligently on its “Vinabeef Cattle Farming and Processing Complex” project, which includes a farm with a capacity of 10,000 cows and a processing plant with an annual capacity of 10,000 tons. The company plans to launch its products in Q4 2024, expecting to generate approximately VND 1,000 billion in revenue in 2025 and VND 3,000 billion in 2029, with a gross profit margin of around 15% for the beef segment by 2029.

In the second half of the year, VNM will work on enhancing the branding and packaging of its remaining products. The company has also introduced three improved product lines in Q2 2024, including a 1-liter Ong Tho condensed milk with a plastic lid and a plant-based protein milk to cater to diverse consumer needs. VNM plans to explore additional protein-rich beverages to expand its customer base among teenagers and middle-aged adults.

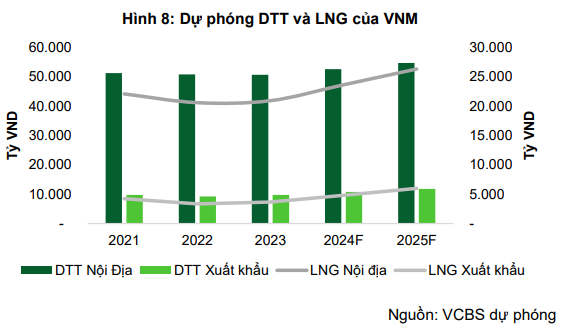

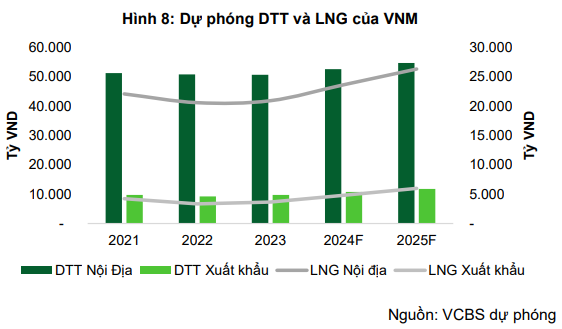

VNM’s domestic and export revenue growth is projected to reach VND 52,541 billion (a 3.8% increase) and VND 10,727 billion (a 10% increase) in 2024, respectively. The gross profit margins for these two markets are expected to increase by 3.6% and 7.2%, respectively.

Based on a combination of the FCFF discount method and the P/E comparison method, with a 50/50 weightage, VCBS recommends buying VNM with a target price of VND 83,831 per share.

Read more here

Buy CTG with a target price of VND 39,300/share

Beta Research reports that Vietnam Industrial and Commercial Bank (HOSE: CTG) has achieved a credit growth rate of 6.7% in the first half of 2024, surpassing the industry average of 6%. This growth was primarily driven by large corporate clients as personal credit demand remained weak in Q1 2024, leading commercial banks to focus on the corporate segment. Beta Research believes that this strategic shift towards corporate lending in Q1 2024 did not significantly impact CTG as the bank continues to expand its scale, and larger loans to businesses are in line with this growth trajectory.

However, in Q2 2024, there was a positive turnaround in credit demand from individual customers. Specifically, CTG’s individual customer lending grew by VND 591 trillion (a 6.3% increase compared to the previous quarter) in Q2, while Q1 remained flat compared to the end of 2023. Beta Research assesses CTG’s credit growth as relatively positive and stable in 2024, attributing it to the bank’s effective strategies. The research firm expects CTG to maintain this growth trajectory in the second half of the year and achieve its credit growth target of 14%-15% for 2024.

CTG’s NIM, which peaked at 4.55% in Q4 2022, has declined for four consecutive quarters, reaching 3.78% in Q4 2023. This trend is consistent with the industry-wide challenge of rising funding costs and declining asset yields due to weak credit demand and low-interest rates to support economic recovery.

In Q2 2024, CTG’s NIM showed a slight improvement, reaching 2.96% (a 10 basis point increase year-on-year but a 7 basis point decrease from the previous quarter). This improvement can be attributed to a significant reduction in funding costs, which fell by 204 basis points compared to the previous year. For the first half of 2024, CTG’s NIM continued its positive trajectory, reaching 2.98% (a 10 basis point increase year-on-year) due to a 176 basis point decline in funding costs. This improvement was driven by (1) a remarkable increase in CTG’s CASA ratio, reaching 22.8% in Q2 2024 (a 4.1 percentage point increase year-on-year), and (2) easing funding costs.

The 12-month yield on earning assets decreased by 159 basis points year-on-year due to (1) CTG’s efforts to support customers by reducing lending rates and attracting new clients, and (2) a higher proportion of short-term working capital loans to businesses.

Beta Research anticipates a mild improvement in CTG’s NIM in 2024 but acknowledges the challenges in asset yields due to (1) intense competition among banks for market share and customers, (2) the gradual reflection of easing funding costs, which are expected to rise slightly in the second half of 2024, and (3) the projected increase in asset yields as individual customer credit demand recovers.

CTG’s total funds mobilized increased by 4% compared to the beginning of the year, and its CASA ratio reached 22.8% (a 4.1 percentage point increase) thanks to the growing contribution of individual customers to the bank’s non-term deposit structure. Beta Research expects CTG’s CASA ratio to continue its recovery, driven by an improving economy, rebounding consumption and investment, and the growing popularity of cashless payments.

In Q2 2024, CTG’s NPL ratio increased slightly, but its Group 2 debt improved. The NPL ratio for Q2 2024 was 1.57%, a 22 basis point increase from Q1 2024, while Beta Research’s full-year forecast for 2024 is 1.4%. However, CTG’s Group 2 debt improved, decreasing by 15 basis points from the previous quarter to 1.44%. Beta Research anticipates improvements in these metrics in the coming quarters due to (1) the bank’s efforts to accelerate write-offs towards the end of the year, and (2) the expected stronger credit growth in the second half of 2024.

Annual credit costs in the first half of 2024 surged to 2.02%, compared to an average of 1.73% in the 2021-2023 period. Provision expenses in the first half of 2024 rose by 20% year-on-year, achieving 50% of Beta Research’s full-year estimate. CTG’s LLR ratio in Q2 2024 continued to decline from the previous quarter but remained high compared to other banks at 114% (a 37 percentage point decrease from the previous quarter and a 55 percentage point decrease year-on-year)

Using a combination of the RI Model and the P/B comparison method with equal weightage, Beta Research recommends buying CTG with a target price of VND 39,300 per share.

Read more here

Buy CTR with a target price of VND 138,000/share

Vietcap Securities expects an increase in demand for 4G network coverage due to the planned shutdown of 2G networks in September 2024 and 3G networks by the end of 2028, as per the goals set by the Ministry of Information and Communications. Additionally, the successful auction of three frequency bands in March and July 2024 is expected to lay the foundation for the deployment of 5G technology in Vietnam, starting in the second half of 2024. As the coverage range of 4G and 5G is lower than that of 2G and 3G, the transition to these newer technologies will require a denser telecommunications infrastructure to maintain adequate coverage.

Vietcap believes that this strong demand for telecommunications stations will correspond to a 22% CAGR in the number of stations for Viettel Construction Joint Stock Corporation (HOSE: CTR) during the 2023-2031 period. The securities firm also expects CTR’s sharing ratio to gradually reach 1.2 by the end of 2031, up from 1.03 at the end of 2023. Vietcap projects that station sharing will increase as they anticipate the three telecom companies to roll out 5G in the second half of 2024, and sharing stations will facilitate their 5G deployment.

Regarding the construction segment, Vietcap forecasts a 19% EBITDA CAGR during the 2023-2026 period, led by growth in civil construction. This projection is based on (1) the securities firm’s positive outlook for the real estate market from 2024 onwards, (2) increased coverage of B2C construction projects, and (3) a growing backlog in the B2B segment.

Vietcap maintains its forecast of a 14%/12% revenue growth for the construction segment in 2024-2025, respectively. Civil construction remains the primary growth driver, supported by a large backlog from 2023 and a portion of new backlog signed in 2024.

In terms of valuation, Vietcap bases its target price on two methods: the Discounted Cash Flow (DCF) method and the Sum of the Parts (SoTP) method. The securities firm maintains a 70%/30% weightage for DCF/SoTP as they believe the DCF method reflects CTR’s long-term growth potential and cash generation, while the SoTP method primarily captures the growth prospects for the next year.

Based on this analysis, Vietcap recommends buying CTR with a target price of VND 138,000 per share.

Read more here

VPBank strengthens its system in 2023, laying the foundation for sustainable growth

By 2023, VPBank has made significant strides in expanding its customer base and scaling up its operations. The bank has managed to make progress amidst challenging macroeconomic conditions, focusing its resources on strengthening its system and building momentum for sustainable growth in 2024 and beyond.

EBITDA Continuously Increases for 4 Quarters, WinCommerce Plans to Open 700 More Stores

In 2023, despite the challenges both domestically and internationally, the retail market in Vietnam is gradually becoming a lucrative investment opportunity and a fiercely competitive battleground. Amidst this backdrop, WinCommerce (a subsidiary of Masan Group) emerges as the solution for an optimized store model, expanding networks, and sustaining market share for Vietnamese businesses…