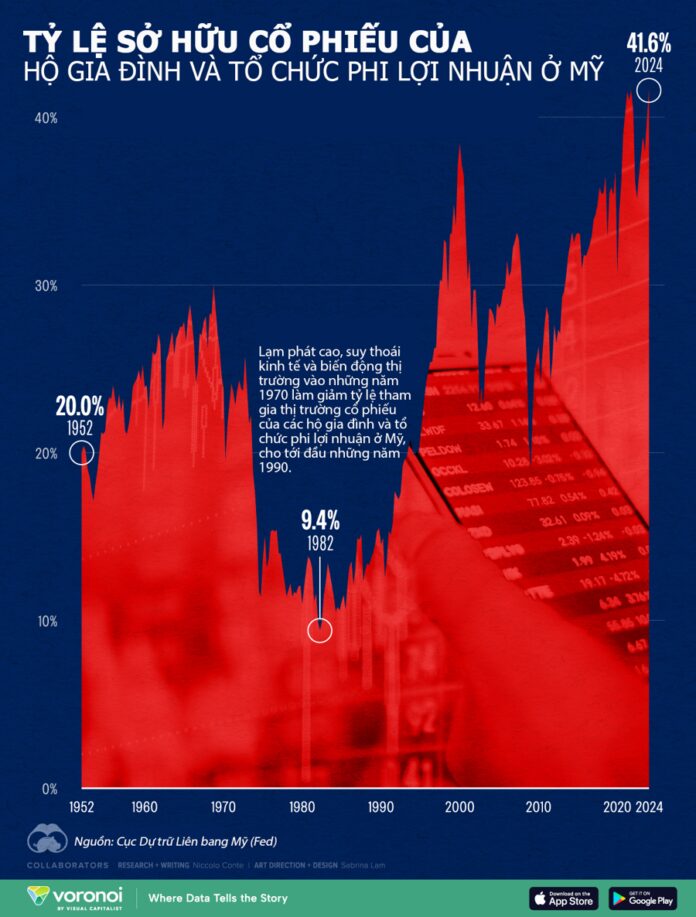

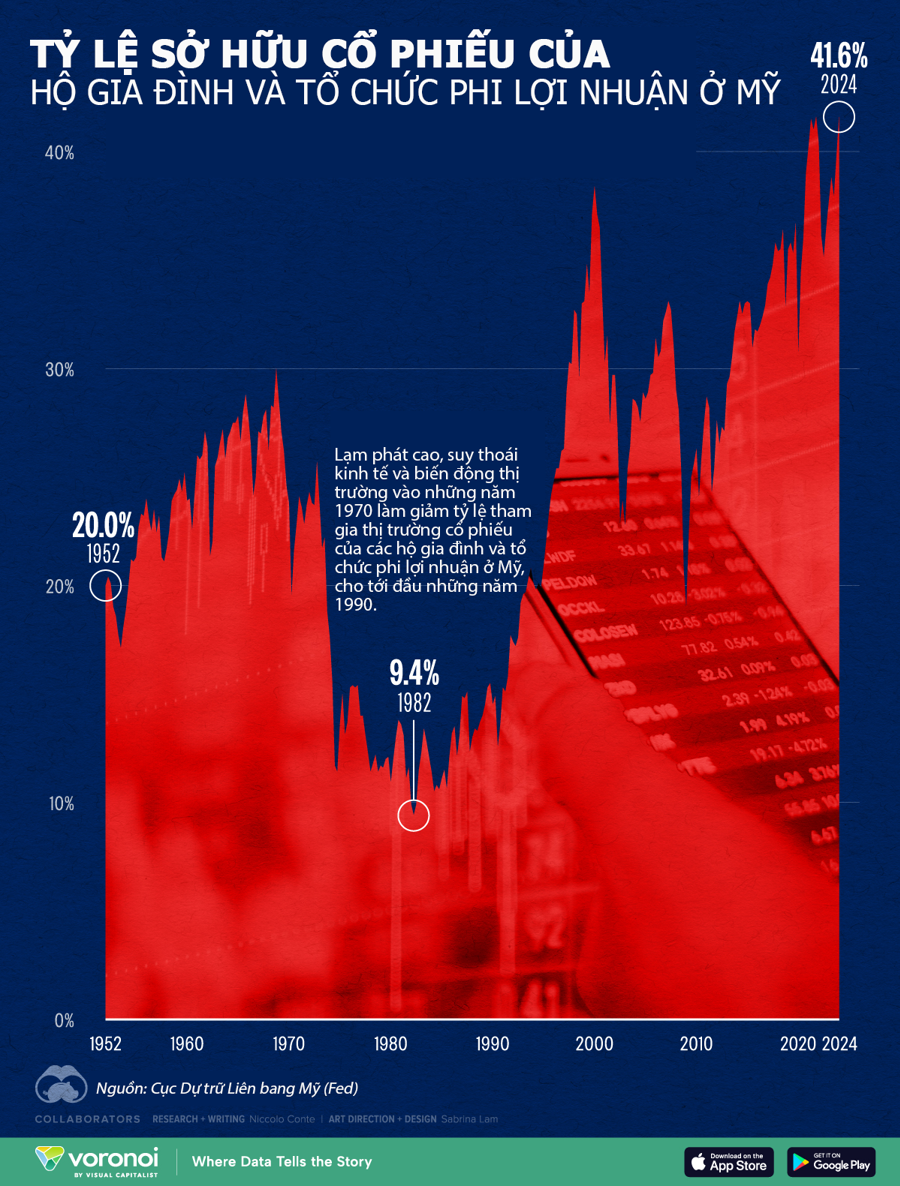

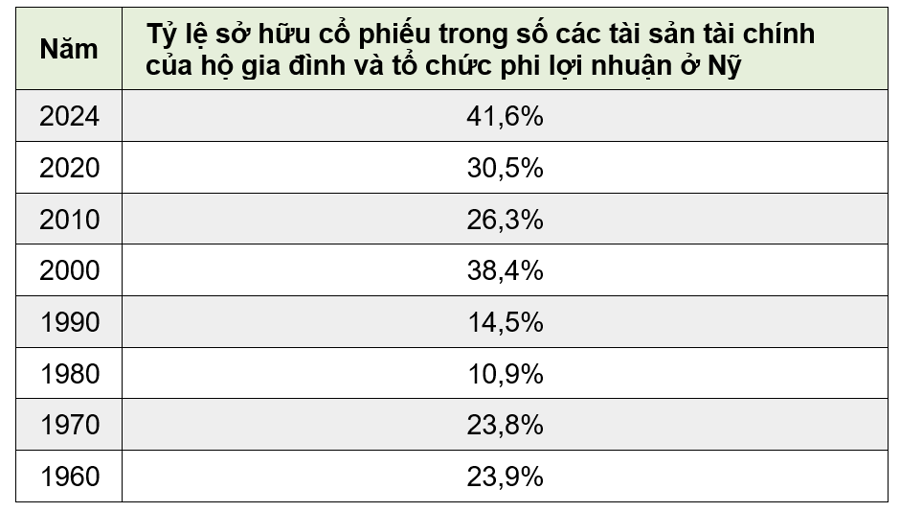

American investors’ faith in the stock market, underpinned by a robust economy and solid historical growth, has driven significant allocations into equities. In 2024, US individual investors allocated 41.6% of their financial assets to stocks and stock-related assets, among the highest in decades.

The chart below illustrates the financial allocation of US households and non-profit organizations to stocks from 1952 onwards, based on data from the Federal Reserve.

As the chart depicts, American investors tend to allocate a larger proportion of their assets to stocks during periods of high inflation and robust consumer spending.

Currently, 62% of Americans own stocks, the highest proportion in two decades. Furthermore, 87% of high-income earners, 65% of middle-income earners, and 25% of low-income earners hold stocks. In Q1 2024 alone, US individual investors’ wealth in the stock market surged by an additional $3.8 trillion compared to the previous quarter.

A similar pattern emerged during the internet bubble, with a significant increase in stock investments. However, the allocation decreased markedly after the bubble burst, as investors suffered losses from risky bets on high-growth tech companies, typically those with high growth but no profits.

In contrast, in 1982, when the 10-year US Treasury bond yielded a record 14.6%, the allocation to stocks by US individual investors dropped to 9.4%. At that time, bond yields outperformed stocks in a high-interest-rate environment, and the US economy was in a recession with high inflation, prompting investors to seek less risky assets.

The historical growth of the US stock market has been a significant drawcard for investors. Compared to other asset classes, US stocks have delivered superior returns over the past few decades. Over the last ten years, US stocks have averaged a 12.3% return, compared to 4% for REITs and 1.4% for high-grade corporate bonds.

Not only US stocks but European and emerging market equities have also outperformed. Since 2014, European stock markets have grown by an average of 4.6% annually, while emerging markets have delivered average returns of 3.3%.