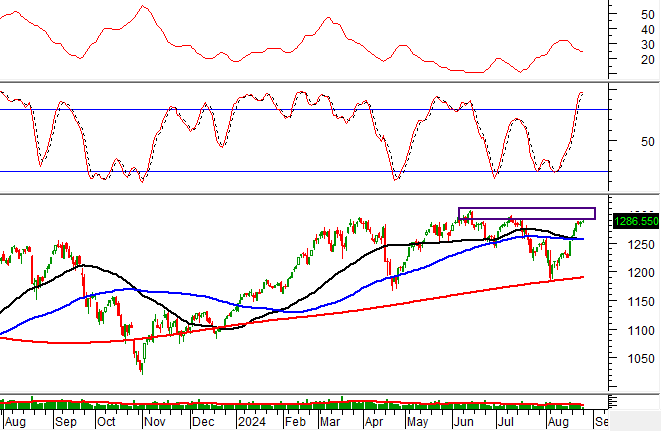

The VN-Index swung below or near the reference level three times this morning due to the influence of large-cap stocks. The late-session rally showed some positive signs, but the breadth of the market didn’t reflect a clear dominance of advancing stocks. However, liquidity started to show signs of improvement.

The lack of consensus among large-cap stocks was the main reason why the market representative index rose but failed to break out. The VN-Index gained 3.74 points or 0.31% by the end of the morning session. The VN30-Index performed even worse, rising only 0.1% and crossing the reference level in the last 10 minutes.

Out of the 10 largest stocks by market capitalization, which have the potential to lead the index, six stocks rose, and even the top four performed well. However, VCB (+0.57%) and BID (+0.64%) showed modest gains. The declines in two very large stocks, VHM (-1.34%) and VIC (-1.09%), offset these gains. More than half of the VN-Index’s morning gain came from FPT (+2.13%) and GAS (+1.72%). The VN30-Index was almost balanced, with 13 gainers and 13 losers, and the difference was due to FPT’s weight compared to VPB’s slight decline of 0.83%.

After a strong rally last week, the bullish momentum seems to have stalled. The breadth of the HoSE floor showed that the advancing stocks couldn’t dominate at any point during the morning session. The balance in the breadth accurately reflected the tug-of-war in the VN-Index. Although there were some positive improvements towards the end of the session, there were no clear breakout leaders. FPT and GAS, the two top performers, also didn’t close at their intraday highs. PLX and SAB were the only two blue-chips with strong upward momentum, and the only ones to temporarily reach their morning highs, with PLX up 3.75% and SAB up 1.49%. However, the impact of these two stocks was limited.

Looking at the broader HoSE floor, the divergence was evident in both quantity and amplitude: By the end of the morning session, the exchange had 193 gainers and 185 losers, but only 67 gainers rose more than 1%, while 55 losers fell more than 1%. No sector showed a significant outperformance, and even within individual industries, there was considerable divergence. Bank stocks are a case in point, with only 11 out of 27 stocks in positive territory. More than half of the securities sector was in the red. In the real estate sector, a few stocks like NBB, VCG, and HDG performed well, while many others, such as DIG, LDG, QCG, NTL, PDR, DXG, VHM, and VIC, fell sharply.

The positive sign was that the buying power was slightly stronger on the advancing side. As mentioned earlier, the group of stocks that rose by more than 1% accounted for about 31.2% of the total matched orders on the HoSE floor, while the group that fell by more than 1% accounted for about 17.1%. The total trading value of the advancing stocks also contributed about 59.7% of the floor’s value, although the vast majority of them rose very slightly, less than 1%. HoSE’s morning liquidity also increased by 22% compared to the previous morning session, reaching over 5,517 billion.

While the relative increase in liquidity is significant, the absolute level is not particularly high. Last week, the average morning session liquidity on HoSE was around 5,741 billion per day. This indicates that new money is improving on a session-by-session basis, but there has been no dramatic surge.

Limited liquidity meant that the best-performing stocks this morning were mainly small- and mid-cap stocks. Aside from CSV, which hit the ceiling with a liquidity of 119.5 billion, a few other stocks with large trading volumes were HHV, up 4.13% with 39.8 billion; VOS, up 3.87% with 16.3 billion; HAX, up 2.88% with 10.9 billion; MSB, up 2.84% with 43.5 billion; SKG, up 2.72% with 12.6 billion; BFC, up 2.62% with 24.6 billion; CMG, up 2.56% with 22 billion; and DGC, up 2.44% with 192.7 billion…