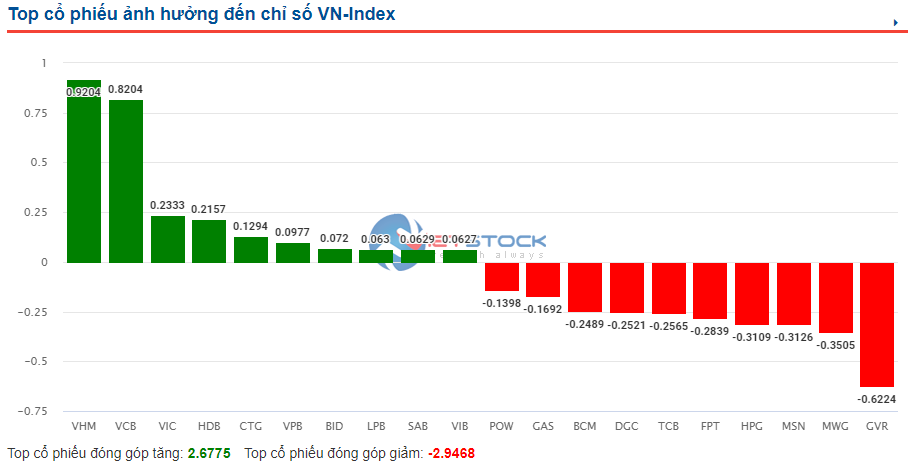

The stock market experienced a volatile trading week from August 5-9, plunging in the first session and recovering in the latter part of the week. Despite the VN-Index posting gains in 3 out of 5 sessions, it ended the week nearly 13 points lower than the previous week, settling at 1,223 points. Average trading liquidity rose 6%, reaching over VND 17,000 billion per session.

Experts concur that the recent recovery was merely technical, and it’s likely that the VN-Index hasn’t truly bottomed out yet. The market may require another corrective phase before resuming its upward trajectory. However, given the positive long-term prospects, investors can seize the opportunity to accumulate promising stocks at favorable prices.

Short-Term Risks Persist

Mr. Dinh Quang Hinh, Head of Macroeconomics and Strategy, VNDIRECT, updated that after the sharp correction at the beginning of the week, domestic stock indices witnessed a technical rebound as the market received supportive information. Specifically, the US Department of Labor announced that the number of people filing for initial jobless claims fell below expectations, easing concerns about a potential US economic recession.

This new data contrasts with the disappointing employment figures last Friday, indicating that the US economy is “not as weak as the way the market reacted during the last session of the previous week and the first session of this week.”

Following this positive news, US stock indices recorded their strongest gains in two years, oil prices rebounded, and yields on US government bonds recovered to 4%. All these developments suggest that market sentiment has gradually stabilized after the shock at the end of the previous week.

Domestically, the market also received supportive news as the Q2 business results of listed companies exceeded expectations. According to VNDIRECT’s analysis, the net profits of listed companies in Q2 2024 grew by over 20% year-on-year, surpassing the market’s earlier projection of 5-10%.

At the same time, after the sharp correction, the market’s valuations became more attractive, with the P/E ratio of the VN-Index dipping to -1 standard deviation at one point, prompting bottom-fishing capital to enter the market.

Maintaining a positive outlook on the Vietnamese stock market’s prospects in the medium term (6-12 months) due to: (1) Positive Q2 business results reinforce the forecast of an 18% profit growth for the entire market this year, and (2) The scenario of the Fed cutting its policy rate 2-3 times by the end of the year is becoming more plausible, which would ease exchange rate pressure and allow the State Bank of Vietnam to be more flexible in injecting liquidity into the system, especially in Q4 through OMO and USD purchases, thereby supporting attractive domestic interest rates to boost economic growth.

VNDIRECT experts maintain their view that the VN-Index could close 2024 in the range of 1,300-1,350 points (base case scenario) and, in a positive scenario (the Fed cuts policy rates as expected and SBV loosens monetary policy), the VN-Index could surpass 1,400 points this year.

Therefore, if the VN-Index retests the 1,200-point support level, long-term investors should consider increasing their stock exposure and building their investment portfolios for the next 6-12 months. Priority sectors include banking and export industries (garment, seafood, steel).

However, Mr. Hinh advises investors to maintain a reasonable portfolio allocation (60-70% stocks) and refrain from using leverage to manage risks as short-term market volatility remains high.

Market Yet to Confirm Bottom

Mr. Nguyen Minh Hoang, Director of VFS Securities Analysis, assessed that the market’s recovery after the sharp plunge at the beginning of the week was quite positive. The shift from a strong downward trend to a sideways movement indicates a reduction in selling pressure, and bottom-fishing forces entered the market as the VN-Index discounted about 9%, approaching the strong support zone around MA200.

The low trading volume is considered normal in the bottom area. Investors have just gone through a panic selling period, and doubts about the “crooked branch” theory will lead to cautious trading behavior. If the index has indeed formed a bottom and stabilized, liquidity will gradually recover along with the market’s upward movement.

However, from a technical perspective, the market has not yet confirmed a bottom. The current uptrend is merely a corrective phase, and there’s a high chance that the VN-Index will experience another volatile phase next week to test supply and demand and the recently formed bottom around 1,120 points. If the bottom test is successful and money flow becomes more robust, the market will confirm a new, higher bottom, indicating that the 1,220 level is the market bottom for this phase.

“The risk of the market continuing its downward trajectory to 1,165 or 1,180 points still exists but is unlikely, in my opinion. This is because the Vietnamese economy is recovering well, and inflation and exchange rate expectations are stable and within control in the second half of the year. Moreover, the market’s P/E ratio, after the price discount, has dropped to around 13 times, which is lower than the 5-year average. And, according to the 2024 P/E fw, it could fall to an attractive area of around 11 times,” said the VFS expert.

Regarding investment strategy, when the market has not confirmed a bottom, making investment decisions can be challenging for many investors. However, with many stocks discounted by 30-40% and the market’s valuation returning to reasonable levels, investors with high cash ratios can deploy 30-50% of their cash. It is prudent to divide the buying power into 2-3 purchases to hedge against the risk of a deeper market slide.

The banking group is highly regarded due to its low P/B ratio compared to the 3-year average, stock prices that have been accumulating discounts for 3-5 months, and expected strong growth in Q2 and the second half of the year, driven by robust credit demand. The retail group is also favored due to its robust growth in line with the economic recovery, low profits in 2023, and the year-end business season. Additionally, investors can consider heavily discounted and bottomed-out sectors: real estate, steel, and construction materials.

A Corrective Phase Needed to Form a “Double Bottom” Before Returning to an Uptrend

Mr. Nguyen Anh Khoa, Head of Agriseco Securities Analysis, assessed that the recovery sessions this week generally maintained low liquidity, and the average weekly trading value increased mainly due to the high-liquidity downward session at the beginning of the week. As the market remains in a short-term downward trend and is influenced by systemic risks from the international market, it is understandable that capital flows are cautious. Market liquidity could recover more robustly when the VN-Index successfully confirms a bottom and surpasses the 1,250-point threshold to resume its short-term uptrend.

Given the numerous uncertainties regarding geopolitical tensions and the global economy, the expert believes the market needs more time to stabilize. The upcoming macroeconomic data releases will provide a basis for investors to assess systemic risks of a recession more concretely. Domestically, after the global macroeconomic risks subside and investor sentiment stabilizes, the market is likely to confirm a bottom in this corrective phase and return to a medium-term uptrend, supported by the economic recovery and improved corporate earnings.

From a technical perspective, despite the positive rebound that pushed the VN-Index back above the 1,200-point mark, this recovery could be technical. The market may require another corrective phase to form a “double bottom” before resuming its uptrend.

The expert noted that the market could still be influenced by various unpredictable geopolitical and global economic factors. The escalating tensions in the Middle East, the risk of a US economic recession, and the impact of the yen carry trade could be potential macroeconomic risks that push the index lower.

“From a technical perspective, while the rebound was positive and pushed the VN-Index back above the 1,200-point level, this could be a technical recovery. The market may need another corrective phase to form a ‘double bottom’ before resuming its uptrend. Therefore, investors can consider deploying capital when the market completes the second bottom or when it forms a balance zone, prioritizing investments in leading stocks and VN30 stocks that have entered the oversold zone,” said the Agriseco expert.

After the recent corrective phase, the valuations of many stock groups have become more attractive, providing investors with opportunities to consider deploying capital. As the Q2 business picture gradually takes shape, it’s evident that the profit growth of enterprises is a positive signal, reflecting the economy’s recovery. However, there is a clear divergence among sectors, and this differentiation is expected to continue in Q3 and the second half of 2024 as the low base effect from the same period last year fades. Therefore, investment decisions and opportunities must be made carefully.

In the last months of 2024, investors can consider groups with recovering profits above the low base of the same period last year, such as export industries (seafood, garments) and retail. For exporters, positive signals like improved demand and orders will support the recovery of businesses in this sector. Regarding retail, profits have been rebounding strongly since Q1/2024 and will likely continue in the second half of 2024, supported by consumption stimulus policies like VAT reductions and minimum wage increases.

Additionally, stocks with attractive valuations relative to their growth potential, such as banks, are also suitable choices in the second half of 2024. The growth driver for bank stocks will be the rising credit demand as the economy recovers.