Financial Report: In-Flight Catering Company Sees Surge in Revenue and Profits

Noi Bai In-Flight Catering Joint Stock Company (stock code: NCS) recently released its financial report for the second quarter of 2024, revealing impressive growth. The company recorded over VND 162 billion in revenue, marking a 19% increase compared to the same period last year.

After deducting expenses, NCS posted a net profit of VND 12.1 billion, reflecting a significant 51.8% surge year-over-year.

For the first six months of 2024, the company’s performance remained robust. NCS achieved VND 340 billion in revenue, a 20% jump from the previous year, along with a post-tax profit of over VND 27 billion, indicating a remarkable 45% increase.

Attributing the substantial profit growth, the company cited the full recovery of the international aviation market, which has surpassed pre-COVID-19 levels in 2019, along with the expansion of international flight routes and increased flight frequencies.

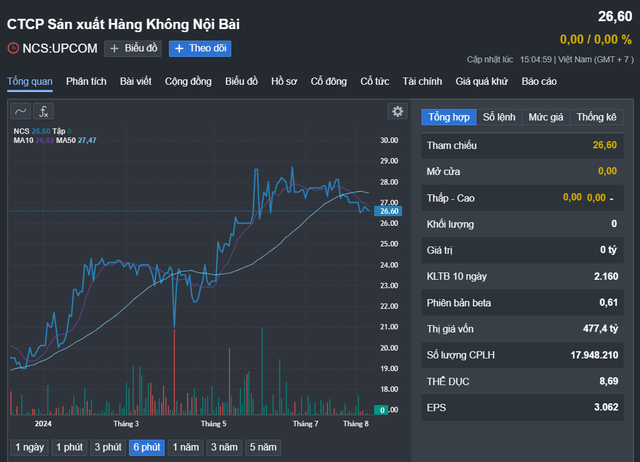

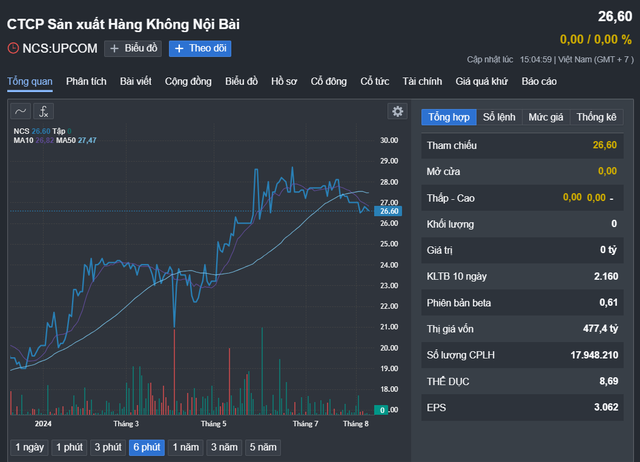

NCS Stock Performance from the Beginning of 2024 Source: Fireant

During this period, the domestic market maintained its stability and witnessed a slight growth. The company also diversified its offerings by providing non-aviation products such as pork pies for the Lunar New Year, bubble tea, mooncakes, and other bakery items.

NCS attributed the significant growth in revenue and profits for the second quarter and the first half of 2024 to the recovery of the international aviation market and the diversification of their product range.

Known as one of the leading in-flight catering providers in the market, NCS also supplies bubble tea to Vietnam Airlines. As of June 30, the company had short-term receivables from Vietnam Airlines amounting to VND 38.4 billion, the largest portion of NCS’s customer receivables.

In the first half of the year, the total expenses for management staff salaries and labor costs reached VND 95 billion, a 27% increase compared to the beginning of 2024. As of June 30, the company employed 746 people.

On average, each employee received approximately VND 21.2 million per month, reflecting a VND 3.5 million increase compared to the same period last year.

As of June 30, NCS held VND 46.7 billion in non-term bank deposits, a significant increase of 3.5 times compared to the beginning of the year. The company’s equity stood at nearly VND 155 billion, a 21.3% surge.

Meanwhile, the company’s payables totaled VND 303 billion, a 9% decrease from the beginning of 2024. Notably, loans and financial lease payables accounted for 61.7% (VND 187 billion) of this amount, indicating that the company’s debt could be a potential risk to its financial health.

NCS’s stock has been on a consistent upward trend in recent months, currently trading at VND 26,600 per share, reflecting a remarkable 32.34% increase since the beginning of the year.