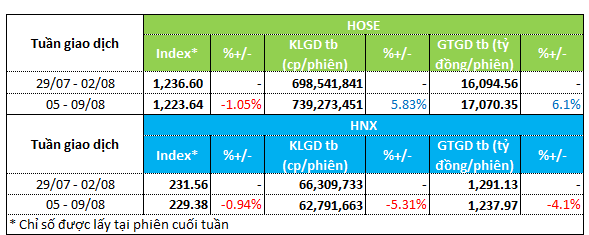

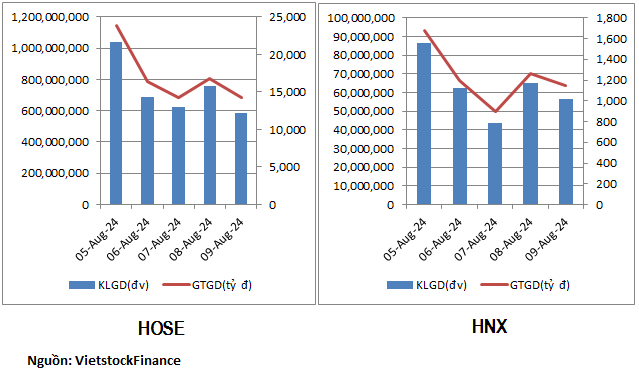

For the week of August 5-9, stocks continued their downward trend. The VN-Index fell 1% to 1,223.64, while the HNX-Index dropped 1% to 229.38.

Trading volume fluctuated within a narrow range on the two exchanges, with opposite trends. On the HOSE, volume increased by approximately 6%, with nearly 740 million units traded per session and a value of VND 17 trillion per session.

Conversely, the HNX exchange experienced a 5% decline in trading volume, with 63 million units traded per session and a value of VND 1.2 trillion per session.

|

Weekly Liquidity Overview for August 5-9

|

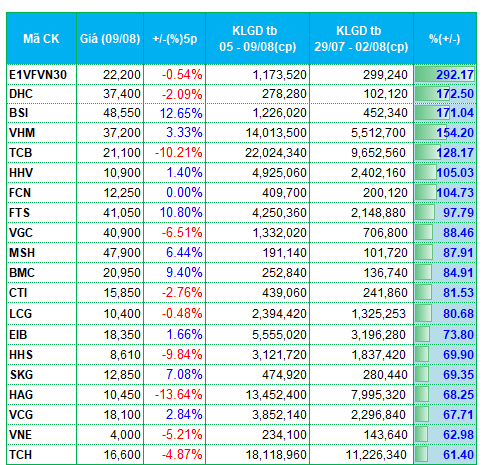

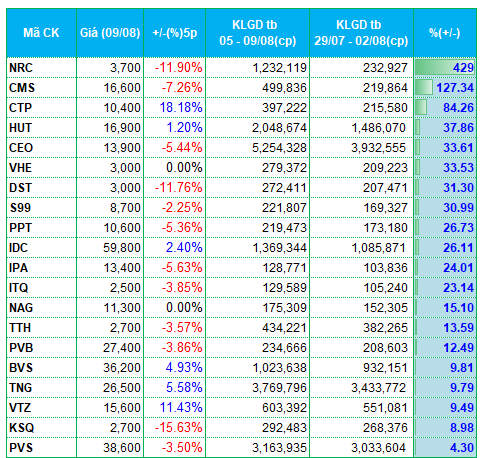

Infrastructure construction stocks witnessed a surge in trading activity last week. This group had the largest number of stocks among those with significant increases in trading volume on the two exchanges. HHV and FCN doubled their trading volume compared to the previous week. Other stocks in this category, including VCG, CTI, LCG, CMS, and HUT, also saw substantial increases in trading activity.

Stocks related to the Hoang Huy Group also experienced a boost in liquidity last week. HHS recorded a 70% increase in trading volume, surpassing 3.1 million units per session. TCH witnessed a 60% jump, reaching 18.1 million units per session.

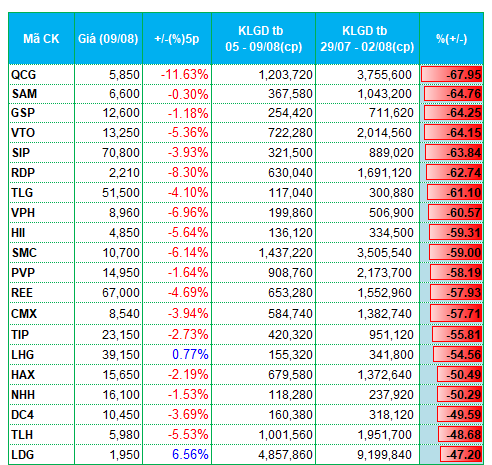

On the other hand, several real estate stocks witnessed a pullback in investment. QCG, SIP, VPH, TIP, LHG, LDG, NDN, AAV, API, and DTD all experienced declines in trading volume, ranging from 40% to 60%.

Additionally, a few metal stocks, such as SMC, TLH, and VGS, also witnessed significant decreases in trading activity.

|

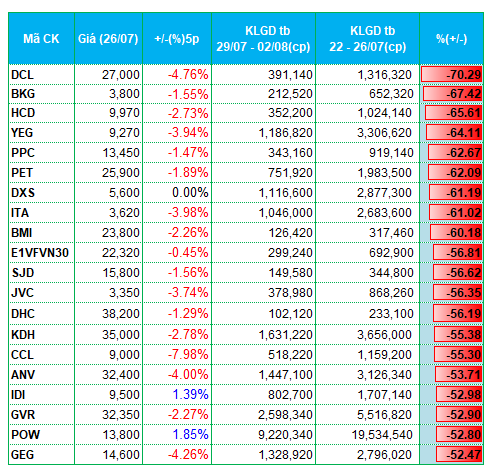

Top 20 Stocks with the Highest Increases/Decreases in Trading Volume on the HOSE Exchange

|

|

Top 20 Stocks with the Highest Increases/Decreases in Trading Volume on the HNX Exchange

|

The list of stocks with the highest increases and decreases in trading volume is based on a minimum average trading volume of 100,000 units per session.

Choose stocks for “Tet” festival celebrations

Investors should consider choosing stocks in the banking industry with good profitability, healthy real estate, and abundant clean land reserves. In addition, the group of stocks in infrastructure investment, iron and steel, and construction materials should also be considered.