Bank BVBank (BVBank) has just announced a public offering of bonds (first tranche) through direct issuance at transaction points.

BVBank plans to have 6 issuances with a total of 56 million bonds. The first tranche offers 15 million bonds, with a 6-year term and a fixed interest rate of 7.9% for the first year. Each bond has a par value of VND 100,000.

From the second year onwards, the reference interest rate will be the 12-month personal deposit interest rate of Vietcombank, VietinBank, BIDV, and Agribank, plus a margin of 2.5% per annum.

In the first tranche, BVBank is expected to raise VND 1,500 billion from the public bond channel. The target audience for this public bond offering includes individual or institutional investors.

Banks aim to raise trillions of dong through public and private bond issuances.

The Board of Directors of Asia Commercial Bank (ACB) has also approved a plan to issue the second batch of private placement bonds in the 2024 financial year, with a maximum total value of VND 15,000 billion.

Accordingly, ACB will issue a maximum of 150,000 bonds with a par value of VND 100 million per bond. The issuance price is equal to the par value, and the maximum term is 5 years. ACB stated that the purpose of the bond issuance is to serve lending and investment needs and to comply with the safety ratios regulated by the State Bank of Vietnam.

The bonds have a maximum term of 5 years and a fixed or floating interest rate depending on market demand. The target audience for this private placement offering includes institutional investors who meet the legal requirements for professional securities investors.

Previously, Agribank and HDBank also offered public bonds to raise thousands of billions of dong. Agribank offered VND 10,000 billion worth of public bonds this year to institutional, individual, and foreign investors at all transaction points nationwide.

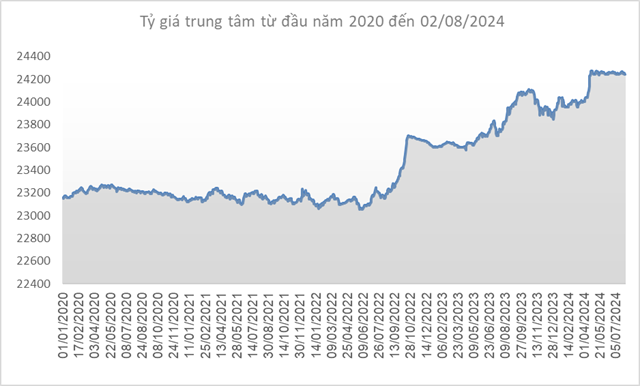

The interest rate for Agribank’s bonds is determined by the reference rate (the average 12-month VND term deposit interest rate of the four state-owned commercial banks on the interest rate determination date) plus a margin of 2%/year. Currently, the 12-month term deposit interest rate of the four state-owned commercial banks ranges from 4.6% to 4.7%/year. Thus, the interest rate for Agribank’s public bonds is close to 7%/year.

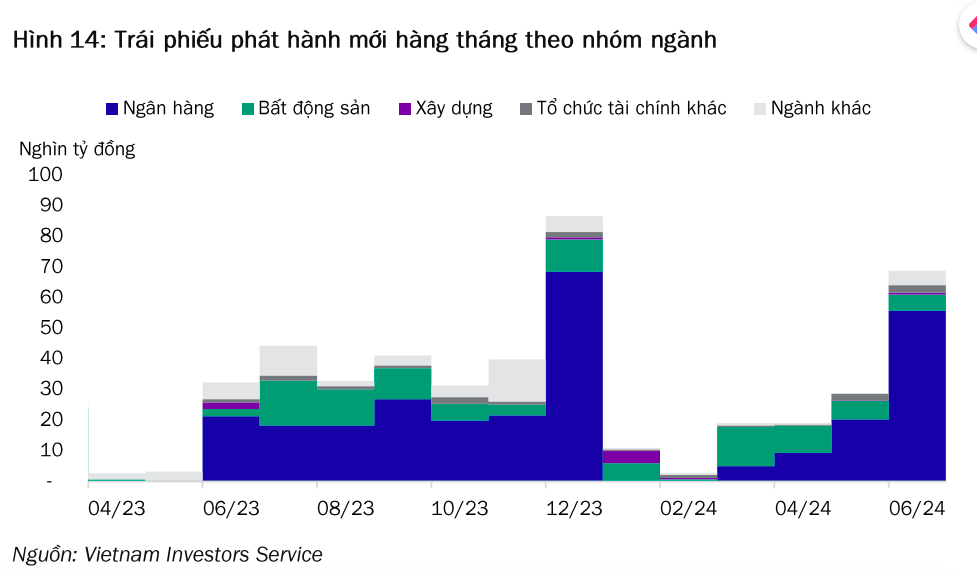

Banks continue to be the top bond-issuing sector, according to VIS Rating’s statistics up to June 2024.

At HDBank, the public bond issuance has a 7-year term and is expected to raise VND 1,000 billion with a floating interest rate applied for the entire term. The interest rate is calculated by adding a margin of 2.8%/year to the reference rate.

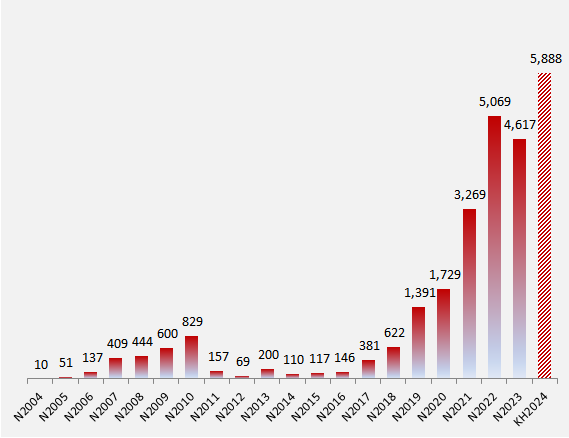

According to a report by the Vietnam Bond Market Association (VBMA), in the first seven months of 2024, there were 33 private placements of corporate bonds worth VND 31,300 billion and one public offering worth VND 395 billion in July.

From the beginning of the year until now, there have been 175 private placements worth VND 168,000 billion and 12 public offerings worth more than VND 14,500 billion. Among the private placements, 7% of the bonds were rated by credit rating agencies.

The banking sector accounted for the highest proportion of bond issuance value in the first seven months of this year, representing 68.2% of the total issuance value.