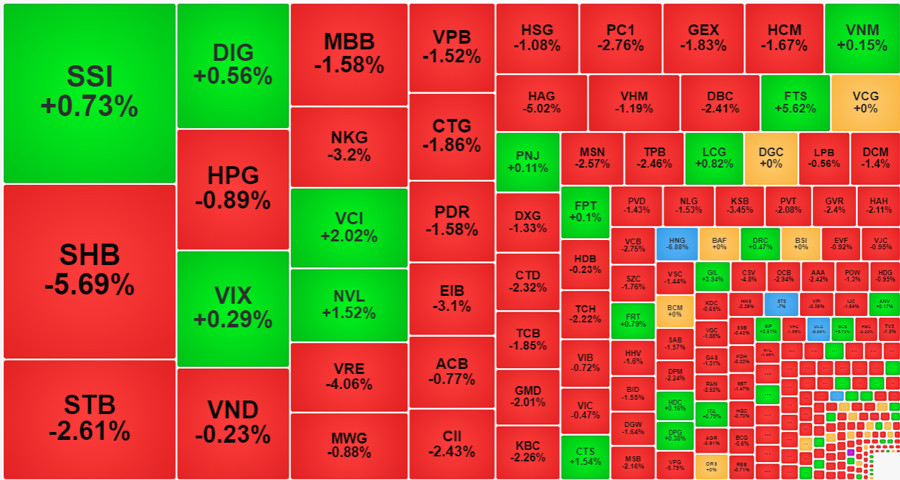

VN-Index swiftly reclaimed the 1,200-point mark. By the end of the week, the VN-Index had dipped 1.1% to 1,223.6 points. Weekly liquidity rose 6.1% to VND17,048 billion per session.

Foreign investors net-sold VND3,994 billion on all three exchanges this week, including VND3,943.5 billion on HoSE.

Following the recovery trend of major markets, the VN-Index maintained its rebound in the latter half of the week after the US Department of Labor announced that the number of people filing for unemployment benefits for the first time last week was lower than expected, easing concerns about the risk of a US recession. At the same time, the US stock market recorded its strongest gain in two years, oil prices rebounded, and yields on US government bonds recovered to 4%, all of which indicated that market sentiment had gradually stabilized after the shock of the previous week.

The VN-Index fell below the 1,200-point level at the start of the week.

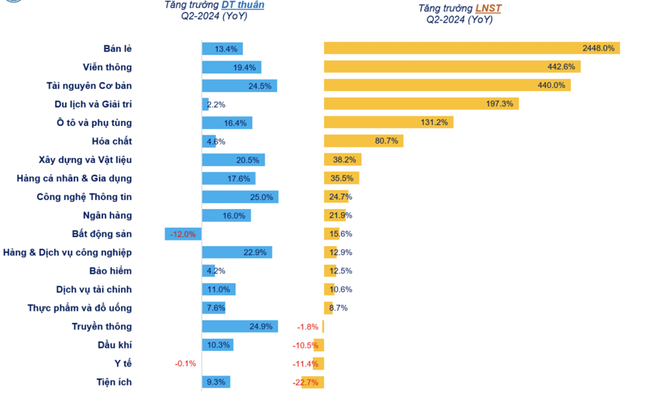

According to VNDirect Securities Corporation’s analysis, the net profits of listed companies in Q2 grew over 20% year-on-year, surpassing the market’s previous forecast of 5-10%.

After a sharp correction, the market’s valuation became more attractive as the VN-Index’s P/E ratio touched -1 standard deviation at one point, stimulating bottom-fishing cash flow.

Expert Pham Binh Phuong from Mirae Asset Securities Vietnam stated that although the overall market recovered amid doubts, some stocks that had previously declined sharply, such as FPT, Viettel’s codes (VTP, CTR), and securities group (FTS, BSI, SSI, VCI), were rebounding strongly. This could be an opportunity for short-term trades.

VPBank Securities’ analysts stated that the domestic market maintained its recovery momentum in the last session of the week, and although liquidity decreased compared to the previous session, the breadth of the market was positive as the buying spread across all sectors. Technically, this was the fifth consecutive weekly loss, but the closing level was the highest of the week…

Given the recent fluctuations in the domestic and international financial markets, VNDirect maintains a positive view on the outlook of the Vietnamese stock market in the medium term of 6-12 months. Supporting factors for the market include positive business results in Q2, with expected full-market profit growth of 18% this year.

Q2 business results of sectors compared to the same period last year.

The scenario of the US Federal Reserve (Fed) cutting its policy rate by 2-3 times from now until the end of the year is becoming more and more realistic, reducing pressure on exchange rates. The State Bank can be more flexible in injecting liquidity into the system, especially in Q4 (through the OMO channel and USD purchases), thereby helping to maintain domestic interest rates at attractive levels to support economic growth.

In the context of the market gradually stabilizing, experts recommend that investors consider restructuring their portfolios for medium and long-term investment goals. According to VNDirect, the VN-Index may close 2024 in the range of 1,300-1,350 points (base case scenario) and, in a positive scenario (the Fed cuts its policy rate as the market expects and the State Bank of Vietnam has monetary policy easing moves), the VN-Index may close above 1,400 points.

Therefore, if the VN-Index retests the 1,200-point support level, it will be a good opportunity for long-term investors to consider increasing their stock proportion and constructing an investment portfolio for a 6-12-month vision.

Investors can observe and prioritize sectors with improved business prospects, such as Banking and Export (garment, seafood, steel); however, it is important to maintain a reasonable portfolio allocation (60-70% stocks) and avoid using leverage to manage risks as the market may still experience strong fluctuations in the short term.