Capital shortage and classification criteria make it challenging to implement green projects in Vietnam. Illustration: HT |

Lack of Green Standards and Support Mechanisms

The demand for green credit is enormous, as evident in the case of the textile industry’s transition. According to VITAS representatives, the industry is benefiting from new-generation free trade agreements, but if Vietnam does not achieve green indicators, there will be no orders. The issue is that “only a few banks are interested in the textile industry,” shared Mr. Vu Duc Giang, Chairman of the Vietnam Textile and Apparel Association (VITAS) at a recent industry seminar.

However, this is not a new issue, especially considering that many banks often require collateral to protect themselves from risks. With green credit accounting for less than 5% of total outstanding loans, the challenges also lie in legal aspects.

According to Mr. Pham Nhu Anh, CEO of MB Bank, one of the main obstacles is the lack of uniformity in definitions and regulations regarding green sectors and fields. The Ministry of Natural Resources and Environment has not yet issued a national-level green classification directory. “Therefore, to a certain extent, MB encounters difficulties in selecting, evaluating, and monitoring when implementing green credit,” said Mr. Anh.

Similarly, Mr. Pham Hong Hai, CEO of OCB, believes that banks are struggling to find customers who meet green standards because they are either unfamiliar with this green trend or still cautious due to unclear incentive mechanisms from regulatory authorities.

Meanwhile, the sectors related to green growth are all new industries, such as solar power, wind power, and waste-to-energy. Therefore, the efficiency of capital is also considered when green projects involve substantial investment, long payback periods, high market risks, and potential additional investment costs.

“Currently, the policies and mechanisms for these sectors are not attractive enough for banks to invest aggressively. Consequently, interest rates for green projects have not received the best incentives and cannot be significantly reduced compared to other sectors,” Mr. Hai assessed.

In the case of Agribank, which focuses on agricultural lending, the disbursement rate of preferential credit packages for clean and high-tech agriculture is less than 10%, according to a previous sharing by Ms. Nguyen Thi Thu Ha, Director of Agribank Training School and Deputy Head of the ESG Steering Committee. “Agribank’s challenge is to find green projects and have staff who understand what constitutes a green project,” Ms. Ha commented.

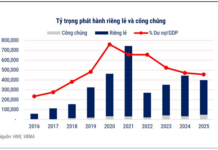

Not only banks but also businesses lack green standards to follow. Currently, the Stock Exchange has issued a set of sustainable development business indices, but it is still in its early stages. “Defining what constitutes ‘green’ remains a significant challenge for Vietnam,” said Mr. Do Ngoc Quynh, Secretary-General of the Vietnam Bond Market Association (VBMA).

|

Lack of Resources for Financing

The current market reality shows that in the green lending market, globally-scaled banks are more dynamic than domestic banks, not only in products but also in lending resources. However, most of the projects financed by foreign institutions must be of a certain scale.

Ms. Lam Thuy Nga, National Director of Large Corporate Clients at HSBC Vietnam, shared in April that financial institutions like HSBC must use international standards with adjustments suitable to the market’s actual situation. “These standards may be too high for most companies, preventing them from accessing sustainable finance,” Ms. Nga assessed.

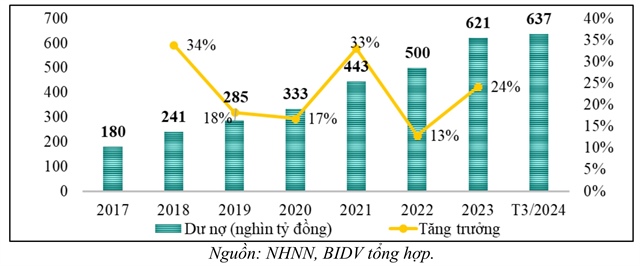

Capital is a weak point for domestic banks. Green projects are mostly medium and long-term, while banks’ mobilized capital is mostly short and medium-term.

To address this issue, many domestic banks have turned to international institutions for funding, naturally following the standards set by these institutions. But they expect more than just financial support.

For example, OCB shared that in 2012, it issued an environmental and social risk management policy with advice from IFC and incorporated pre-loan evaluation activities. In April this year, the two sides officially signed an agreement on consulting for the green banking transition and retail and SME digital banking services, aiming for sustainable development.

According to Mr. Hai of OCB, the bank expects to gain experience from IFC to strengthen its internal systems, such as procedures and standards for evaluating green projects and credit. At the same time, it also sets out more concrete plans related to developing green finance business, managing environmental and social risks and climate strategy, and reducing emissions from bank operations and investments.

Another significant obstacle is the story of human resources, as many bank leaders admit that many employees do not understand the concept of “green.” Meanwhile, enterprises operating in the green field often complain that banks only assess them using traditional methods.

The technical challenge lies in evaluating the loan’s quality throughout its life. For example, Mr. Nguyen Ba Son, Deputy Director of BIDV’s Capital and Monetary Business Division, mentioned green bonds as an example. To remain “green throughout their life,” a continuous data monitoring and evaluation system is required. Therefore, if the bank wants to deeply assess the “greenness,” it also needs a larger team of technical experts.

Currently, the State Bank is issuing more specific criteria for the industry’s green indicators, but it cannot do it alone because the green fields involve many other ministries and sectors, including the environment and agriculture – two sectors often mentioned in the context of “greening.”

Dung Nguyen

Capital Raising for Sustainable Growth

The trend of greening the economy is becoming increasingly popular worldwide, and Vietnam is no exception. As a result, the demand for green credit is also growing, aiming to promote the transition to a green economy and sustainable development. However, the domestic source of green credit is still limited, necessitating the need to expand the funding for this sector.

Many investors benefit from borrowing green real estate project labels to promote and increase their attraction capacity.

According to VARS, there is still a lack of accurate understanding among the public about green construction. This also provides an opportunity for many opportunistic investors to exploit and use the label of green real estate projects for promotion purposes, aiming to increase attraction, capital turnover, and expand their customer base.