The Market Will Soon Balance Itself Out

In a recent report, Rong Viet Securities (VDSC) assessed that in the first sessions of August, the market reacted negatively, following the adjustment trend of global stock markets. The adjustment pace of the index was more intense than the macroeconomic picture in the first half of 2024.

Therefore, VDSC expects that with a rapid and strong adjustment, mainly following the movement of global stocks rather than reflecting a bleak picture of business operations, the market will soon balance itself out.

Looking at the earnings outlook for the remainder of 2024, VDSC estimates that profit growth will accelerate significantly, with a ~25% increase compared to the same period last year. Similarly, the portfolio of stocks analyzed by Rong Viet, representing ~60% of HSX’s market capitalization, is expected to grow by 25% year-over-year.

The primary growth driver is expected to come from the banking group, thanks to (1) the economy’s expansionary needs, which could boost credit growth in 2024 to reach the target of 14%-15% year-over-year, and (2) the slight reduction in bad debt by the end of the year as banks improve their pre-provision profit positions compared to 2023, continue to absorb and clean up their balance sheets, and economic recovery helps ease bad debt formation and expedite the handling of collateral for non-performing loans.

VDSC forecasts that the real estate group will significantly contribute to profit growth in the second half, based on the low base from the previous year, as large investors such as VHM, KDH, and NLG focus on handing over products that were pre-sold.

For other sectors with a significant contribution to profit growth, including industrial goods and services, retail, and aviation stocks, will be the main highlights contributing to the overall growth picture. This is due to the positive industrial production outlook, improved profit margins as the price war comes to an end in the retail sector, cooling material costs in the consumer goods sector, and consecutive quarters of positive profits for aviation businesses due to increased sales and production volumes.

For the full year 2024, the growth rate of the portfolio of stocks analyzed by VDSC is estimated to reach 19% year-over-year. Accordingly, VN-Index’s net profit is expected to increase by 18% compared to the previous year.

Which Stock Groups Will Lead in the Second Half of the Year?

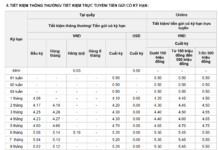

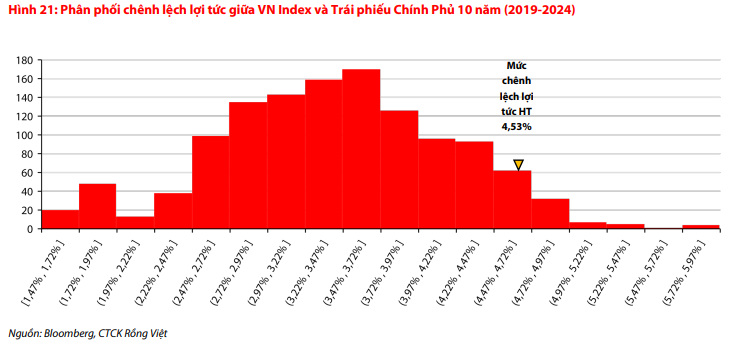

With the above earnings growth prospects, the analysis team believes that the stock market’s yield will continue to improve at the current capitalization. Moreover, the current yield gap (E/P of the stock market compared to government bond yields) is well above the five-year average and falls within a range with a relatively low probability of occurrence.

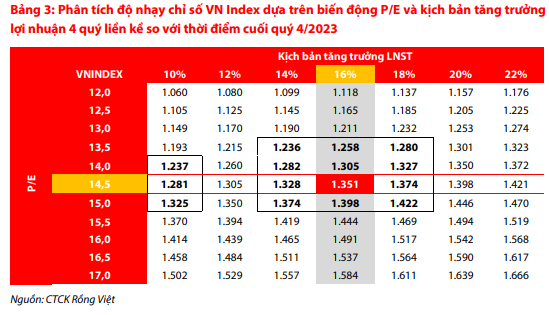

A yield gap of over 4.0% usually occurs when there is an unexpected headwind, which tends to pass quickly, allowing the market to rebalance and recover promptly. Therefore, with a growth rate of ~10% in the latest quarter (as of Q2/2024) compared to the cumulative four-quarter EPS (as of Q4/2023), a reasonable P/E range for Q3/2024 is expected to be 14x – 15x (corresponding to a yield gap of 3.5% – 4.0%), equivalent to a balanced trading range for the VN-Index of 1,237 – 1,325.

For the long term, based on the profit growth outlook (14%-18% year-over-year) and a P/E trading scenario of 13.5 – 15 times, the reasonable range for the VN-Index is 1,236-1,420, reflecting the full-year 2024 business results compared to 2023.

Looking into the second half of 2024, a moderate monetary policy environment and sustained profit growth among businesses will be the driving forces for the market’s early recovery. Thus, VDSC’s stock picks for the second half are those of enterprises that maintain a recovery/profit growth trend in the consumer goods, steel, banking, industrial park, and seafood sectors. In addition, the textile sector is also an industry that investors can consider revisiting if there is a significant price discount during market adjustments, as the profit trend in this sector is promising.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.