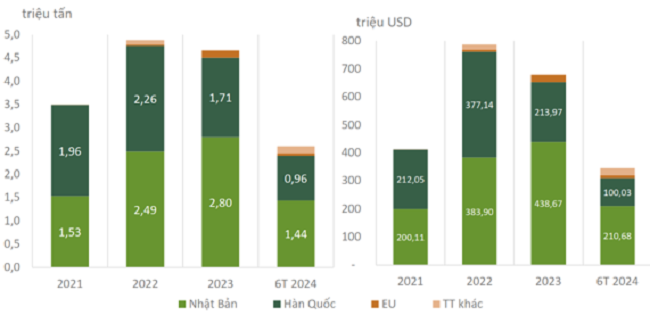

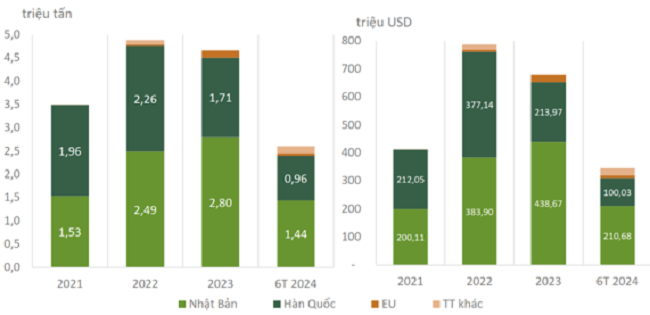

Speaking at a recent roundtable discussion, “Current Status and Solutions for Some Timely Issues in Vietnam’s Wood Industry,” Dr. To Xuan Phuc, an expert from Forest Trends, shared that Vietnam’s briquette exports reached 2.6 million tons in the first half of 2024, valued at $345.5 million. This marks a significant increase of 25.9% in volume and 4.6% in value compared to the same period last year.

SOUTH KOREA AND JAPAN REMAIN THE DOMINANT MARKETS

South Korea and Japan are the two largest export markets for Vietnamese briquettes. In the first six months of 2024, exports to these two countries accounted for 9.2% of the volume and an impressive 89.9% of the value of Vietnam’s briquette exports.

Additionally, the EU is the third-largest export market for Vietnamese briquettes, with a volume of 48.6 thousand tons, equivalent to $9.5 million. This accounts for 1.9% and 2.8%, respectively, of Vietnam’s briquette exports by volume and value. Other markets for this product include Taiwan and PNP.

The average export price of briquettes witnessed a sharp decline in both the South Korean and Japanese markets during the first half of 2024.

In Japan, the average export price of briquettes was $170 per ton in the first half of 2023, reaching $185 per ton in some months. However, in the same period this year, the average price dropped to $146 per ton, a decrease of $24 per ton.

Similarly, in the South Korean market, the average export price was $139 per ton in the first six months of 2023, while it fell to $104 per ton in the first half of 2024, a reduction of $35 per ton.

“To reduce dependence on the South Korean and Japanese markets, briquette manufacturers need to explore and promote consumption in new markets, such as the European market and the domestic market.”

Dr. To Xuan Phuc, Expert from Forest Trends

According to Dr. Phuc, the Japanese market will continue to play a crucial role for Vietnamese briquette producers in the near future. Vietnamese businesses also have the opportunity to replace Indonesia as a supplier of briquettes to Japan, as Indonesia’s palm oil shell-based briquettes may not meet Japan’s sustainability certification requirements.

“There is potential for increased domestic consumption of briquettes and woodchips in the future due to the Vietnamese government’s commitment to reducing emissions and businesses voluntarily switching from high-emission materials to briquettes, especially if the government introduces incentives for this transition,” Dr. Phuc added.

Mr. Olaf Naehrig, Chief Engineer of the KAHL Group in Vietnam, pointed out that the EU market currently accounts for a small share of Vietnam’s briquette exports, representing only 3.3% of the total export volume and 3.8% of the total value. In 2023, the EU imported more than 155,000 tons of briquettes from Vietnam, totaling nearly $26 million. This reflects a nearly threefold increase in volume and a 3.7-fold rise in value compared to 2022, indicating a positive trend for Vietnamese briquettes in the EU market.

Mr. Naehrig concurred with the view that the Vietnamese briquette industry needs to promote market entry into Europe, as it is the world’s largest consumer of briquettes.

TECHNOLOGICAL INNOVATION NEEDED TO EXPAND RAW MATERIAL SOURCES

According to the Vietnam Timber and Forest Product Association, there are currently 83 companies directly involved in briquette exports and over 300 briquette manufacturing facilities in Vietnam. However, compared to the export demand, the number of Vietnamese companies in this sector is relatively small, with exports concentrated among a few large corporations.

The briquette industry in Vietnam faces intense competition for raw materials from the woodchip export sector. Therefore, it is essential to explore technological advancements to expand the range of input materials for briquette production.

Mr. Nguyen Son Ha, representing the KAHL Group in Vietnam, shared a similar perspective, noting that the sustainability of briquette production in Vietnam is challenged by inconsistent sources and variable quality of raw materials.

“The raw material for briquette production is not limited to acacia wood. Elephant grass, corn stalks, and sugarcane bagasse can also be used. In fact, any agricultural by-product that can be burned is a potential raw material for briquettes.”

Mr. Nguyen Thanh Phong, Chairman of the Vietnam Briquette Association

Mr. Ha emphasized the advantage of Vietnam’s briquette industry lies in the presence of numerous furniture manufacturers. Utilizing wood waste and sawdust from furniture production reduces environmental pollution, as businesses no longer need to burn or dispose of these by-products. Vietnamese briquettes are favored in the Japanese market because they produce no smoke or CO2 emissions when burned.

However, the competition for raw materials is intensifying, and the industry faces a scarcity of wood from planted forests. To ensure sustainable development, the Vietnamese briquette industry must embrace technological advancements and seek alternative sources of raw materials.

“KAHL is the world’s first company to produce briquettes from sugarcane bagasse, using a unique technology with six rollers that compress the bagasse. KAHL is the only company capable of producing 10–12 tons of briquettes per hour. With modern technology, we can achieve lower production costs and higher-quality products to remain competitive in the market,” shared Mr. Nguyen Son Ha.

Mr. Nguyen Thanh Phong, Chairman of the Vietnam Briquette Association, added, “To produce briquettes from agricultural by-products, the technology doesn’t need significant alterations, but businesses should focus on identifying suitable customer segments.”

Recovery in exports, but Vietnam’s footwear industry faces many concerns

In the first quarter of this year, Vietnam’s footwear and leather industry reached an export turnover of 5.6 billion USD, up 10% over the same period last year. However, the industry is facing many challenges, the most significant of which is the bottleneck in the supply chain of raw materials.