Individual investors have net bought 16.2 trillion dong worth of bank stocks since the beginning of the year, while profits and bad debt of the banks peaked in the second quarter of 2024.

PROFITS AND BAD DEBTS PEAK

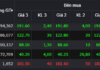

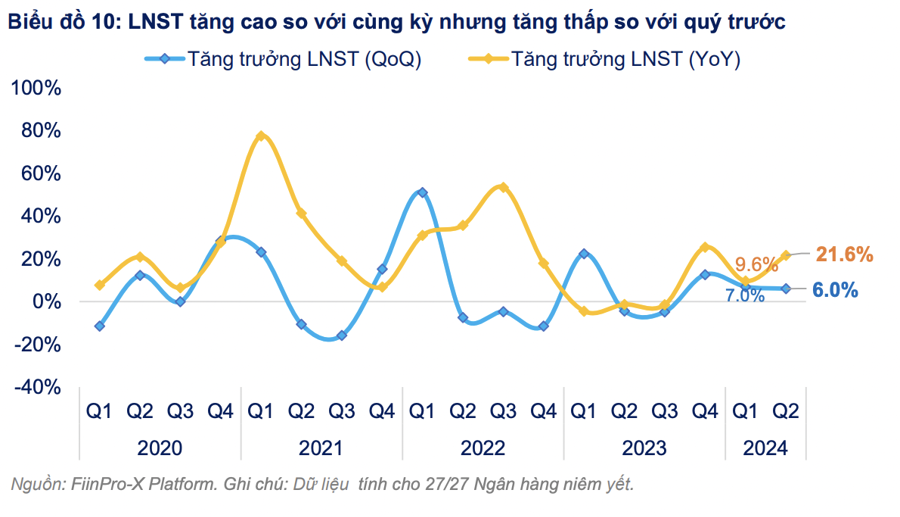

The after-tax profit of 27/27 listed banks reached more than 60.9 trillion dong in the second quarter of 2024, contributing 49.5% to the total after-tax profit of the whole market in the same period and surpassing the historical peak of the first quarter of 2022, according to statistics by FiinTrade.

The industry’s after-tax profit increased by 21.6% over the same period last year but rose modestly by 6% compared to the previous quarter. Net interest income increased slightly by 6% as credit growth slowed and NIM remained at the bottom of the post-Covid-19 period. Non-interest income increased by 16.5% compared to the previous quarter but accounted for a small proportion of total operating income at about 12.2%.

The industry’s profit growth was driven by the private joint-stock bank group, which increased by 28.2% year-on-year and 7.6% quarter-on-quarter, while the state-owned joint-stock bank group increased by a lower rate of 10% year-on-year and 2.9% quarter-on-quarter.

Some banks with high after-tax profit growth include BID, ACB, MBB, LPB, and VPB. In contrast, VCB, TCB, and SHB saw their Q2 2024 after-tax profit decrease compared to the previous quarter.

As of June 30, 2024, credit growth at the 27 listed banks reached 6% compared to the end of 2023, with disbursement activities intensified in the last week of June. Credit declined again in July, narrowing credit growth to 5.7%.

Notably, credit for real estate business (supply side) increased sharply by 10.4%, while credit for real estate consumption increased very slightly by 1.2%. Usually, loans to the real estate consumption group will have higher interest rates and bring better NIM to the bank.

The NIM of the 27 listed banks stood at 3.43% in the second quarter of 2024, remaining at the bottom for the fourth consecutive quarter. This trend was influenced by the narrowing NIM in the state-owned joint-stock bank group, which fell from 2.83% in the first quarter to 2.73% in the second quarter of 2024. In contrast, the NIM improved from 3.88% to 3.96% in the private joint-stock bank group, including VPB, TCB, and MBB.

The pure LDR ratio, calculated as Total Loans/Total Mobilized Capital, continues to rise, approaching the old peak, indicating the system’s high liquidity needs amid a “negative” gap between credit growth and mobilization.

The recent upward trend in deposit interest rates will put pressure on the industry’s NIM, especially in the state-owned joint-stock bank group, in the coming quarters, as the lending rate remains stagnant due to weak credit demand and the government’s policy to keep interest rates low to support growth.

In terms of bad debt, the pressure has increased significantly. The reported non-performing loan ratio of the 27 listed banks as of June 30, 2024, was 2.21%, returning to its historical peak (2.24%). The NPL ratio increased at CTG, TCB, VPB, and STB but decreased at VCB, MBB, and HDB. Special mention loans decreased sharply by 19 trillion dong, or -8.9%, while doubtful debts continued to increase by 11 trillion dong, equivalent to a 10.6% increase.

Bad debt increased while provisioning costs remained moderate due to the extension of Circular No. 02, causing the buffer for future losses to continue to thin, limiting the capacity for debt handling in the coming period. The loan loss coverage ratio (LLCR) fell to 81.5% in Q2-2024, the lowest since the Covid-19 pandemic and quite far from the peak (143.2%) in Q3/2022. The NPL formation ratio was 0.16% in Q2/2024, the second consecutive quarterly increase.

INDIVIDUALS NET BOUGHT 16.2 TRL DONG, WHAT’S THE OUTLOOK?

According to FiinTrade’s assessment, the industry’s outlook is not optimistic, while the banking sector index remains sideways at the peak, limiting capital inflows into this stock group.

However, in the stock market, individual investors are net buyers of bank stocks since the beginning of the year, with more than 16.2 trillion dong, absorbing all the net selling of institutions, mainly foreign investors.

The P/B ratio of banks has fluctuated within a narrow range (1.4x-1.6x) for nearly two years, significantly lower than in 2021-2022 (1.7x-2.7x). Still, this is a reasonable valuation for the banking industry, reflecting concerns about the quality of the banking system’s assets after the fallout from the negative developments in the corporate bond market and the real estate market in 2022.

Meanwhile, looking at the business results outlook for the rest of the year, Rong Viet Securities expects banks to continue to lead the market’s profit growth in the second half of the year, thanks to the economy’s expansionary needs, helping credit growth in 2024 to reach the target of 14%-15%.

The bad debt scale will decrease slightly by the end of the year when banks have a better pre-provision profit position than in 2023 to continue absorbing and cleaning up the balance sheet, and economic recovery helps reduce bad debt formation pressure and speed up the handling of collateral of non-performing loans.

VnDirect recently forecast that the banking industry’s net profit growth in 2024 would reach about 23.8% year-on-year (Q1/24: 18.1%). VPB, LPB, and CTG are expected to be the banks with the highest growth rates in the industry.

After a period of rising due to loose monetary policy and a low-interest-rate environment, bank stocks will continue to differentiate and adjust based on business performance.

Therefore, VnDirect believes that this is a good time to continue accumulating bank stocks selectively based on growth prospects. The reasons include: The real economy’s evident recovery in Q2/24 has eased concerns about the quality of the banking system’s assets.

Mr. Nguyen The Minh, Director of Individual Customer Analysis at Yuanta Securities, maintains a positive view on banks in the coming period.

According to him, the pressure on the exchange rate has eased as US interest rates have fallen, and the overall economic environment has become more stable, reducing liquidity pressure on the system. The banking industry will be the first to benefit from the economic recovery. The P/B ratio of the banking industry is lower than the five-year average. Selling pressure from foreign investors is gradually decreasing.

“The stock groups that can be considered in the coming time are still banks. The banking group is facing bad debt pressure, but there are signs that bad debt has peaked, and credit growth recovery will offset the challenging NIM,” emphasized Yuanta’s analyst.

Overcoming Challenges in Dealing with Bad Debts

In the newly passed Revised Securities Law, securities companies (SCs) no longer have the privilege to hold collateral. Therefore, SCs need to recognize that debt collection is their responsibility, and they should be extremely strict in assessing borrowers, ensuring compliance with principles, procedures, and conditions before granting loans.

Declining profits at Bank increase in 2023

Throughout the year 2023, this bank achieved a pre-tax profit of over 928 billion VND, a decrease of 16.2% compared to 2022 and only 73% of the set plan was accomplished.