The market continued its upward trajectory amid uncertainty as money remained tight but stocks recovered well during the first trading session of the week. The index closed 6.64 points higher, approaching the 1,230-point mark, with a positive breadth of 238 gainers versus 168 losers.

While the real estate sector faced a 0.73% correction, most other sectors witnessed gains. Banks rose by 0.54%, securities increased by 1.07%, telecommunications climbed by 1.68%, steel went up by 0.85%, transportation gained 0.63%, and information technology advanced by 2.41%.

There was a significant level of consensus among banks as profit-taking and bad debt concerns were already priced into their stock prices. MBB rose by 1.07%, VPB gained 0.83%, while the national group of VCB, BID, and CTG saw more modest increases. MBB and VPB alone contributed 0.6 points to the overall market recovery.

However, FPT was the strongest stock, lifting the index by 1.10 points, followed by HVN with a 0.70-point contribution. Other notable performers included GVR, GAS, and PLX. On the flip side, the real estate sector witnessed a sharp decline, led by VIC, which fell by 1.46%, VHM dropping by 1.88% and becoming the biggest drag on the index, VRE losing 0.57%, and NVL declining by 1.75%.

Investors remained cautious, awaiting positive news as external risks persisted, resulting in low liquidity across the three exchanges. Total matched transactions amounted to VND 15,700 billion. Foreign investors recorded a negligible net buy of VND 54.5 billion, but when considering only matched transactions, they were net sellers to the tune of VND 43.2 billion.

Their net buys in the matched transactions were focused on the information technology and retail sectors, with top purchases including FPT, MWG, CTG, HVN, GAS, PLX, CSV, SIP, SKG, and MSB.

On the selling side, foreign investors offloaded bank stocks in the matched transactions, with HDB, HPG, DGC, TCB, STB, MSN, VIC, VCB, and DGW being among their top sells.

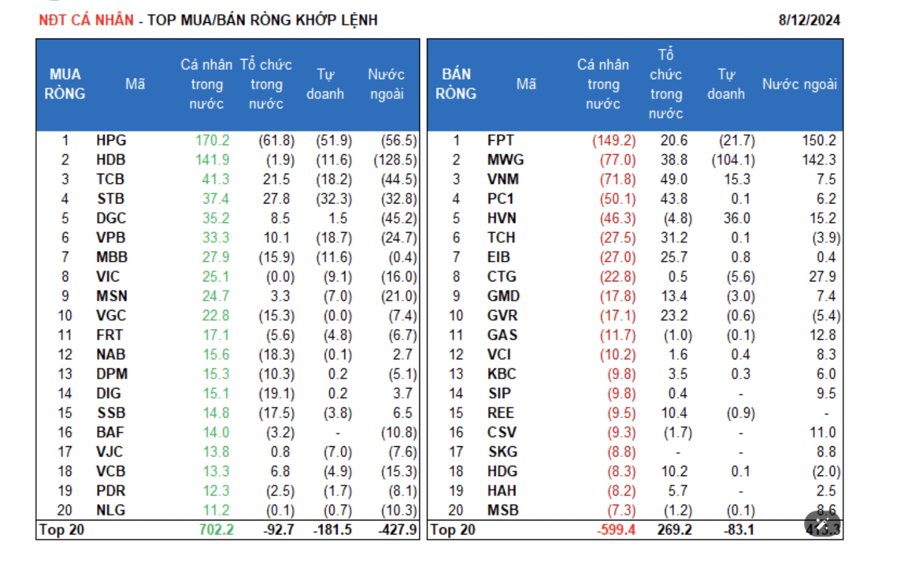

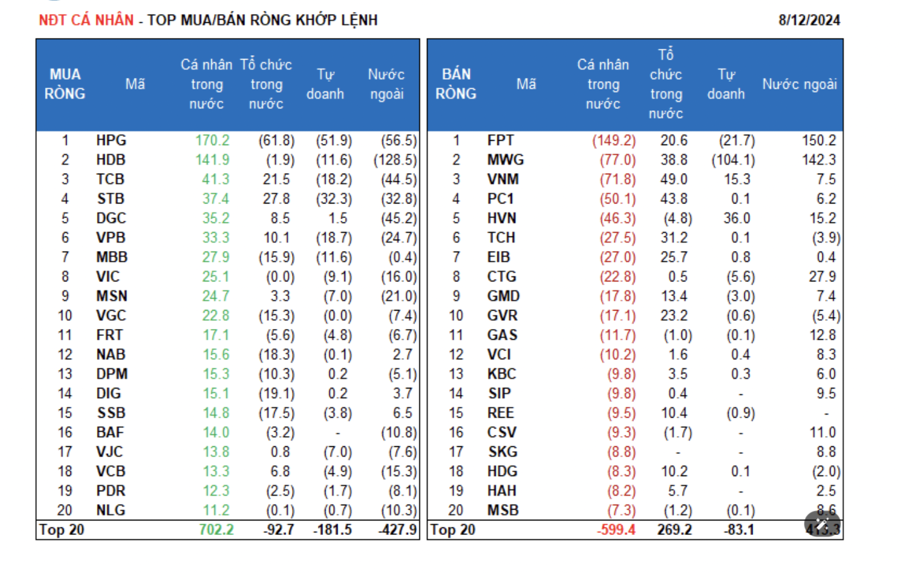

Individual investors recorded a net buy of VND 45.4 billion, with a net buy of VND 142.1 billion in the matched transactions. In the matched transactions, they were net buyers in 8 out of 18 sectors, primarily in the banking sector. Their top purchases included HPG, HDB, TCB, STB, DGC, VPB, MBB, VIC, MSN, and VGC.

On the selling side of the matched transactions, they offloaded stocks in 10 out of 18 sectors, mainly in the information technology and retail sectors. Their top sells included FPT, MWG, VNM, PC1, HVN, TCH, CTG, GMD, and GVR.

Proprietary traders were net sellers to the tune of VND 308.6 billion, with a net sell of VND 302.1 billion in the matched transactions.

In the matched transactions, they were net buyers in 7 out of 18 sectors, with the strongest purchases in the tourism and entertainment, and food and beverage sectors. Their top buys included HVN, VNM, VRE, CTD, FUEVFVND, BMI, DGC, PNJ, EIB, and TV2.

On the selling side, banks were the top sector. Their top sells included MWG, HPG, STB, FPT, VPB, TCB, ACB, MBB, HDB, and VIB.

Domestic institutional investors recorded a net buy of VND 238.0 billion, with a net buy of VND 203.1 billion in the matched transactions. In the matched transactions, they were net sellers in 5 out of 18 sectors, with the largest net sell in the basic materials sector. Their top sells included HPG, DIG, NAB, SSB, MBB, VGC, PLX, DPM, DXG, and FRT.

On the buying side, they focused on the food and beverage sector, with top purchases including VNM, PC1, MWG, TCH, STB, EIB, GVR, TCB, FPT, and DGW.

Today’s trading session saw a significant increase in negotiated transactions, totaling VND 2,157.2 billion, a 20% jump compared to last Friday, contributing 13.8% to the overall trading value.

Notably, there was a large negotiated transaction among domestic individuals involving VHM, totaling nearly 18.8 million units worth VND 699.1 billion. Additionally, there were negotiated transactions between domestic individuals and foreign investors involving HDB and VJC.

In terms of money flow, the real estate, information technology, food and beverage, chemicals, oil and gas production, textiles, and electrical equipment sectors witnessed increased allocations, while the banking, securities, retail, steel, and agricultural sectors saw reduced allocations.

Specifically, in the matched transactions, money flow increased towards large-cap stocks in the VN30 index and small-cap stocks in the VNSML index, while there was a decrease in allocation towards mid-cap stocks in the VNMID index.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.