Illustrative image. Source: VTC.

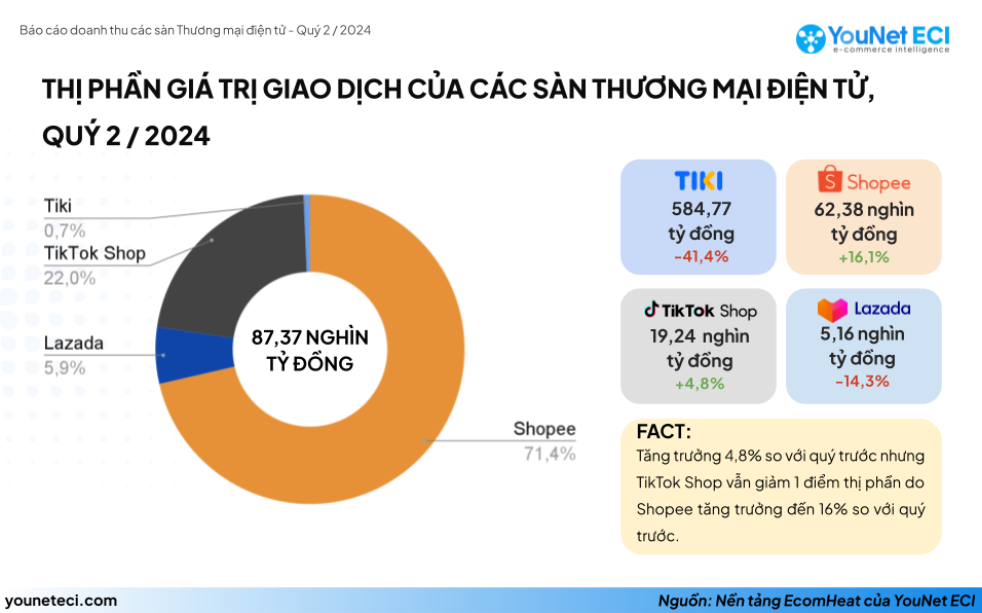

YouNet ECI, a leading e-commerce growth analytics and consulting firm, has released its Q2 2024 report on the revenue performance of Vietnam’s top e-commerce platforms. The report reveals that the four major players, Shopee, TikTok Shop, Lazada, and Tiki, collectively generated a staggering 87.37 trillion VND in GMV (Gross Merchandise Volume), reflecting a 10.4% growth compared to the previous quarter.

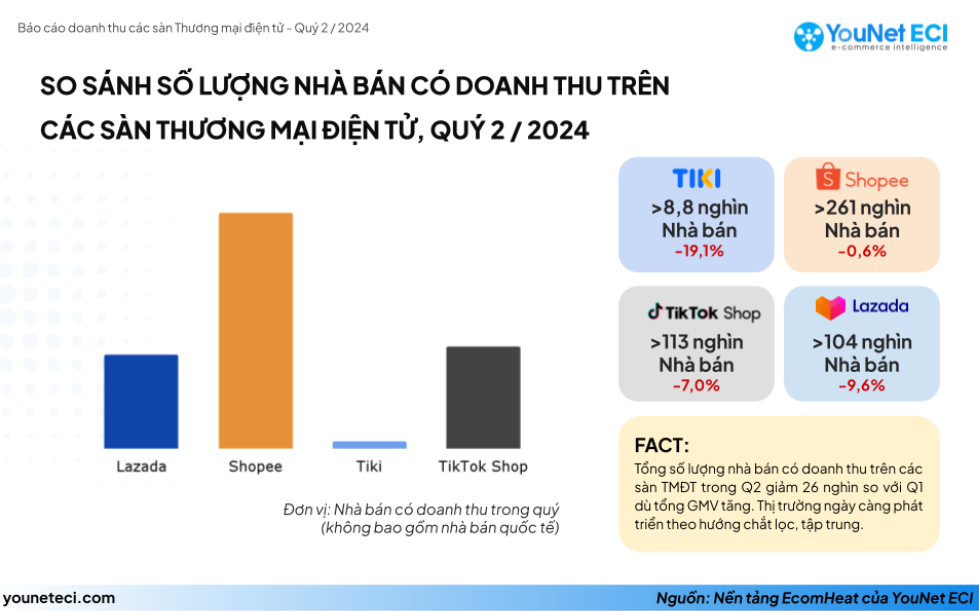

A notable highlight of Q2 is the decline in the number of sellers with revenue, dropping by 26,000 from the previous quarter. However, the average revenue per seller increased by 9%, and the average value per product consumed in e-commerce also rose by 7%.

The e-commerce landscape is rapidly evolving towards a more refined and focused approach, with a decrease in the number of non-specialized, low-revenue sellers.

“The key to success in e-commerce now lies in market and customer understanding, as well as professionalism at every touchpoint,” says Nguyen Phuong Lam, Market Analysis Expert and Director at YouNet ECI. “The days of simply setting up a store on a platform and expecting sales are over. It is imperative to have data-driven strategies and continuously find new directions to thrive.”

In the platform race, Shopee retains its dominance with 62.38 trillion VND in GMV, capturing a whopping 71.4% market share. Shopee also dominates across all e-commerce product categories, holding over 50% market share in each.

TikTok Shop maintains its strong position in second place with 19.24 trillion VND, accounting for 22% of the GMV market share. Lazada and Tiki follow in third and fourth places, with 5.16 trillion VND and 584.77 billion VND, respectively. Since November 2023, TikTok Shop has consistently held the second spot in the market, creating a duopoly with Shopee.

Comparing the two platforms, Shopee’s growth in Q2 outperformed TikTok Shop’s. While TikTok Shop’s total GMV grew by 4.8% from the previous quarter, Shopee’s GMV surged by 16.1%, allowing it to capture an additional 3.5% market share.

The main reason for this discrepancy lies in their reliance on the Fashion & Accessories category. This category accounts for only 24% of Shopee’s total GMV in the quarter, but a significant 37.5% for TikTok Shop. As the demand for Fashion & Accessories decreased in Q2 compared to Q1 due to the absence of the Tet holiday, TikTok Shop was more affected than Shopee.

In Q2 2024, both Shopee and TikTok Shop continued to focus on Shoppertainment, blending shopping with entertainment. Notably, in June, while TikTok Shop made headlines with its record-breaking livestreams, Shopee countered with its Shopee Live – Super Music Festival. This rivalry pushed the GMV for the entire market in June to a record high of 33.8 trillion VND, the highest monthly figure so far this year.

At the Vietnam-Asia Digital Transformation Forum 2024, expert Nguyen Phuong Lam also predicted that three key trends will drive the growth of Vietnam’s e-commerce industry over the next 3-5 years: the daily online shopping habit, the rise of high-value products, and the explosive growth of the shoppertainment trend.