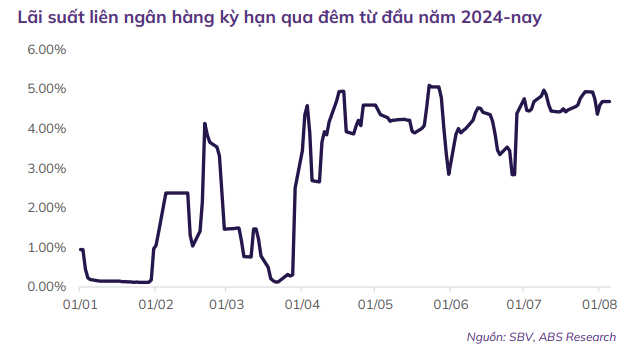

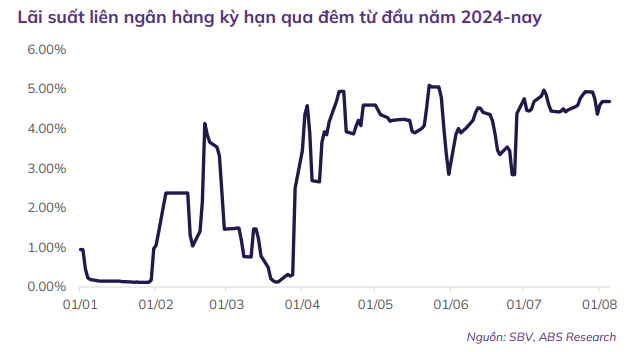

Interbank rates remain elevated

Experts from Military Commercial Joint Stock Bank Securities Company (MBS) have just released a report on the macro economy, stating that interbank rates remain high, above the 4% threshold across all tenors. In July, the State Bank of Vietnam (SBV) flexibly utilized both the OMO and bill issuance channels to stabilize system liquidity. Notably, the amount of money injected through the OMO channel this month increased fivefold compared to the previous month.

As of the end of July, the net money supply to the system was estimated at VND 416 trillion with a tenor of 7 days and an interest rate of 4.5%, including VND 236 trillion in maturing bills.

“We estimate that about VND 81.6 trillion in bills will continue to mature in August. Along with this, in July, the SBV also maintained bill issuance with a total value of about VND 196 trillion at a tenor of 14 days and an interest rate of 4.5%,” the report stated.

Interbank market rates remained above 4% across all tenors during the month. On July 9, the overnight rate jumped to 4.9% – the highest since the end of May – signaling system liquidity after the SBV’s strong net withdrawal moves in the past two months.

Additionally, credit growth as of June 30 reached 6%, also impacting the upward trend of interbank rates. By the end of July, thanks to the SBV’s intervention efforts, the overnight rate had dropped to 4.3%, while rates for tenors from one week to one month fluctuated between 4.5% and 4.6%.

According to the strategic report for August by An Binh Securities Joint Stock Company (ABS), on August 5, the SBV lent nearly VND 13,669 billion to seven market members through the OMO channel with a tenor of 7 days and an interest rate of 4.25% per annum.

“Compared to the previous session, the OMO lending scale of the SBV doubled, and the lending rate decreased by 0.25 percentage points, from 4.5% per annum to 4.25% per annum. This is the first time the SBV has cut the OMO rate since the end of 2023,” the report said.

ABS experts opined that with the prospect of a weaker US dollar and less pressure on exchange rates, the SBV’s reduction in OMO and bill rates aimed to establish a lower interest rate corridor in the interbank market, reducing the funding cost pressure on credit institutions.

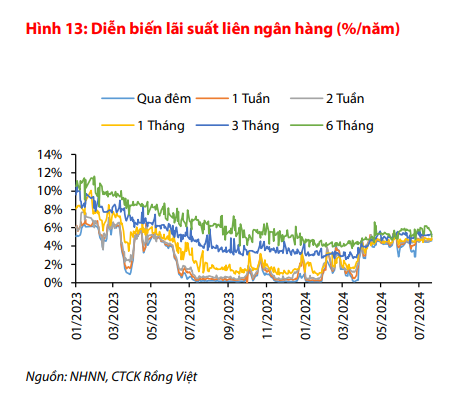

With the view that the overnight lending rate in the interbank market has remained stable at around 4.6% per annum in the past month, and the SBV’s bill and secured lending rates in the open market are both at 4.5% per annum, equivalent to the refinancing rate since the end of June; experts from Dragon Capital Securities Company (VDSC) also attributed the high interbank rates to the SBV’s money withdrawal through the open market and foreign currency sales in the first half of the year. These activities could make VND liquidity challenging in the coming time, especially as M2 money supply increases slowly while credit growth accelerates.

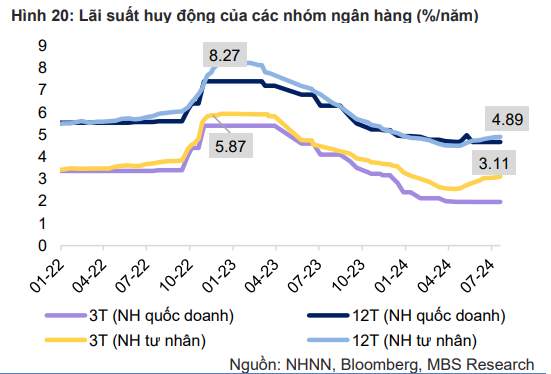

Deposit rates continue to rise

According to statistics, in August, deposit rates (for tenors of 6, 9, 12, and 24 months) were adjusted upward by many banks, with increases ranging from 0.1% to 1.3% depending on the tenor and bank, with some banks even offering rates above 6% per annum. This context of rapid credit growth, tripling the pace of capital mobilization, has prompted banks to raise deposit rates to enhance the competitiveness of savings channels compared to other investment channels in the market.

In the base case scenario presented by VDSC, the SBV may maintain the current policy rate until the end of 2024. A more challenging scenario is that if pressure on exchange rates increases in the last quarter of 2024 and system liquidity tightens, VDSC believes the SBV will raise policy rates by 25-50 basis points.

Regarding deposit rates, they declined at the beginning of the year and have only recovered since April, with an average change of 0.45-0.70 percentage points compared to the end of the first quarter. Currently, the deposit rate for a 9-12 month tenor has returned to the level of last year-end, while the deposit rate for shorter tenors is only 0.15-0.3 percentage points lower than at the end of 2023.

According to VDSC, the argument about liquidity leads to the expectation that deposit rates may continue to rise slightly and end 2024 higher than the beginning of the year by about 0.5-1.0 percentage points.

Regarding lending rates, VDSC stated that statistics from the SBV show that the average lending rate decreased by about 0.96 percentage points in the first six months of 2024, faster than the decline in deposit rates.

“The shift from deposit rates to lending rates always has a lag, so we believe that the increase in deposit rates may not significantly affect the downward trend of lending rates, at least until the end of 2024,” VDSC predicted.

Meanwhile, MBS believes that credit demand will continue to increase from mid-2024 as production and investment accelerate in the last months of the year. Cumulative for the first seven months of the year, the industrial production index (IIP) increased by 11.2% over the same period, and the purchasing managers’ index (PMI) reached 54.7 in July. Public and private investment increased by 2.3% in the first seven months of 2024 and 6.7% in the first six months, respectively.

Based on these analyses, MBS forecasts that the 12-month deposit rate of large joint-stock commercial banks may increase by 50 basis points, returning to the range of 5.2% – 5.5% by the end of 2024. However, output rates will remain at the current level as regulators and banks support businesses in accessing capital.

Banking: Huge Profits Yet Worried

Several banks have announced their 2023 financial results, showing outstanding growth. However, they are also facing increased pressure in setting aside provisions for credit risk.