NO NEW SUPPLY OF AFFORDABLE APARTMENTS IN Q2 2024

The first half of 2024 saw a continued surge in the real estate market, with the apartment segment witnessing a sudden spike in interest, leading to a significant rise in secondary market prices.

Ms. Do Thi Thu Hang, Senior Director of Consulting and Research at Savills Hanoi, shared, “Compared to the same period last year, secondary market apartment prices have increased by an average of 25%, with Grade B and C segments recording even higher increases of 27% to 29%.”

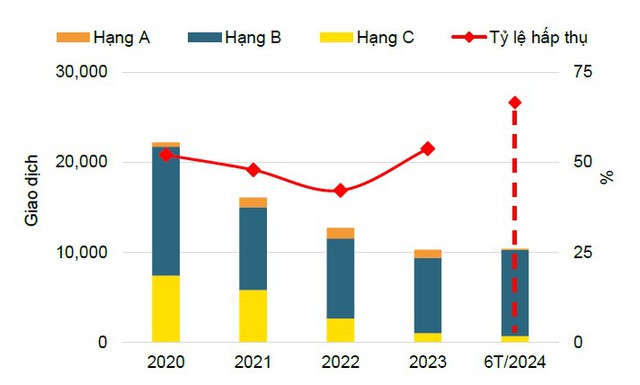

Hanoi apartment market performance.

Savills Vietnam’s Q2 2024 report also highlighted that, since 2020, primary market prices have increased by 18% annually, while secondary market prices have risen by 14%. As of mid-2024, primary market apartment prices reached VND 65 million/sqm, a 10% increase quarter-on-quarter and 24% year-on-year. Notably, Savills recorded no new supply below VND 45 million in Q2 2024.

The limited supply and imbalance in product availability are considered the main reasons for the continuous price increases in the apartment segment. In Q2 2024, new supply decreased by 34% quarter-on-quarter and 25% year-on-year, with 2,697 units. Primary supply stood at 10,317 units, a decrease of 20% quarter-on-quarter and 49% year-on-year.

Most apartment purchases recorded in the first six months belonged to the Grade B segment, which accounted for 96% of the total 5,085 units sold. This segment offers a good balance between service quality and daily needs, allowing buyers to strike a balance between housing costs and quality of life.

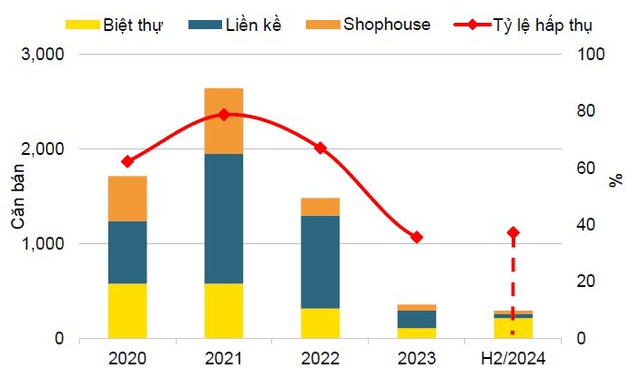

VILLA AND TOWNHOUSE SEGMENT: HIGH PRICES, LOW LIQUIDITY

The villa and townhouse segment showed signs of a slow recovery. In the first six months, transaction volume in this segment decreased by 40% quarter-on-quarter, although it increased by 5% year-on-year, reaching 111 units. The quarterly absorption rate was only 18%. New supply absorption stood at 48%, a decrease of 15 percentage points quarter-on-quarter and 3 percentage points year-on-year.

Most primary market transactions were recorded in Ha Dong district, accounting for 61%, thanks to upcoming infrastructure projects such as Le Quang Dao Street, expected to be operational in Q4 2024. Hoang Mai district and Thuong Tin district followed with 14% and 9%, respectively.

Hanoi villa and townhouse market performance.

Ms. Hang explained, “The villa and townhouse segment in existing projects has not shown signs of recovery, with high prices but low liquidity. Meanwhile, neighboring markets continue to offer new supply at competitive prices, attracting more buyers.”

Specifically, new supply of villas in new projects remained abundant. According to Savills, new supply reached 128 units, a 38% increase quarter-on-quarter but a 2% decrease year-on-year. This new supply came from two existing projects in Ha Dong: An Quy Villa with 54 villas, and An Lac Green Symphony in Hoai Duc with 12 new townhouses, and Him Lam Thuong Tin with 11 new shophouses.

Primary supply stood at 608 units from 16 projects, a decrease of 9% quarter-on-quarter and 24% year-on-year. Villas dominated the primary supply with 39%, thanks to new supply in this quarter.

In the first six months, primary market villa prices in projects increased by 9%, reaching VND 178 million/sqm of land. Townhouse prices decreased by 2% quarter-on-quarter to VND 188 million/sqm, mainly due to the sale of higher-priced units, leaving only lower-priced units available. Shophouse prices also increased by 3% quarter-on-quarter to VND 288 million/sqm of land.

A NEW CYCLE FOR THE HOUSING MARKET AFTER AUGUST 1

According to Ms. Hang, the Hanoi housing market is expected to enter a “new cycle” due to the early enforcement of the Land Law, Housing Law, and Real Estate Business Law, effective from August 1, 2024.

“With the early enforcement of these laws, many market issues will be addressed, and the impacts will be faster. For example, the limited supply issue in many localities. When supply is limited, consumers have fewer choices, leading to unstable and rising prices. Addressing the limited supply issue will have a positive impact on the overall market.”

However, it is important to note that even with the early enforcement of these laws, it will take time to resolve the limited supply issue as projects are awaiting guiding documents,” Ms. Hang added.

Currently, the high prices of various real estate segments significantly impact investment decisions and market liquidity. As the guiding documents are gradually issued, price stability is expected to improve, and the interests of the people will be better protected, such as the conditions and regulations for the sale of products formed in the future. Previously unapproved projects will now have a basis for resolution, and other issues, including land use fees, land lease, and social housing development, can also be addressed.

The early passage of these laws will also provide early support to the market, positively impacting the psychology of buyers and investors, giving them more confidence in their decisions and business plans for the upcoming period.

Notably, the Real Estate Business Law stipulates that developers can only collect a deposit of up to 5% of the property value and are only allowed to collect this deposit if the housing or construction project meets all the conditions for business operations according to the 2023 Real Estate Business Law. This helps protect buyers from the risk of capital occupation before completing the necessary legal procedures, giving them more time to prepare financially. At the same time, this regulation boosts confidence in transactions for the market.

Additionally, with the current limited land funds, projects, and supply in the central areas, the trend of shifting to the outskirts will continue to gain momentum, affecting both the apartment and villa/townhouse segments.

For apartments, demand mainly comes from the middle-income group, who can afford products priced below VND 3 billion. However, Hanoi offers limited options within this price range, leading buyers to consider projects in the outskirts, such as Nam Tu Liem, Ha Dong, and Gia Lam, which provide up to 93% of the supply in this segment.

Similarly, for villas and townhouses, by the end of 2024, thirteen projects will provide a total of 2,951 units, mostly in Dong Anh district, accounting for 34% of future supply. Ha Dong district follows with 19%, and Hoai Duc district with 16%.

Commenting on this trend, Ms. Hang explained, “In this context, the city has to invest in developing infrastructure in the peripheral areas to reduce congestion in the inner city and relocate residents to these areas. There are already new urban areas in these peripheral areas, which are invested with synchronous and quality utilities, and the number of transactions in these areas is increasing, making people more open to moving to these locations. The demand also comes from those who can work remotely and do not need to commute frequently while still enjoying synchronous utilities and good infrastructure.”

According to the Hanoi Department of Transport, there are currently 11 projects for traffic infrastructure construction planned to be implemented in Hanoi. Thirteen central ministries and sectors will be relocated outside the inner city, focusing on the West West Lake and Me Tri areas.

Price Check: Thủ Đức District Hanoi Alleyway House Prices Near Tet Holiday

Compared to the beginning of 2022, the prices of private houses in the alleys of Thủ Đức City (HCMC) have decreased.