As one of the 20 primary economic sectors and ranking 11th in scale (according to 2022 statistics from the General Statistics Office of Vietnam), real estate plays a crucial role in the country’s economy. It contributes to infrastructure development, job creation, and economic growth. Additionally, it boosts related sectors such as retail, tourism, education, and manufacturing.

Over the last decade, the real estate market has made significant contributions to state budget revenues through various taxes, including land use tax, tax on transfer of land use rights, and corporate income tax.

Vietnamese real estate companies, with their large-scale and modern projects, have transformed the face of many provinces and cities across the country, bringing prosperity to local communities and the nation. In the service journey of these real estate companies, their tax contributions serve as an important metric to evaluate their impact on the country’s development.

Currently, there are multiple lists recognizing enterprises, but none specifically reflect their tax contributions. To address this gap, CafeF has created a list honoring the top private enterprises in terms of tax contributions to the state budget, titled PRIVATE 100 – TOP PRIVATE ENTERPRISES WITH THE LARGEST STATE BUDGET CONTRIBUTIONS IN VIETNAM. Enterprises with state budget contributions of VND 100 billion or more in the latest fiscal year are eligible for inclusion in this list.

The list honoring the top 10 private real estate companies in terms of state budget contributions is a part of PRIVATE 100. Previously, we have announced the lists of the top 10 private banks, the top 10 private securities companies, and the top 9 private enterprises in the distribution and retail sector.

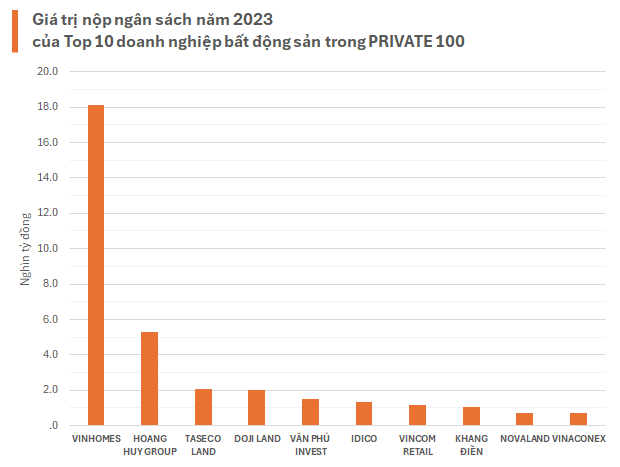

According to PRIVATE 100 data, the total state budget contribution of the top 10 real estate companies exceeded VND 32,000 billion, with 8 out of 10 enterprises contributing over VND 1,000 billion.

Unsurprisingly, this list includes some of the leading companies in the market, such as Vinhomes, Khang Dien, Idico, Novaland, Vinaconex, and Van Phu Invest, which have established their names over the past two decades. It also features younger but impressive players like Hoang Huy Investment Financial Services JSC, Taseco Land, and DOJILAND. Vincom Retail (VRE) is the only retail real estate company on the list.

Interestingly, the top five companies on the list are all connected to the keyword “Hai Phong.”

Vinhomes Royal Island project in Vu Yen Island, Hai Phong

Vinhomes JSC (stock code VHM) contributed approximately VND 18,000 billion to the state budget in 2023. This included VND 9,400 billion in value-added tax, over VND 5,800 billion in corporate income tax, nearly VND 2,000 billion in land use tax/land rent, and other taxes.

In 2023, VHM recorded more than VND 103,000 billion in net revenue, a 66% increase from the previous year, mainly from the handover of 9,800 low-rise real estate units at the Vinhomes Ocean Park 2 and 3 projects in Hung Yen.

In addition to Ocean Park, another project that has attracted significant attention from Vinhomes is Vinhomes Royal Island in Vu Yen Island, Hai Phong, which was launched at the end of March 2024. This large-scale urban area spans 877 hectares and is known as Vietnam’s first “city in the city.”

While Vinhomes represents Vingroup in the list of top private real estate companies in terms of tax contributions, Vingroup itself, along with several other member companies, also makes substantial budget contributions annually.

Ranking second in PRIVATE 100 in the real estate sector is Hoang Huy Investment Financial Services JSC (stock code TCH). TCH contributed over VND 5,300 billion (mainly from land tax and land rent), with its subsidiary, CRV Real Estate, contributing more than VND 5,100 billion.

TCH, originally a leading company in the field of tractor business, made a transition to the real estate sector in 2017 with its first project, Hoang Huy Golden Land in Hanoi. However, with the strong development of the Hai Phong real estate market, TCH has become one of the biggest players there, with 7 completed, ongoing, and upcoming projects.

The latest and largest project, covering nearly 50 hectares, is the Do Muoi project in Thuy Nguyen, which was acquired by CRV Real Estate (a subsidiary of TCH) through a public auction for VND 4,828 billion. This project also has a commercial name, Hoang Huy New City – II.

The tax contribution from the Do Muoi project is the main reason for TCH’s second-place ranking in the real estate sector.

In third place in PRIVATE 100 for the real estate sector is Taseco Real Estate Investment JSC (Taseco Land, stock code TAL) with a contribution of over VND 2,000 billion.

The projects in the Ngoai Giao Doan area served as a stepping stone for Taseco Land when it first entered the real estate sector in 2016. Since then, the developer has expanded its portfolio with multiple projects in the Ngoai Giao Doan and Tay Ho Tay (Hanoi) areas. Simultaneously, the company has also developed urban and residential projects in Quang Ninh, Nam Dinh, and Thanh Hoa provinces, as well as a mixed-use commercial and apartment project in Quang Ninh.

In the third quarter of 2023, Taseco Land paid VND 1,200 billion in land use fees for the Central Riverside project (a new urban area in the east of Thanh Hoa city, covering an area of 15.66 hectares). This significant payment was the main factor in the company’s 2023 budget contribution.

Recently, Taseco Land’s board of directors approved the establishment of a subsidiary named Taseco Hai Phong, indicating their intention to enter the real estate market in Hai Phong.

DOJILAND’s Diamond Crown and Golden Crown projects in Hai Phong

In fourth place, DOJILAND Real Estate Investment Co., Ltd., a subsidiary of DOJI Gold and Gems Group JSC, contributed nearly VND 2,000 billion to the state budget in 2023.

DOJILAND is renowned for its Kim Dia Oc (Golden Real Estate) product line, featuring artistic real estate projects. One of their iconic buildings is the DOJI Tower, the group’s headquarters, located in the heart of the capital at the intersection of Le Duan, Nguyen Thai Hoc, and Dien Bien Phu streets. With a total area of nearly 19,000 m2, 16 floors, and 3 basements, DOJI Tower is Vietnam’s largest specialized commercial center and gold and jewelry trading center, with the first five floors designed as a shopping mall.

The next two iconic projects are both located in Hai Phong. Diamond Crown Hai Phong, DOJILAND’s first project in the city, is designed in the shape of a queen’s diamond crown, while Golden Crown Hai Phong resembles a king’s golden crown. Golden Crown Hai Phong is also the tallest apartment tower in Hai Phong as of now.

Previously, the company successfully developed several luxury projects in Quang Ninh, including The Sapphire Residence, the 5-star Best Western Premier Sapphire Ha Long, and The Sapphire Mansions. Moving forward, DOJILAND will continue to introduce luxury real estate projects under the Kim Dia Oc brand in various provinces across the country, such as Hai Phong, Hanoi, Vinh Phuc, Hue, and Quang Ninh.

In fifth place, Van Phu Invest Investment Joint Stock Company (stock code VPI) contributed over VND 1,500 billion to the state budget in 2023, including nearly VND 1,140 billion from land auction payments. The majority of this amount came from the Vlasta Thuy Nguyen project in Hai Phong (over VND 950 billion) and the Song Khe – Noi Hoang project in Bac Giang (over VND 180 billion).

Idico Corporation (IDC) is the only representative of the industrial real estate sector on the list. Last year, the company contributed over VND 1,300 billion to the state budget in 2023, with the largest contributions coming from corporate income tax (VND 540 billion), value-added tax (VND 305 billion), and land tax and land rent (VND 340 billion).

Industrial real estate is one of Idico’s core business areas, along with residential real estate, energy, and services. The company owns and operates 10 industrial parks across the country, covering a total area of 3,400 hectares, and is the third-largest listed industrial park developer in terms of leasable land area (580 hectares).

Vietnam Construction and Import-Export Joint Stock Corporation (Vinaconex, stock code VCG) contributed over VND 700 billion to the state budget, with half of this amount coming from land use fees.

Vincom Retail JSC (VRE) is the only retail real estate company on the list. As the owner of 87 shopping centers, the largest network in the country, Vincom Retail has contributed over VND 1,170 billion to the state budget, mainly from corporate income tax and value-added tax.

Khang Dien House Trading and Investment Joint Stock Company (stock code KDH) contributed over VND 1,000 billion to the state budget. While most real estate companies on the list made their contributions through land auction payments, the majority of Khang Dien’s contribution came from corporate income tax (over VND 800 billion).

Similarly, Novaland Investment Group Corporation (Novaland, stock code NVL) contributed VND 739 billion to the state budget, mainly from corporate income tax. Despite facing challenges and being “frozen” for nearly two years to address issues in previous projects, Novaland still ranked 10th in the top 10 real estate companies in terms of budget contributions in 2023.

PRIVATE 100 – Top Private Enterprises with the Largest State Budget Contributions in Vietnam is a list compiled by CafeF based on publicly available data or verifiable figures. It reflects the actual budget contributions of enterprises, including various taxes, fees, and other payable amounts. Enterprises with state budget contributions of VND 100 billion or more in the latest fiscal year are eligible for inclusion in the list. Some notable enterprises in the 2024 list, reflecting their contributions in the 2023 fiscal year, include ACB, DOJI, HDBank, LPBank, Masan Group, MoMo, OCB, PNJ, SHB, SSI, Techcombank, TPBank, Hoa Phat Group, Vingroup, VNG, VPBank, VIB, Vietbank, and VPS (listed in alphabetical order)