In an unprecedented move last weekend, the People’s Bank of China (PBOC) instructed banks in Jiangxi province to halt purchases of government bonds.

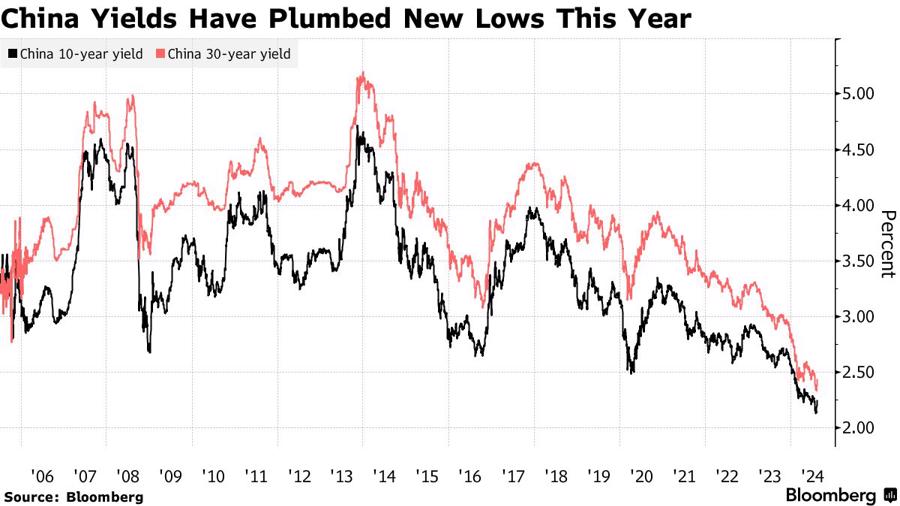

This was the latest and most heavy-handed intervention in a series of measures taken by Chinese authorities to cool the bond market as yields on government debt fell to record lows, raising concerns about risks to the banking system.

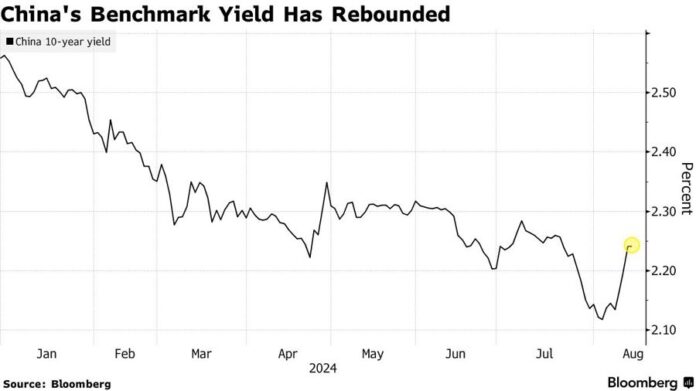

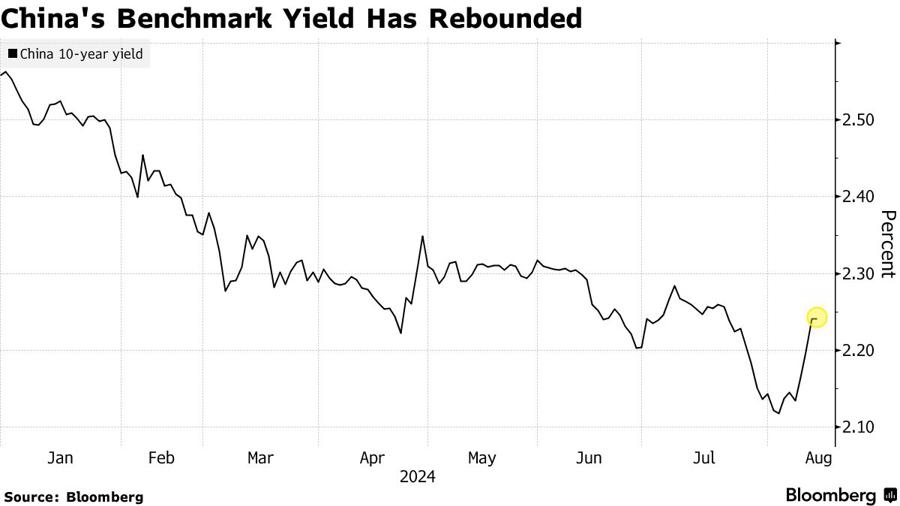

The interventions appear to have had their desired effect. After hitting a historic low of around 2.12% earlier this month due to worrying signals of an economic slowdown, the yield on China’s 10-year government bonds has gradually risen to around 2.25%.

However, analysts argue that these aggressive interventions undermine the integrity of the bond market, detaching it from fundamental economic factors and eroding investor confidence in the long run.

The Chinese government’s efforts to intervene in the stock and currency markets in recent years have led to record outflows of foreign investment from the country in the second quarter. This indicates a deep-seated pessimism among foreign investors towards financial assets in China.

“While the interventions have been effective in curbing excessive speculation, it is crucial for the government to implement more forceful monetary and fiscal measures to prevent deflationary expectations,” remarked Serena Zhou, a senior China economist at Mizuho Securities Asia Ltd.

The current situation also highlights Beijing’s dilemma. On the one hand, the government aims to support the lackluster economy by maintaining low borrowing rates. On the other hand, they must also ensure that rates don’t fall too low, leading to a dangerous bond bubble that could threaten the stability of the entire financial system. Chinese authorities are well aware of the risks, as evidenced by the collapse of Silicon Valley Bank, which had accumulated a large amount of US government bonds before the Fed aggressively raised rates.

According to a source familiar with the matter, among the recent interventions by the authorities, at least four of China’s top brokerage firms have reduced their trading of government bonds since last week. The regulators have also asked some of the largest state-owned banks to keep detailed records of customers buying government bonds to curb speculative activities.

“The PBOC’s concerns about financial risks are justified. However, it is difficult to say whether their interventions will be enough to lift bond yields in the long run,” wrote Xiangrong Yu, an economist at Citigroup Inc., in a report on August 12. “Despite temporary interventions, bond yields are ultimately determined by fundamental economic factors.”

Since the beginning of the year, Chinese government bond prices have surged amid a bleak economic outlook and expectations of further cuts in lending rates. The lack of attractive alternative investment channels, such as real estate and stocks, along with a shift from savings to investment, has increased the demand for Chinese government bonds.

However, according to asset management firm Pictet Asset Management, the PBOC’s recent interventions are standard policy adjustments within the toolkit of a central bank.

“The lack of low-volatility alternative investment channels makes Chinese government bonds attractive to investors, especially when the country’s stock market remains under pressure and the economy is recovering slowly. We believe this is not a cause for concern,” said Cary Yeung and Sabrina Jacobs of Pictet in a report earlier this week.

Choose the best mortgage deal when buying a home on installment.

The scarcity of supply will continue to drive up prices of apartments in 2024. As a result, projects that have already been completed or are about to be handed over, along with the best installment policies in the market, are the key factors that help Vinhomes attract a large number of customers in their search for a prestigious place to settle down.

China Increases Gold Reserves for the 16th Consecutive Month

In February, the People’s Bank of China (Central Bank) increased its gold reserves by approximately 12 tons compared to the previous month. This marks the 16th consecutive month that the bank has increased its gold reserves.