Shares of CSV, owned by Southern Basic Chemicals JSC, have been on a remarkable upward trajectory. After hovering around its peak for almost a month, CSV stock quickly regained its familiar upward momentum. On August 13, it soared to a new all-time high, surging by 6.92% to close at VND 42,500 per share.

Since the beginning of 2024, this leading chemical stock has skyrocketed by 168%. As a result of this impressive price rally, the company’s market capitalization surpassed VND 4,696 billion for the first time in its nine years of listing.

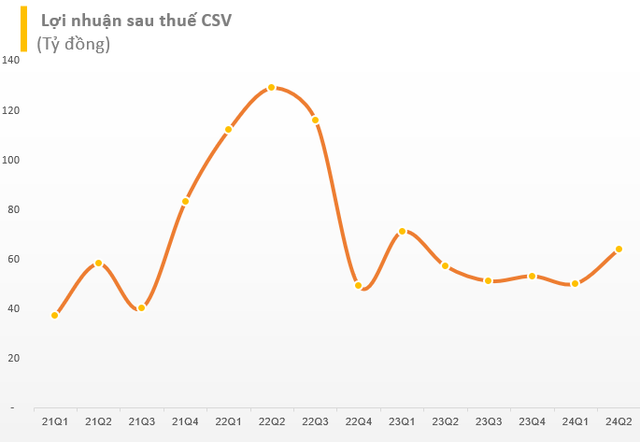

Strong Q2 2024 Earnings Growth

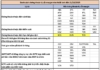

The primary catalyst behind CSV’s stock price surge is its robust financial performance. According to the consolidated financial statements for the second quarter of 2024, Southern Basic Chemicals JSC reported net revenue of nearly VND 481 billion, marking a 34% increase compared to the same period last year. As the growth in cost of goods sold was lower than the increase in revenue, the company’s gross profit improved significantly, reaching VND 135 billion, a 46% jump.

CSV attributed the rise in net revenue to a decrease in the selling prices of its main products, coupled with an increase in sales volume (NaOH up by 42%, HCL up by 36%, liquid chlorine up by 27%, and H2SO4 up by 38%).

After accounting for various expenses, the company posted a pre-tax profit of nearly VND 97 billion, reflecting a 40% growth compared to the corresponding period in 2023. For the first six months of 2024, CSV’s net revenue and pre-tax profit reached VND 832 billion and VND 159 billion, respectively, representing an 11% and 1% increase compared to the same period in 2023.

For the full year 2024, CSV has set ambitious business targets, aiming for a revenue of VND 1,640 billion, a modest 3% increase compared to 2023. However, the company expects its pre-tax profit to decrease by 10% from the previous year’s performance, reaching VND 261 billion, which would be the lowest profit level in the past four years. Nonetheless, after the first half of the year, CSV has already achieved 51% and 61% of its revenue and profit targets, respectively.

Healthy Financial Position

Additionally, CSV is recognized for its robust financial health, characterized by ample cash reserves and a very low financial leverage.

As of June 30, 2024, CSV held over VND 627 billion in cash and bank deposits, accounting for nearly 35% of its total assets. An Binh Securities (ABS), in a recent report, highlighted that this substantial cash position empowers CSV with the flexibility to navigate its business operations effectively.

Short-term receivables displayed an upward trend, reaching nearly VND 303 billion at the end of Q2 2024, representing a 28% increase compared to the beginning of the year. Meanwhile, inventory stood at VND 364.9 billion, a slight decrease of 0.1% from the end of 2023, and accounted for 20.2% of total assets. Both short-term receivables and inventory are associated with very low provisions.

On the capital side, the company had short-term borrowings of approximately VND 74 billion, with a very low debt-to-equity ratio of 0.05. ABS noted that CSV has maintained a low financial leverage, with the debt-to-equity ratio declining from 0.22 in 2019 to 0.07 in 2023. This low leverage ensures that the company is not burdened by significant interest expenses.

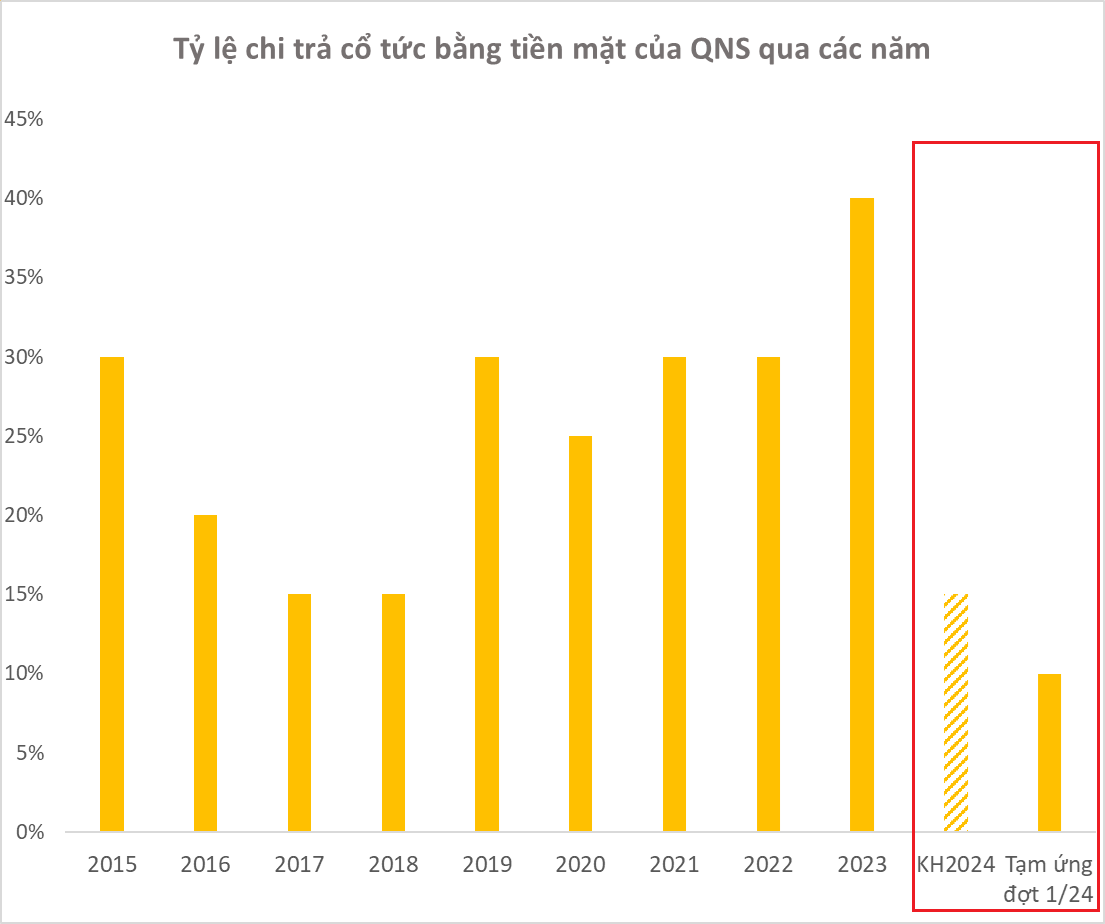

Moreover, CSV has a consistent track record of paying cash dividends, with a minimum annual payout of 10% of par value (35% in 2022, 25% in 2023, and a planned 10% in 2024 in cash).

Promising Profit Outlook for 2024

According to ABS analysts, CSV’s profit outlook for 2024 is anticipated to be more favorable than in 2023.

Firstly, sales volume is expected to continue its upward trajectory as domestic industrial production rebounds, driving demand for chemicals, particularly NAOH and yellow phosphorus.

Secondly, prices of basic chemicals such as NAOH, HCl, liquid chlorine, and yellow phosphorus have witnessed a relative decline recently, and ABS expects this downward trend to stabilize.

However, CSV also faces certain challenges, including the relocation of three factories from Bien Hoa Industrial Park 1 to Nhon Trach Industrial Park 6, which could lead to temporary production disruptions. Nevertheless, the company has devised a well-planned relocation strategy to ensure a smooth transition and maintain stable business operations. Additionally, the analysts pointed out that import quotas for industrial salt, a key raw material for CSV, are restricted, and the company currently relies entirely on imports.

ABS Research projects CSV’s net profit attributable to shareholders for 2024 to exceed VND 253 billion, representing a 21% increase compared to the previous year.