Packaging fertilizer products that meet the 3 criteria of “organic, biological, and microbial” fertilizers at TH Group’s factory. Illustration: Vu Sinh/ VNA

Low demand for fertilizer

As of early August, the amount of fertilizer consumed for the summer-autumn rice crop is estimated at 750-830 thousand tons, equivalent to about 98% of the total demand. Only about 2% of the total fertilizer demand remains unused for the summer-autumn rice crop, scattered in the coastal provinces of Soc Trang, Kien Giang, Long An, Tra Vinh, Bac Lieu, Ca Mau, and Ben Tre. The demand for DAP has been met, while the demand for potassium, NPK, and urea is estimated to be at 6%, 3%, and 2%, respectively.

In the North, the provinces are still in the stage of planting the autumn rice crop, but many areas continue to experience heavy rainfall this week, delaying fertilization activities. In the Central region, the summer-autumn rice crop has completed the fertilization stage, and the demand has almost stopped, with only sporadic demand for flowers and fruit trees. In the Eastern and Western Highlands of the South, the main crops have passed the peak of the first fertilization period in the rainy season, so the demand has slowed down. It is expected that by mid-August, the main crops will have the demand for the second fertilization.

Meanwhile, the production of urea fertilizer in July reached about 205 thousand tons, an increase of 10 thousand tons compared to June. In addition, the amount of imported urea fertilizer in July also reached 30 thousand tons. Urea inventory at the end of July was estimated at 389 thousand tons, an increase of 38 thousand tons compared to the end of June.

Therefore, urea prices in the last week of July tended to decrease in most areas when the two northern factories reduced the selling price by VND 200/kg from July 27, while the Ca Mau Fertilizer Factory kept the selling price unchanged from July 26.

Regarding DAP fertilizer, the import activities of this type of fertilizer are quite vibrant, with 21,500 tons imported to Vietnam in the last week of July from July 24-30. It is expected that in August and September, more DAP ships will be delivered to Vietnam. By the end of July, DAP inventory was estimated at 263 thousand tons, an increase of 29 thousand tons compared to June, while DAP transactions were also quiet, and DAP selling prices remained stable compared to the previous week.

Regarding NPK compound fertilizer, the import offer price for NPK was stable, while the domestic offer price for NPK increased slightly. NPK inventory by the end of July was at 509 thousand tons, a decrease of 53 thousand tons compared to June.

Promoting exports when domestic demand decreases

To operate efficiently when the consumption of fertilizer for agricultural production in Vietnam is not high, fertilizer manufacturers in Vietnam have promoted exports, taking advantage of the increase in world fertilizer prices due to the increase in fertilizer consumption for the crop season.

According to reliable data from the Vietnam Market Forecast and Research Company (a company that fertilizer manufacturers in the country are using market data to serve production management), fertilizer exports slowed down in the last week of July, with more than 6,800 tons of urea (Phu My, Ca Mau, and Ha Bac urea) exported, a decrease of 4,000 tons compared to the previous week.

Statistics from the international market research company Argus also show that the shortage of Chinese urea on the export market has pushed up the bid price of granular urea to $370/ton FOB in Indonesia, but the loading activities at the Bontang port are still delayed. (FOB price is the price at the seller’s border gate, including all costs of transporting the goods to the port, export tax, and export procedure tax.)

In the markets west of Suez, the price of granular urea in Brazil remains unchanged at $355-360/ton CFR (CFR price is the price at the border gate of the exporter, including transportation costs) due to limited demand from Europe and the US hindering price recovery.

It is expected that the demand for urea fertilizer will be stronger from the European and American markets from September. Demand increased in some Asian markets as some tenders for purchasing goods took place in Sri Lanka, Pakistan, etc., and an Indian urea import tender is expected to be issued within one or two weeks. In the Americas, transactions are not vibrant. The price of granular urea in the US/Brazil generally decreased by $3-7/ton/st compared to the previous week.

According to the Ca Mau Petroleum Fertilizer Joint Stock Company (PVCFC), the company always prioritizes the supply of fertilizer in the domestic market, meeting the demand for fertilizer for agricultural production and ensuring national food security. However, in the off-season, PVCFC will focus its business on the world market, seeking opportunities to export not only key products but also other chemical fertilizers.

Currently, the world’s major fertilizer consumers, such as China, India, the US, Brazil, and Europe, are re-tendering to ensure fertilizer supply. China and Russia have also extended the time to restrict fertilizer exports. Therefore, this is an opportunity for Vietnamese enterprises to promote exports when the domestic demand is at a low level. With the existing advantages in more than 18 countries in the world, PVCFC continues to promote exports to markets it has conquered and expands its penetration into new markets.

To realize the goals of promoting exports, DCM has been investing in expanding its production and business activities, developing infrastructure, logistics, ensuring shortened time, and optimized transportation costs. In addition, DCM also implements solutions to increase the safe operating capacity of the factory by 10-20%.

Similarly, the Vietnam National Chemical Group Joint Stock Company (PVFCCo) continues to operate fertilizer factories efficiently, safely, and stably, prioritizing cost reduction and product quality improvement. PVFCCo also continues to closely monitor market developments and strengthen forecasting to make optimal business decisions. In addition, PVFCCo also considers transforming its business model and distribution system to suit the market context. In addition, PVFCCo aims to seek and take advantage of all export opportunities to India, South Korea, Japan, Thailand, Taiwan (China), and the Philippines to reduce the pressure of excess supply from the domestic market during the off-season.

Vietnam maintains its position as South Korea’s third largest trading partner

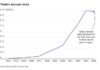

For the second year in a row, Vietnam has surpassed Japan to become South Korea’s third largest trading partner, despite a decrease in both imports and exports from Vietnam.

Export revenue of 7 commodities exceeded 1 billion USD in January 2024.

The Ministry of Industry and Trade has reported that the export turnover of goods in January 2024 is estimated at $33.57 billion, representing a 6.7% increase compared to the previous month. In the face of unpredictable developments in the world, businesses need to be prepared to seize opportunities and be flexible in responding to challenges, in order to devise the most appropriate strategies.