The Vietnam Social Security (VSS) has recently announced its focus on enhancing pension payment methods by offering direct deposits into personal bank accounts to ensure the welfare and convenience of beneficiaries. This is in addition to existing payment options such as cash payments, payments through employers, and home deliveries for the elderly or infirm.

As of August 1, 2024, the VSS began directly depositing monthly pension and social insurance allowances into the personal accounts of beneficiaries in 43 provinces and cities.

Receiving pensions or social insurance benefits through a bank account is voluntary and not mandatory.

The VSS also announced that starting September 1, 2024, this direct deposit payment method will be implemented in the remaining 20 provinces.

This announcement has raised concerns among some people who wonder if everyone will be required to receive their pensions through bank accounts from September 1, 2024, onwards.

According to the provisions of Article 18, paragraph 3 of the 2014 Social Insurance Law and Articles 93 and 114 of the 2024 Social Insurance Law (effective from July 1, 2025), there are three optional forms of pension receipt for employees participating in compulsory social insurance:

1. Through the beneficiary’s bank account

2. Directly from the social insurance agency or an authorized service organization

3. Through the employer

Therefore, receiving pensions through a bank account is not mandatory for pensioners. Starting September 1, 2024, the VSS will implement this additional payment method in 20 provinces and cities, which previously only offered direct payments from the VSS or through employers.

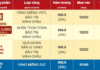

According to Vietnam Social Security statistics, there are currently almost 3.4 million people receiving monthly pensions and social insurance allowances nationwide. In line with the government’s directives, the VSS has actively promoted and communicated the benefits of receiving these benefits through personal accounts, allowing beneficiaries to make voluntary and informed decisions.

As of now, approximately 74% of beneficiaries in urban areas receive social insurance benefits and unemployment allowances through their personal accounts, a 10% increase compared to 2023.

It is evident that receiving pensions or social insurance allowances through a bank account is entirely voluntary and not mandatory for beneficiaries.

Pensioners and Social Insurance Allowance Recipients: Choosing the Right Payment Method

The Social Insurance Agency is currently offering multiple payment methods for pension and social insurance allowances. This provides recipients with the flexibility to choose a payment method that best suits their personal preferences and circumstances.