Thursday marks the derivatives due date, with the market seeing a sixth rebound session and many stocks posting decent gains. Trading stagnation dragged liquidity to a 14-session low, but it didn’t significantly hurt stock prices. The stagnation was mainly due to weak demand.

The Ho Chi Minh Stock Exchange (HoSE) today matched approximately VND 10.8 trillion in trading value, with an average of VND 11.5 trillion in the first three sessions of this week, compared to VND 14.6 trillion last week. This trading volume cannot create a breakthrough, although there are still some impressive individual stocks. The market is still in a phase where money is selectively invested, rather than a real uptrend.

Therefore, the strategy of surfing or T+ trading is still happening daily. The upside is that since the inflow is small, the outflow is also minimal, so no side can really dominate. Some stocks were relatively heavily dumped today, but they are not representative of the overall market. Even within industry groups, there are codes that move in opposite directions. Money flow seems to be waiting for a dip to “test” the bottom before deciding whether to participate strongly or not.

However, this expectation is from the perspective of the VN Index. Signals from this representative indicator can create greater consensus, but from a stock perspective, buying and selling at this point does not necessarily have to follow the index. Even if the VN Index retreats, many stocks will not fall further and may even move against the overall trend. Strong one-day fluctuations under the influence of general developments can be utilized for quick capital reduction trading. If you’re not agile enough, just hold on, as the market will eventually change after the current dull and frustrating phase.

The derivatives market has narrowed its fluctuations in the last two sessions. F1 will mature tomorrow, and foreign investors are taking a strong position to roll over. For most of this maturity period, the VN30 decreased. However, since the August 5 session (the low-creating session for this maturity period), OI has only increased in the next five sessions and has now contracted significantly. So, this maturity session is also likely to be calm.

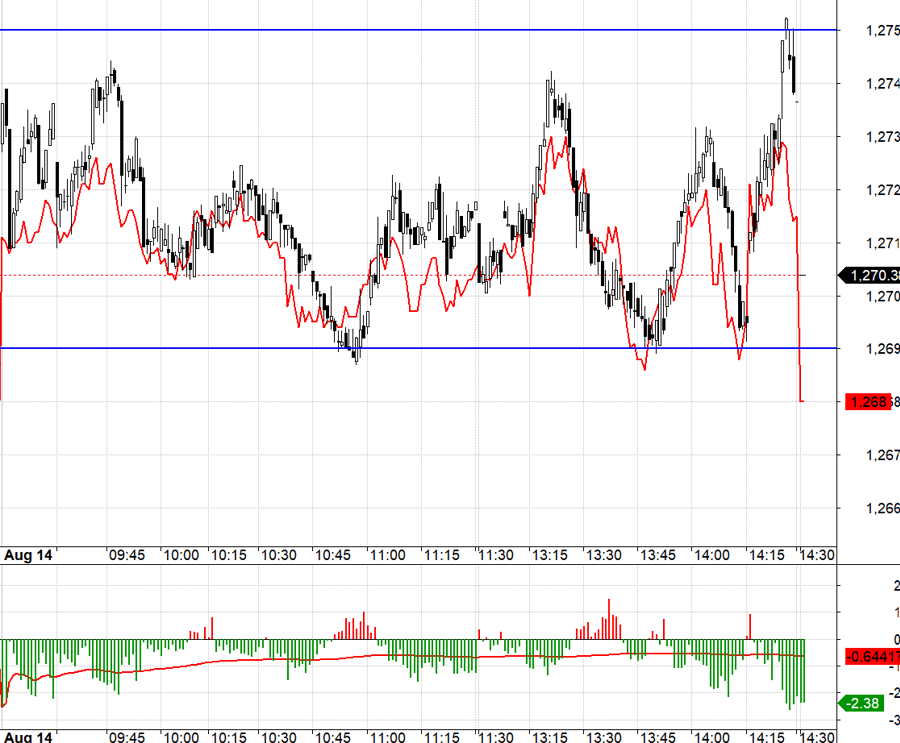

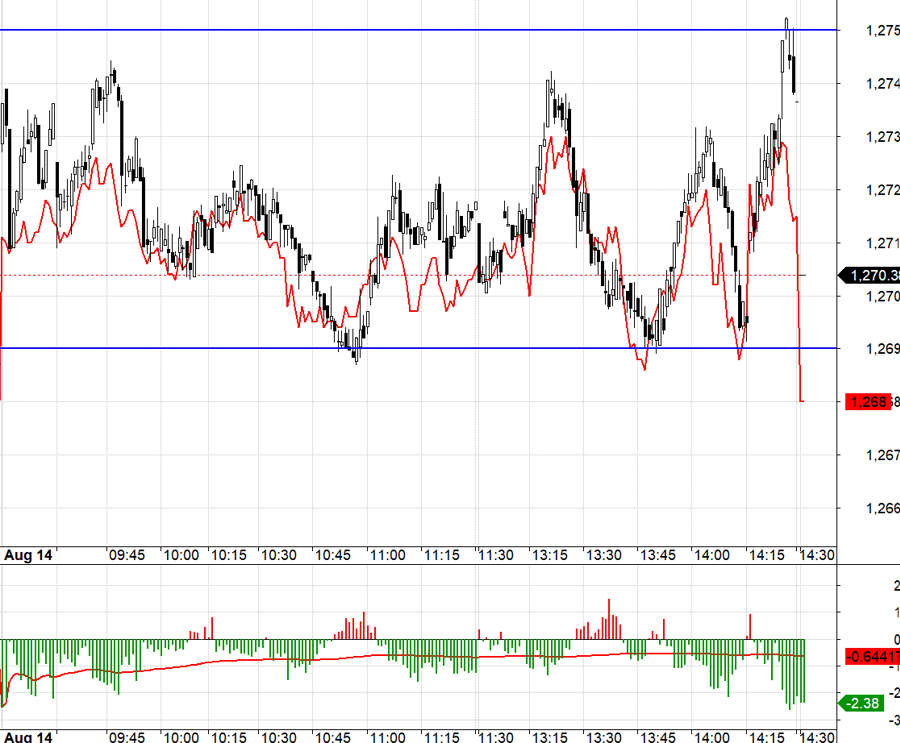

VN30 started narrowing its range yesterday, fluctuating today between 1269.xx and 1275.xx. The Long setup at 1269.xx is more attractive, while the Short near 1275.xx is not ideal as VN30 didn’t get close to this level, and each time it approached, F1 weakened first. Liquidity in F1 has also decreased significantly in the last two sessions. Generally, if there is no impact on the pillars, this range is very uncomfortable. In today’s session, VPB, VCB, and MBB fell slightly, while the rising MSN and TCB also had their impact mitigated.

Fluctuations tomorrow may expand slightly due to the influence of the maturity date, but if so, it will be very quick as money flow is unlikely to increase. If you’re willing to take the risk of a quick trade, consider flexible Long/Short positions in F1; otherwise, take a break.

VN30 closed today at 1270.38. Tomorrow’s nearest resistances are 1277, 1285, 1290, 1298, and 1307. Supports are at 1269, 1260, 1257, 1247, 1239, and 1230.

“Stock Blog” is personal and does not represent the opinions of VnEconomy. The views and evaluations are those of the individual investor, and VnEconomy respects the author’s perspective and writing style. VnEconomy and the author are not responsible for any issues arising from the published investment views and opinions.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.