The Vietnamese stock market witnessed a remarkable comeback on August 13th, with several stocks breaking records, including NAB (+6.93%) and CSV (+6.92%). This positive development comes after a period of unstable market psychology.

In fact, since the beginning of 2024, the VN-Index has been on an upward trajectory, achieving a growth rate of nearly 8.9%. Numerous stocks have broken all-time high records since the start of the year, with 285 stocks or securities reaching new peaks as of August 13th.

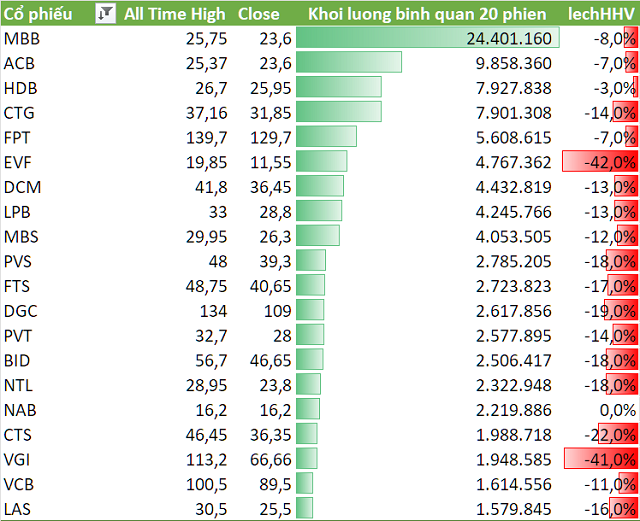

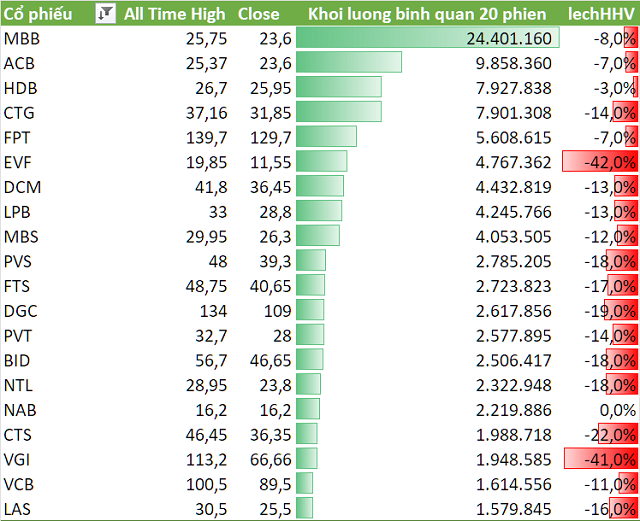

Due to the low liquidity of many stocks, investors’ attention is primarily focused on those with the highest liquidity. The following are the 20 most liquid stocks among those that have reached all-time highs:

20 stocks that broke all-time highs with the highest liquidity (Based on the average volume of 20 latest sessions)

|

These 20 stocks have liquidity ranging from over 1 million units, such as LAS (1.5 million shares per session), to over 24 million units for MBB (24.4 million shares per session).

The banking group, known for its high liquidity, includes 8 stocks that have reached new highs: MBB, ACB, HDB, CTG, LPB, BID, NAB, and VCB. The finance and securities group contributed MBS, FTS, and EVF. The technology sector is represented by FPT and VGI. Even the real estate group, despite the industry’s challenges, boasts NTL, which reached a record high of 28,950 VND per share.

After going through a rather pessimistic phase, the market is now offering significant discounts on stocks that have broken all-time highs.

As of the close of August 13th, the aforementioned 20 stocks have declined by an average of 15.7% from their record highs. In previous sessions, the decline was even more pronounced, indicating that even the strongest stocks in the market have entered a correction phase (a decline of over 10%) or a bear market (a decline of over 20%).

VGI and EVF are prime examples of this, having fallen more than 40% from their record highs as of the close of August 13th.

EVF stock has declined by over 40% from its 2024 record high

|

Nevertheless, many stocks have shown signs of recovery, narrowing the gap between their current price and their record high (Drawdown) in recent sessions. In addition to NAB, banking stocks such as MBB (-8%), ACB (-7%), and HDB (-3%) have also exited the correction phase.

If the Drawdown of banking stocks and other stocks continues to narrow in the coming periods, investors will have more convincing evidence to regain the confidence that was lost during the previous bearish period.

According to Bui Van Huy, of DSC Securities, the market experienced panic reactions last week but has since recovered in recent sessions. Buyers tend to prioritize sectors or stocks that have become oversold. The initial recovery rhythm tends to focus on groups that have fallen deeply by 20-30% in the past month, while there is nothing fundamentally wrong with these stocks.

“After the recovery of oversold stocks, the market may become more differentiated and follow individual stories. Stocks with strong fundamentals will continue to recover, while those with weak fundamentals will struggle to go far. Investors will need to restructure their portfolios to focus on sectors and stocks with solid foundations,” added Mr. Huy.

Dinh Quang Hinh, Head of Macroeconomics and Market Strategy at VNDirect’s Analytics Division, stated that the market’s valuation has become more attractive, with the VN-Index’s P/E ratio touching -1 standard deviation at one point, stimulating bottom-fishing money to enter the market.

The VNDIRECT Analytics Division maintains its base scenario that the VN-Index is likely to close the year 2024 in the range of 1,300-1,350 points.