The VN-Index continued its recovery, climbing to 1,233 points by 10 a.m. on August 14, marking its sixth consecutive rebound after a sharp decline earlier this month. The HNX-Index also edged higher to 230.47 points.

Many investors had sold off or cut losses when the VN-Index dipped below 1,200 points, even breaching the 1,190-point level on August 5. Now, as the market has been on an upswing, many stocks have rebounded, but the recovery lacks breadth and liquidity remains weak. Many investors find themselves in a dilemma, torn between the fear of missing out and the anxiety of potential market downturns.

Stocks rally for six straight sessions after a major correction

Commenting on this situation, Mr. Barry Weisblatt David, Director of Analytics at VNDIRECT Securities Corporation, shared his outlook on promising investment opportunities in various sectors for the remainder of 2024, particularly in banking and steel.

Regarding the banking sector, while asset quality has deteriorated recently, it is expected to recover in the coming months as the Vietnamese economy improves. New laws related to the real estate market that came into force on July 1 will make it easier for banks to realize value from collateral. Robust credit growth, surpassing the State Bank’s 15% target, is anticipated to boost the earnings of commercial banks. Currently, banks are trading at a P/B ratio of 1.7 times, which is below the five-year average and considered attractive.

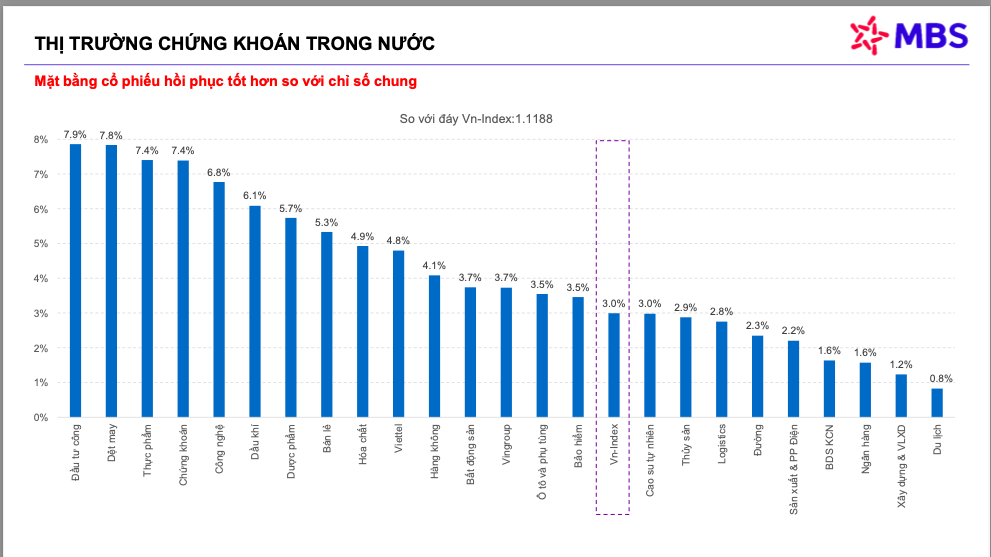

Recovery pace of sectors compared to VN-Index since the low of 1,188 points in early August. Source: MBS

“As for the steel industry, this industrial sector has demonstrated robust profit growth of 437.3% year-on-year in Q2 2024, with notable performers like Hòa Phát (HPG) achieving 129% growth, Hoa Sen (HSG) surging 18-fold, and Nam Kim (NKG) rising by 75%… largely driven by financial gains. Exports of steel coils and coated steel products surged in the first half of the year, and the revival of the real estate market is expected to boost domestic consumption,” said Mr. Barry Weisblatt David.

Analysts from MBS Securities Joint Stock Company recommended investment opportunities in several stock groups with compelling narratives, including logistics, public investment, textiles, oil and gas, securities, and industrial real estate.

According to MBS, the sharp decline in the domestic market at the beginning of last week was not due to internal economic factors. As the external impacts subside, investors will return to assess and buy stocks. Compared to the recent low, the VN-Index has rebounded by 3%, but individual stocks have shown stronger momentum. Numerous stock groups have performed well, including public investment, textiles, food, securities, and technology.

“This will be a signal for money to flow into the market this week as many stocks have not only erased their losses from the previous week but have also surged higher. Technically, such stocks have a higher probability of forming a bottom earlier than the overall market,” said MBS analysts.

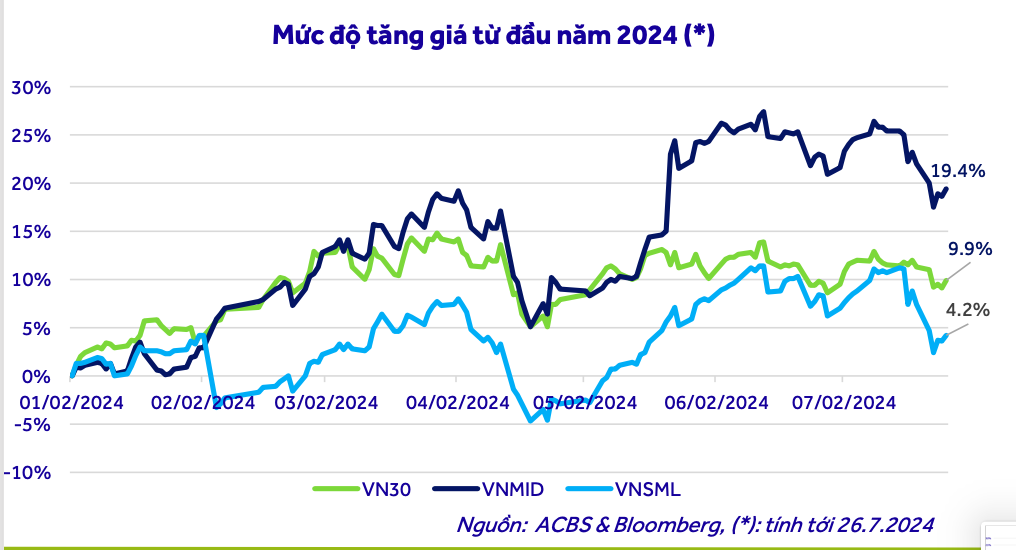

VN30 groups that have lagged since the beginning of the year have potential to catch up later this year. Source: ACBS

ACBS Securities Company shared that mid-cap stocks (VNMID) have outperformed with a price increase of approximately 19.4% since the start of the year. In contrast, large-cap stocks (VN30) have risen in line with the VN-Index, and small-cap stocks have gained only 4.2%. The P/E ratio of VN30 remains significantly lower than in the 2020-2024 period.

According to ACBS experts, opportunities in the second half of the year may favor the VN30 group (with a large weightage of bank stocks), especially in the context of the Fed’s interest rate cuts and potential capital inflows from foreign investors.

Additionally, ACBS upgraded its outlook for the retail and consumer sectors from neutral to positive for stocks like FRT, MWG, PNJ, DHG, DHC, and VNM, anticipating a stronger recovery in the latter half of the year.