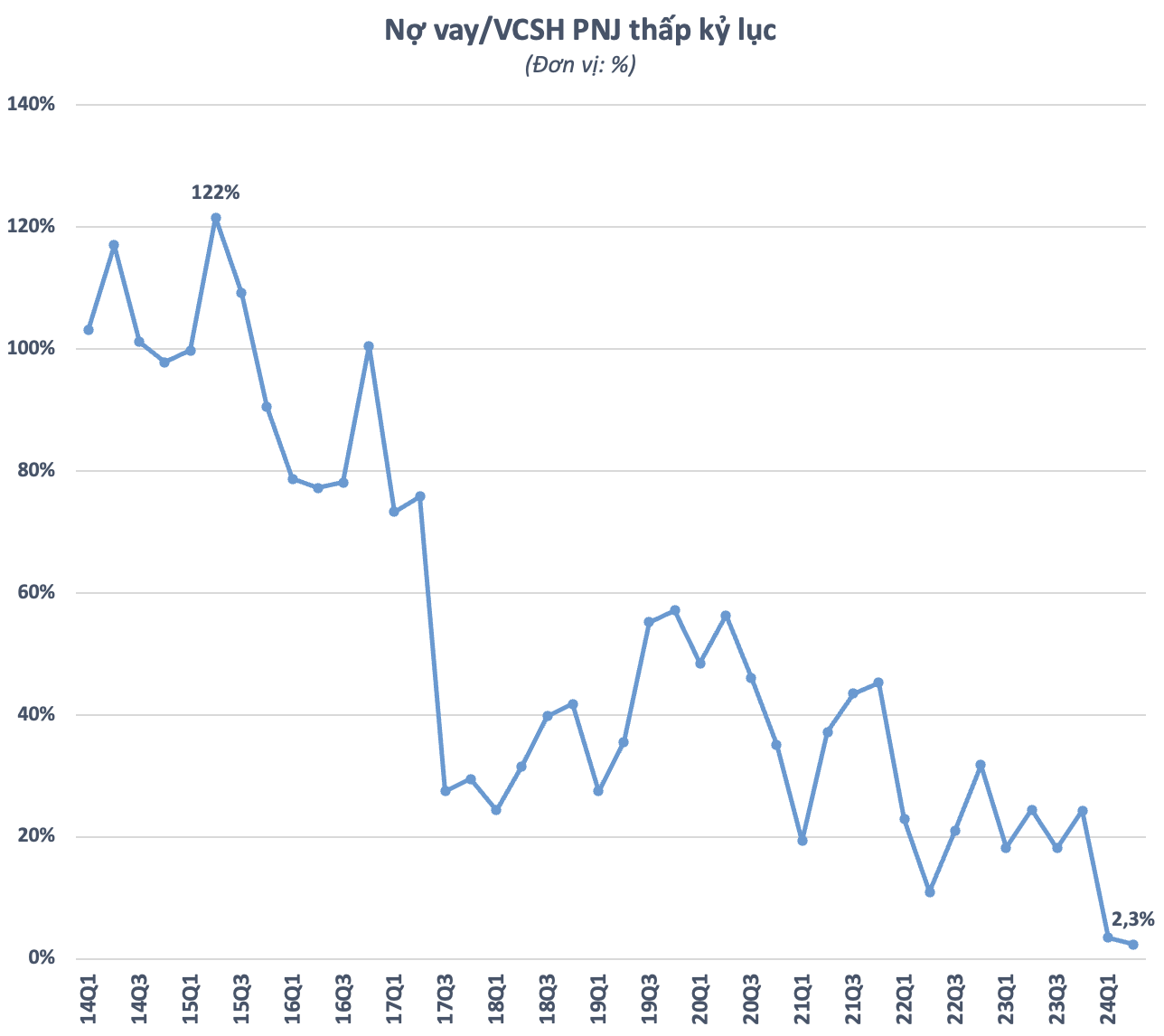

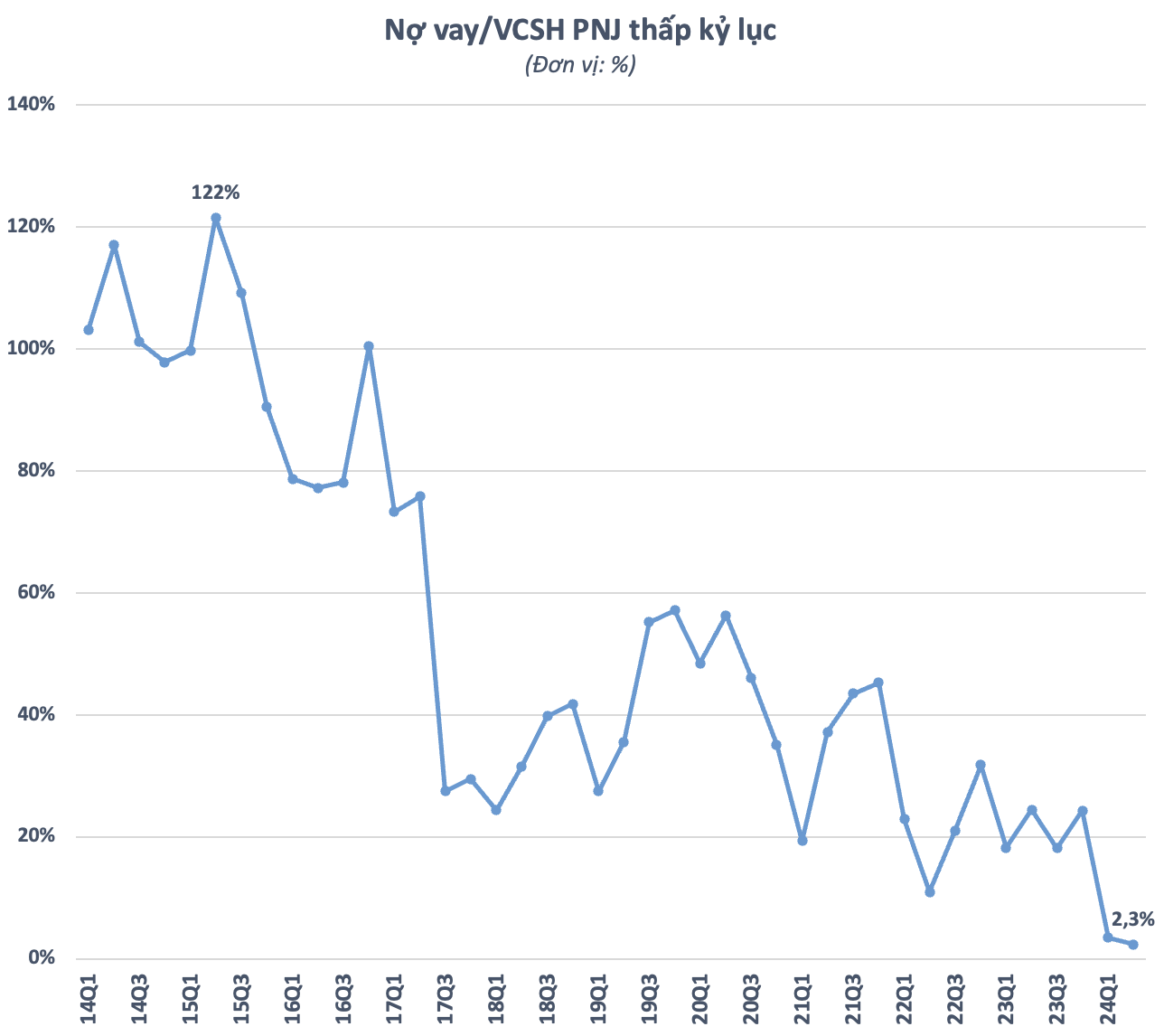

PNJ, a prominent Vietnamese enterprise in the gold and jewelry business, boasts an exceptionally low debt level compared to its peers. As of Q2 2024, their financial debt stood at a mere VND 250 billion, a significant reduction from the beginning of the year, and the lowest it has been since its listing in 2009.

As a result, PNJ’s debt-to-equity ratio as of June 30 plunged to a record low of approximately 2.3%. Historically, this ratio surpassed 100% during 2014-2015 but has since witnessed a substantial decline. From mid-2017 onwards, the company consistently maintained this ratio within the 20-40% range before witnessing another steep drop in the first half of 2024.

Aggressive debt repayment strategies led to a near VND 2,200 billion negative financial cash flow in the first half of the year (repaying nearly VND 4,500 billion in principal and borrowing VND 2,350 billion in new loans). Nonetheless, the period’s cash flow remained positive at almost VND 650 billion. Cash reserves (cash, cash equivalents, and short-term deposits) were sustained above VND 1,700 billion, second only to the beginning of 2022.

This highlights PNJ’s robust cash flow. In the first six months of 2024, the company’s operating cash flow was nearly VND 2,000 billion, almost double that of the same period in 2023, primarily due to reduced inventory. The investment cash flow was also positive at nearly VND 900 billion, attributed to loan recoveries and sales of debt instruments.

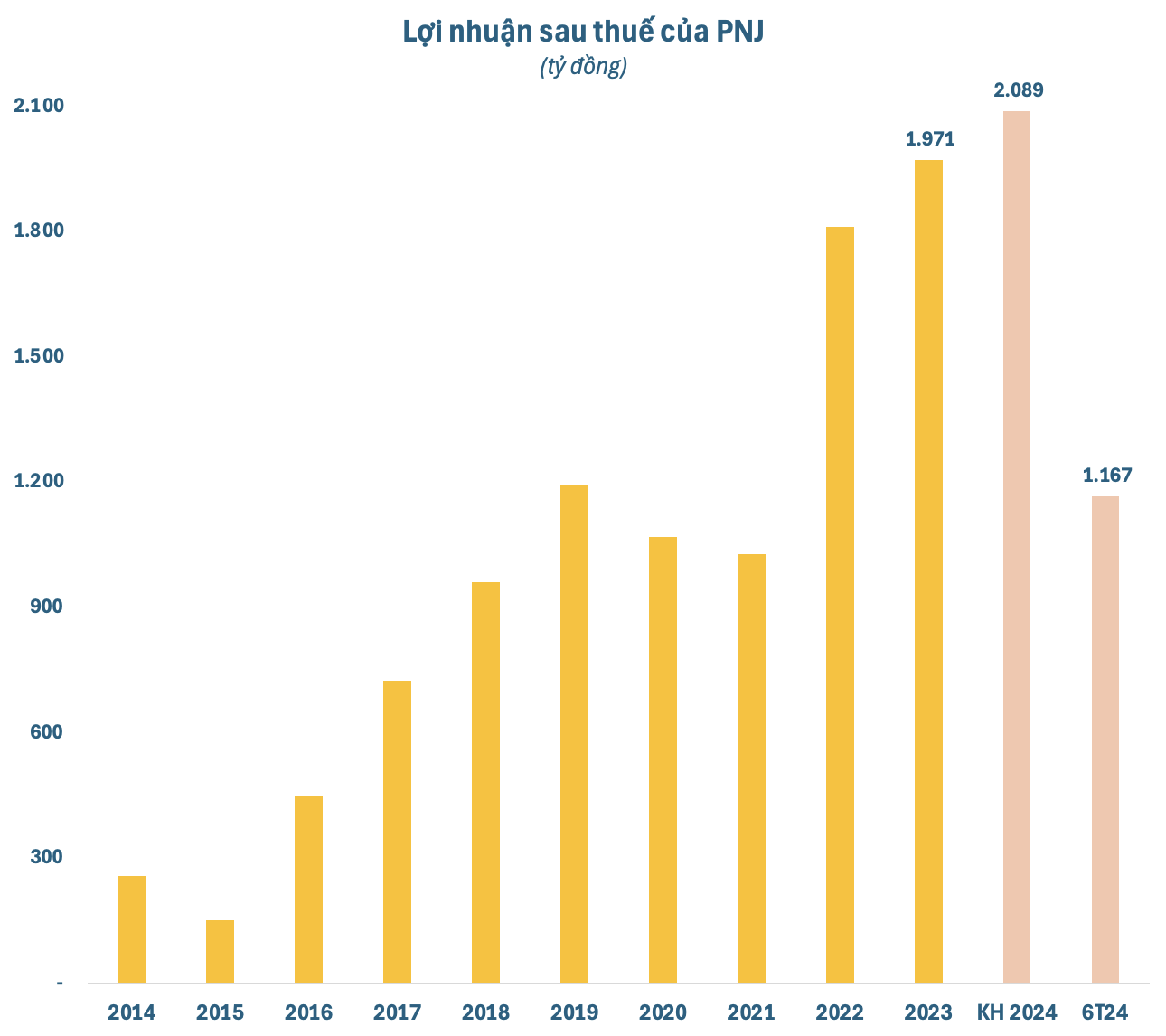

The robust cash flow is a consequence of thriving business operations. Following an extraordinary profit in 2022, PNJ surpassed itself in 2023, registering a record-breaking profit after tax of VND 1,971 billion, a nearly 9% increase from the previous year. The management attributed this success to PNJ’s increased market share, expanded customer base, enhanced distribution network, diversified product portfolio, and improved customer engagement.

For 2024, PNJ has outlined ambitious business plans, targeting a 12% increase in revenue to VND 37,147 billion and a 6% rise in profit after tax to VND 2,089 billion. These figures represent all-time highs for the company. The projected dividend for 2024 remains at 20% in cash.

The management of PNJ acknowledges the challenges in the macroeconomic landscape, stemming from geopolitical tensions and the sluggish recovery of global trade. Additionally, the growth of leading economies is hindered, and Vietnam, with its highly open economy, faces hurdles in retail consumption and overall consumer purchasing power, which may fall short of expectations this year.

Amid these circumstances, PNJ aims to optimize revenue at its stores, streamline operating costs, invest in technology and digital transformation, enhance customer experiences, and pilot modern customer engagement models, while also promoting ESG criteria. Indeed, the results achieved in the first half of the year have been highly promising.

For the first six months of 2024, PNJ recorded impressive results, with revenue of VND 21,113 billion and profit after tax of VND 1,167 billion, reflecting a 34% and 7% increase, respectively, compared to the same period last year. This profit level is the highest the company has achieved in the first half of any year since its inception. PNJ has already accomplished 60% of its revenue plan and 56% of its profit target for the full year 2024.

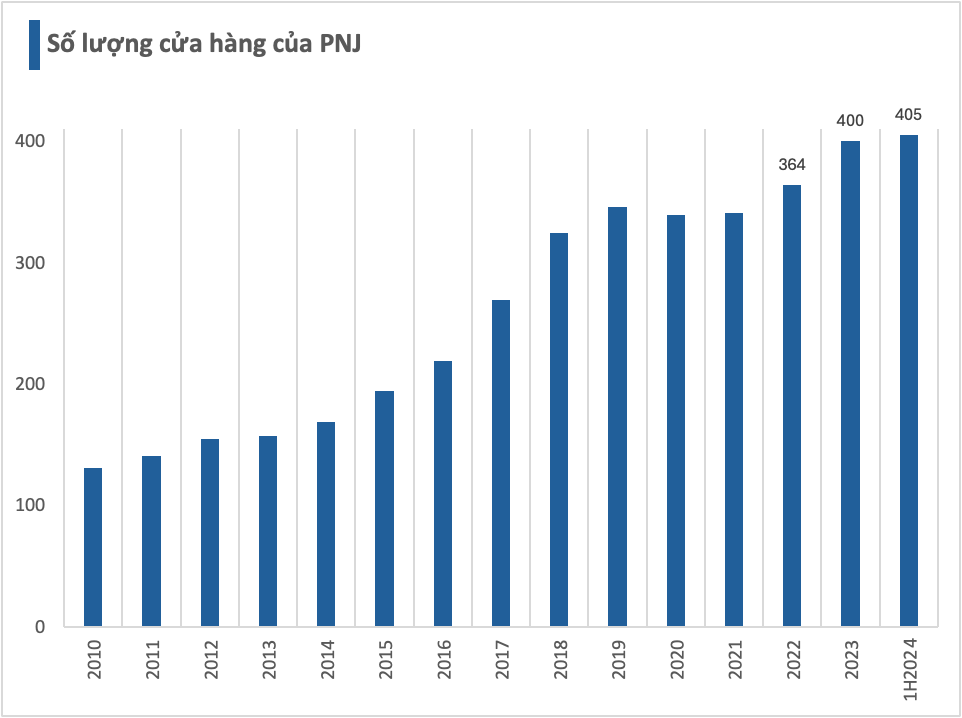

Notably, despite their focus on cost optimization and profit assurance, PNJ has continued to expand its store network. As of June, PNJ operated a total of 405 stores across 57 out of 63 provinces in Vietnam, including 396 PNJ stores, 5 Style by PNJ stores, 3 CAO Fine Jewellery stores, and 1 wholesale business center. The company has opened 13 new PNJ stores and closed 8 others since the beginning of the year.

PNJ’s leadership had previously shared their expansion plans to reach over 500 stores by 2025. However, their measured approach to network expansion, coupled with modest fixed asset investment requirements and a robust cash flow, may explain the company’s record-low debt level.

Profit from Sugarcane, Durian, and Leafy Vegetables with the Lunar New Year approaching

Good news for farmers in the Mekong Delta provinces as the prices of sugarcane, durian, and vegetables… have skyrocketed during the days leading up to the Lunar New Year, providing them with attractive sources of income.