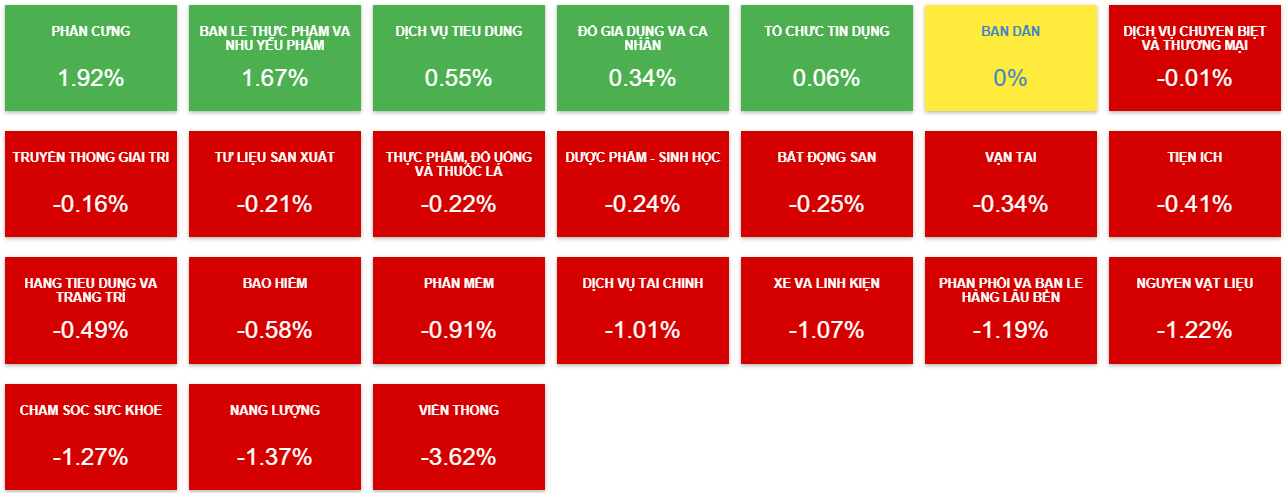

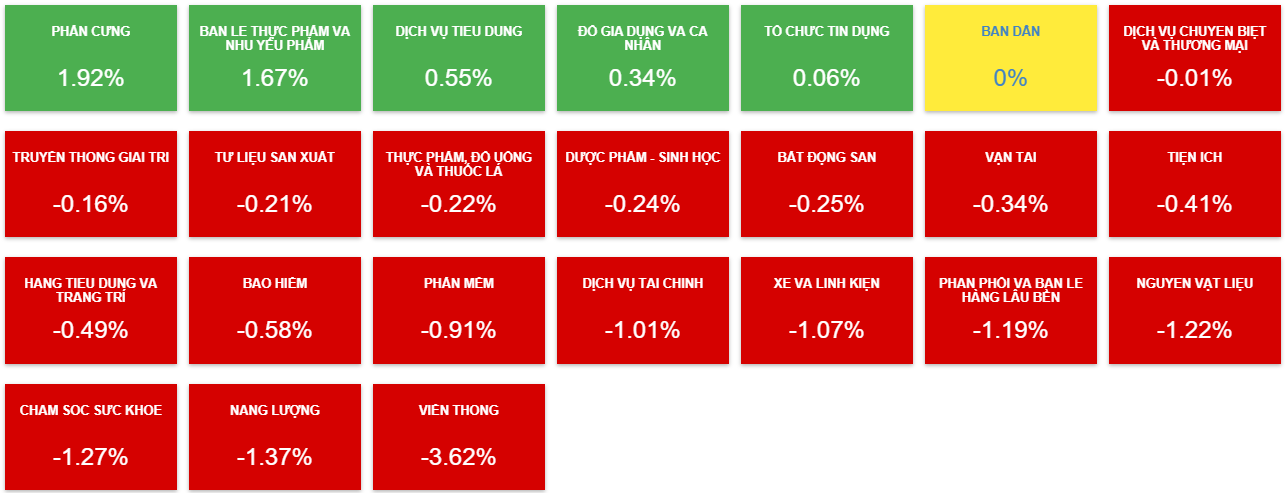

Only 5 industry groups closed in the green after the morning session, with two industries gaining over 1%: Hardware up 1.92% and Food & Staples Retail up 1.67%.

Meanwhile, 18 industries declined, with Telecommunications leading the losses, falling 3.62% under pressure from VGI’s 4.28% drop and FOX’s 1.83% decline. This was followed by a string of industries falling over 1%, including Energy, Healthcare, and Materials.

Source: VietstockFinance

|

Foreign investors also traded very little in the morning session, with a buying value of just over 448 billion VND and a selling value of nearly 427 billion VND, resulting in a net buy of nearly 22 billion VND. If they continue to net buy today, it will be the fifth consecutive net buying session, which has not happened in a long time.

A closer look at today’s foreign trading activities reveals that VNM, FPT, and HDB stood out with net buys of 46 billion VND, 39 billion VND, and 21 billion VND, respectively. On the other hand, VHM, TCB, and MWG were the top net sold stocks, with values of 42 billion VND, 33 billion VND, and 24 billion VND, respectively.

10:35 a.m.: Continued Challenges, Liquidity “Pressure”

The market continued to face difficulties as red dominated all three exchanges, with the VN-Index falling more than 4 points at one point. Liquidity showed a significant decline.

As of 10:30 a.m., the VN-Index fell 3.46 points to 1,226.90, the HNX lost 0.79 points to 228.89, and the UPCoM dipped 0.08 points to 92.57.

Red also spread across the market, with 369 codes in red and 6 codes on the floor, while 168 codes were in the green and 22 codes were at the ceiling price. Most industry groups were also in the red, led by Telecommunications, down 2.84% due to VGI and FOX, and Energy, down 1.06% under pressure from PVS, PVD, and BSR.

In the top 10 stocks negatively impacting the VN-Index, GVR was leading, taking away 0.5 points, followed by a series of giants such as MWG, FPT, TCB, and MSN. On the other hand, HDB stood alone in its effort to “rescue” the index.

The trading value on the three exchanges was just over 3,498 billion VND, significantly lower than the previous session and the 5-session average. However, this caution is understandable as today is the derivatives expiry, which often brings unpredictable fluctuations.

Opening: Moving Against Global Trends

Contrary to expectations of a positive response to the global stock market performance, the VN-Index started the day with a slight decline. It’s worth noting that today is the derivatives expiry, which could bring about significant fluctuations.

As of 9:30 a.m., the VN-Index fell 2.08 points to 1,228.28, the HNX slipped 0.18 points to 229.50, while the UPCoM rose 0.2 points to 92.85. Liquidity was lower than the previous session and the 5-session average, indicating a certain level of caution among investors.

HDB stood out in the early morning session, attracting notable buying interest and rising over 2%.

The performance of the Vietnamese market contrasted with the expectations of many investors, who anticipated a positive correlation with the global market performance. Notably, on the other side of the globe, major US indices such as the Dow Jones, S&P 500, and Nasdaq Composite closed in the green, buoyed by positive inflation data.

The US Labor Department reported that the Consumer Price Index (CPI) for July rose 2.9% year-over-year, down from 3% in June and the lowest since March 2021. On a monthly basis, CPI increased by 0.2%. Economists surveyed by Dow Jones had forecast a 0.2% rise in CPI compared to the previous month and a 3% increase from the previous year.

Core inflation, which excludes food and energy prices, rose 0.2% in July, in line with forecasts.

This report came a day after lower-than-expected wholesale inflation data boosted stock prices.