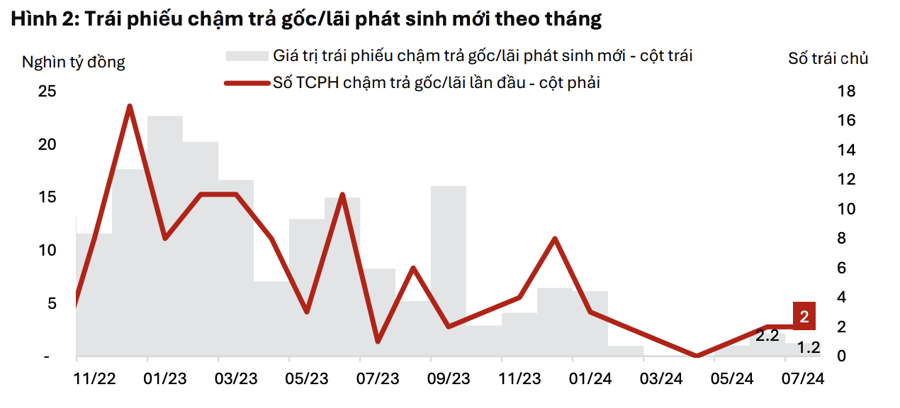

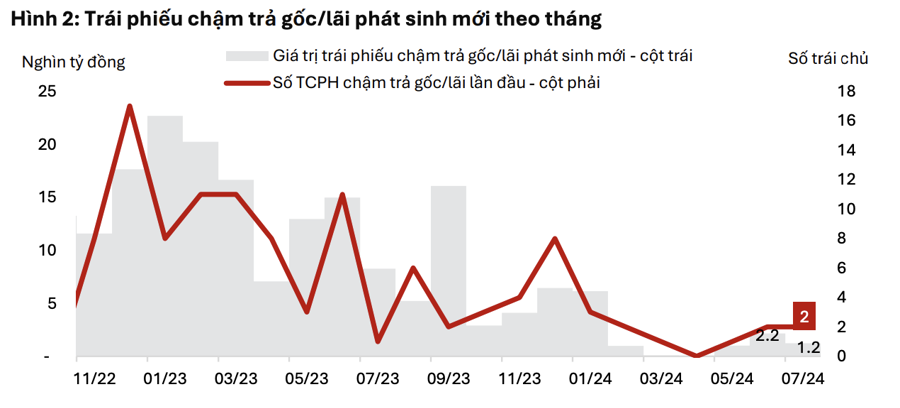

The total value of bonds that were delayed in payment for the first time in July 2024 was 1.24 thousand billion VND, lower than the previous month of June 2024 by approximately 2.2 thousand billion VND, according to statistics by VIS Rating.

Accordingly, in July 2024, there were 5 bonds that were announced to be delayed in payment for the first time, issued by Sunrise Vietnam Investment and Construction JSC, Big Gain Investment Co., Ltd., and Song Han Sun Company Limited, with a total value of 1,240 billion VND in circulating corporate bonds, a lower value than the previous month. Sunrise and Song Han Sun are two enterprises that have violated the bond payment delay for the first time.

Big Gain Investment Co., Ltd. delayed the payment of the bond principal due of 438 billion VND because only 562 billion VND was paid on the total of 1,000 billion VND of bonds due on July 30, 2024. Sunrise Vietnam Investment and Construction JSC delayed the payment of both the principal and interest due on July 15, 2024, for the first time. Then, on August 1, 2024, the company was granted a maturity extension by the bondholders for another 2 years until July 15, 2026.

Song Han Sun Company Limited delayed the payment of 300 billion VND of principal on July 4, 2024, and then repaid it in full on August 1, 2024, and currently has no outstanding bonds.

The market-wide bond delinquency rate at the end of July 2024 was 15.1%, down from 15.6% at the end of June 2024.

In July 2024, there were 5 issuing organizations that partially repaid the bond principal with a total value of 1,500 billion VND in the fields of Services, Residential Real Estate, and Construction. The remaining bond debt of these issuing organizations was at the threshold of 2,300 billion VND.

Most of the value of bond principal and interest repayment in July 2024 was from two issuing organizations in the Residential Real Estate sector, Hung Thinh Quy Nhon Entertainment Services JSC and No Va Thao Dien Co., Ltd.

After repaying 1 thousand billion VND of overdue debt in July 2024, Hung Thinh Quy Nhon Entertainment Service JSC still has about 5 thousand billion VND of overdue debt. Most of these bonds have been extended for another 1 to 2 years. From 2023 to July 2024, No Va Thao Dien Co., Ltd. has repaid 15% of the overdue bond debt through asset swap.

The debt recovery rate increased by 0.4% to 18.5% at the end of July 2024.

In July 2024, a supplier opened bankruptcy proceedings against LDG Investment JSC. This action may affect the interests of LDG’s current bondholders. This issuing organization is still delaying a bond package worth 186 billion VND and has not paid coupon interest to bondholders since February 2023.

The value of high-risk maturing bonds in August 2024 is higher than in July 2024 because the number of bonds maturing in August 2024 is three times higher than in July 2024.

In August 2024, it is estimated that about 7,300 billion VND out of 18,600 billion VND of high-risk maturing bonds will not be able to repay the principal on time, mainly from the Residential Real Estate and Energy sectors. The figure of 7,300 billion VND increased compared to the previous month due to the higher volume of maturities in August 2024, which is three times higher than in July 2024.

Of the high-risk maturing bonds in August 2024, 4.3 thousand billion VND of bonds were issued by companies in the Construction and Residential Real Estate sectors, namely Nova Land, Hung Thinh Land, and Dai Thinh Phat, which are organizations that have delayed multiple bond payments since 2023. The remaining bonds were issued by a company in the Services sector. As of the reporting date, this company has not published its 2023 financial statements as required on the Hanoi Stock Exchange’s information portal.

In the next 12 months, about 20% of the total value of 259 thousand billion VND of high-risk maturing bonds will be delayed. 90% of these have previously delayed coupon interest payments at least once and are currently highly leveraged, with low cash flow and low EBITDA margin.

Earlier, in July 2024, the issuance of new bonds was 42.8 thousand billion VND, lower than the figure of 82.4 thousand billion VND in June 2024. Of the bonds issued by the Banking group in July 2024, 55% were subordinated debt issued by Military Commercial Joint Stock Bank, Ho Chi Minh City Development Joint Stock Commercial Bank, Nam A Commercial Joint Stock Bank, and Vietnam Joint Stock Commercial Bank for Investment and Development, with an average term of 7.1 years and an interest rate of 5.9% to 7.5% in the first year, floating in subsequent years with a spread of 1.2% to 2.8% compared to the reference.

Other priority debt issued by other banks has a term of 3 years with a fixed interest rate throughout the term ranging from 4.6% to 5.5%.

In the first half of 2024, the issuance of new bonds reached 202,400 billion VND, of which 70% were issued by banks.