The VN-Index ended the trading session on August 15, 2024, down 0.55%, closing at 1,223.56.

The total trading value on the three exchanges reached VND 12,918.6 billion, a 12.0% decrease compared to the previous session. Of this, the matched order trading value reached VND 11,282.4 billion, down 19.5% from the previous session, down 17.9% from the 5-session average, and down 30.2% from the 20-session average.

In terms of industry, liquidity increased in Real Estate, Construction, and Steel. In contrast, liquidity slightly decreased in Banking, Securities, Chemicals, and Oil Equipment, while it significantly decreased in Agricultural & Seafood Farming, Food, Information Technology, Electrical Equipment, Water Transport, and Oil Production. The price indices of all these industries decreased.

Foreign investors bought a net of VND 134.8 billion, and their net purchase value of matched orders was VND 102.0 billion. Their main net purchase by matched orders was in the Food and Beverage and Information Technology sectors. The top stocks in their net purchase by matched orders included VNM, FPT, CTG, GMD, DGW, TCH, HDG, FTS, GAS, and LPB.

On the selling side, their top net sale by matched orders was in the Real Estate sector, including stocks such as VHM, TCB, HPG, MSN, FRT, VIC, VRE, KDC, and SHB.

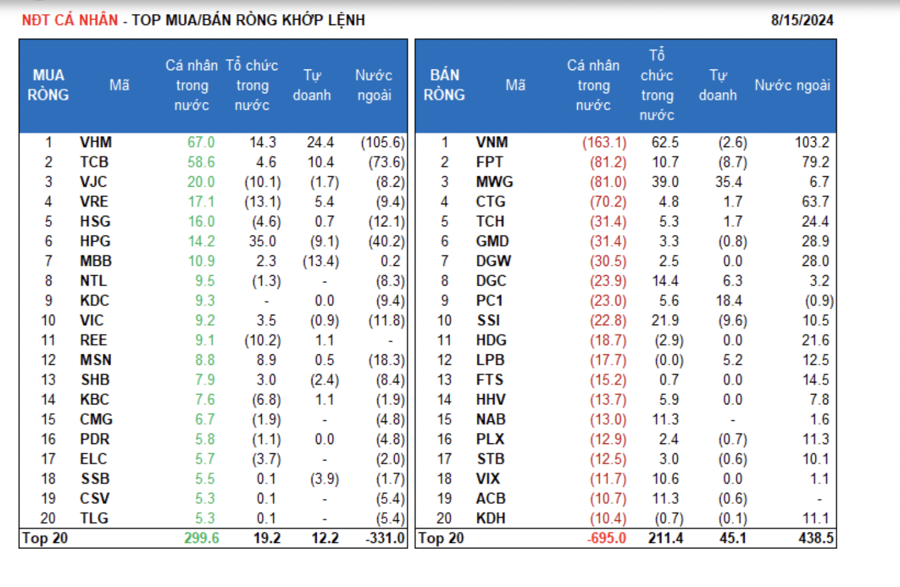

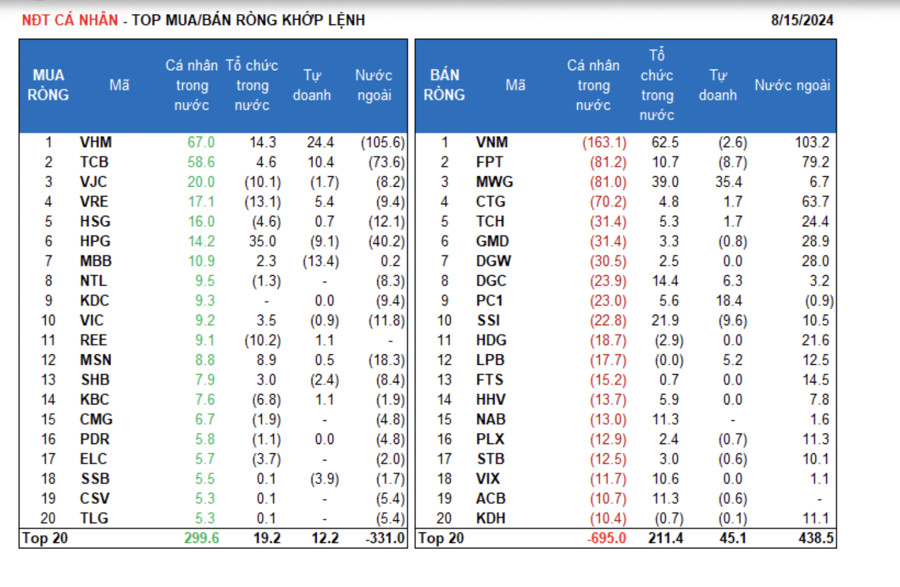

Individual investors sold a net of VND 380.1 billion, including a net sale of VND 479.1 billion in matched orders. In terms of matched orders, they net bought in 6 out of 18 sectors, mainly in Real Estate. Their top net purchases included VHM, TCB, VJC, VRE, HSG, HPG, MBB, NTL, KDC, and VIC.

On the selling side, they net sold in 12 out of 18 sectors, mainly in Food and Beverage and Retail. Their top net sales included VNM, FPT, MWG, CTG, TCH, GMD, DGC, PC1, and SSI.

Proprietary trading bought a net of VND 32.5 billion, and their net purchase value of matched orders was VND 66.0 billion. In terms of matched orders, proprietary trading net bought in 7 out of 18 sectors. Their top net purchases by matched orders included MWG, VHM, PC1, GVR, TCB, DGC, VRE, LPB, PNJ, and TV2.

On the selling side, their top net sale was in the Banking sector, including stocks such as MBB, SSI, HPG, FPT, SSB, HDB, VCB, GAS, VNM, and SHB.

Domestic institutional investors bought a net of VND 227.2 billion, and their net purchase value of matched orders was VND 311.0 billion.

In terms of matched orders, domestic institutions net sold in 2 out of 18 sectors, with the highest value in the Electricity, Water & Fuel sector. Their top net sales included VRE, REE, VJC, KBC, LCG, HSG, MSB, ELC, VCI, and HDG.

The sector with the highest net purchase value was Food and Beverage. Their top net purchases included VNM, MWG, HPG, SSI, DGC, VHM, HDB, DCM, FRT, and NAB.

Today’s matched orders trading value reached nearly VND 1,640 billion, down 32.7% from yesterday, contributing 12.7% of the total trading value.

Today’s matched orders trading was mainly conducted by individual investors, focusing on Banking (MSB, HDB, SSB), and foreign institutions in PNJ, MBB, and ACB.

The money flow allocation ratio decreased in Securities, Agricultural & Seafood Farming, Electrical Equipment, and Information Technology, while it increased in Real Estate, Construction, Steel, and Retail.

In terms of matched orders, the money flow allocation ratio increased in the mid-cap group (VNMID) and decreased in the large-cap group (VN30) and the small-cap group (VNSML).

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.