Scarce Supply of Primary Apartments Below VND 50 Million/m2

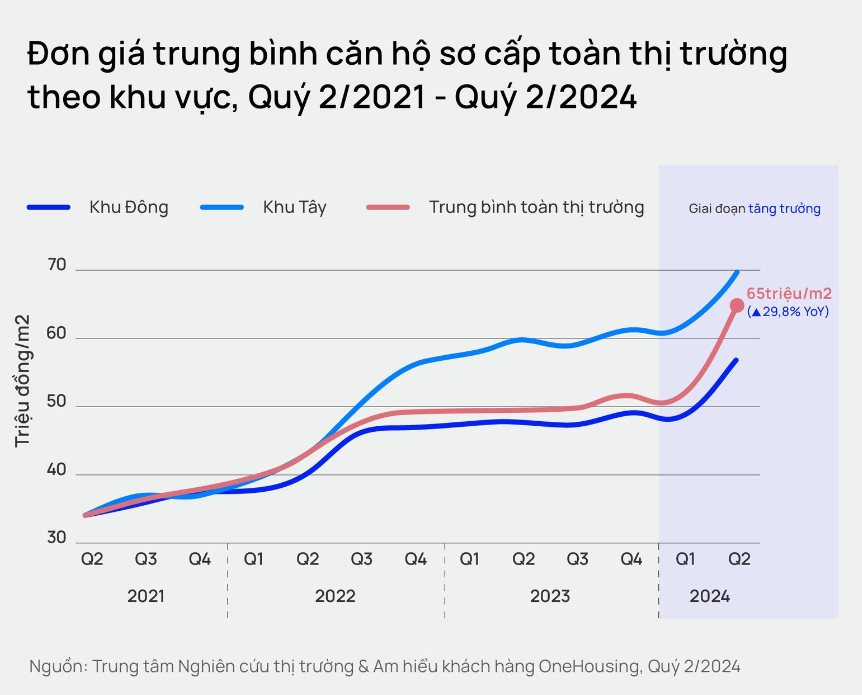

According to data from the OneHousing Market Research and Customer Insight Center, as of Q2 2024, the average primary apartment price in Hanoi reached approximately VND 65 million/m2, a 25% increase quarterly and a 29.8% increase annually. The Western region currently boasts the highest prices in the city, averaging VND 70 million/m2, while the Eastern region’s prices are slightly lower at VND 56 million/m2.

Mr. Tran Quang Trung, Director of Business Development at OneHousing, shared his insights: “It’s not accurate to say that there are no apartments priced below VND 50 million/m2 anymore, as such options are still available in the secondary market. However, when it comes to primary supply below that price point, it’s safe to say that the market is currently lacking.”

Explaining this phenomenon, Mr. Trung attributed it to several factors.

Firstly, there isn’t a significant supply of new projects entering the market. OneHousing forecasts a total supply of 22,000 units for Hanoi in 2024, while the city’s population grows by 160,000 people annually, creating substantial housing demand, according to the Hanoi Population Bureau.

Secondly, during the years 2016–2021, investors had a wide range of segments to choose from, such as land, resorts, villas, townhouses, and shophouses. However, in the past year, investors have primarily focused on segments that meet practical needs, favoring liquid and income-generating real estate in major cities to mitigate risks. As a result, apartments have become their preferred choice.

Thirdly, there has been a shift in customers’ preferences for housing. Previously, Hanoians didn’t favor purchasing apartments for rent, investment, or residence, opting for land instead. However, their mindset has evolved, and they now embrace the idea of apartment living.

Lastly, Vietnam is experiencing a rapid expansion of its middle class, leading to a substantial demand for mid-range and high-end housing. Developers are responding to this demand by creating projects that cater to this demographic, resulting in an upward push on apartment prices.

Waiting for Apartment Prices to Drop Post-Law Change Is Unrealistic

Mr. Trung believes that it is unrealistic to expect apartment prices to decrease, given the rising costs of input factors such as land, design, construction, landscaping, and amenities. Currently, developers with available land are located in large urban areas, where project development costs are high due to the extensive infrastructure and amenities required.

OneHousing forecasts that the apartment supply situation is unlikely to improve significantly in the near future, with 23,000 units expected in 2025 and 24,000 in 2026. There don’t appear to be any factors that could drive prices down in the foreseeable future.

“Waiting for apartment prices to drop, especially after the law change, is highly unlikely in the current context,” said Mr. Trung. “While supply may improve in 2026–2027, those seeking affordable apartments will likely have to look further out, such as in Thanh Tri or Phu Xuyen. For now, I don’t foresee any factors that could lead to a decrease in apartment prices in 2024, 2025, or even 2026.”

Hanoi’s and the government’s development plans for the upcoming period include the construction of roads and bridges to connect the city’s center to the eastern bank. I believe the eastern part of Hanoi holds tremendous potential in terms of natural beauty, transportation connectivity, regional linkage, and quality of life.

Astonishingly high price for old and dilapidated apartment buildings reaching nearly 200 million VND/m2, rivaling the most luxurious condominiums in Hanoi

Old collective apartments with prices starting from 100 million VND/m2 are usually the first-floor units that can be used for commercial purposes, while the upper-floor units are priced at 60-80 million VND/m2 for residential purposes.

“Emerging from the storm” – Real estate market anticipates bright “shades” in 2024

2023 is a year of concerted efforts and hard work from all parties to overcome challenges in the real estate market. A series of government policies have been enacted to create a certain impact on the real estate market.

Continuous Change and Adaptability, Affordable Housing Cravings to be “Satisfied” by 2024?

Developing affordable housing will open up opportunities to address the supply-demand imbalance and reduce the overall housing prices in the market. If the market as a whole collaborates and adopts market-driven housing policies, the development of affordable housing will progress alongside social housing.