The tightening of credit in the real estate sector, especially for project development enterprises, has been a topic of discussion among experts at many workshops and seminars in the past year. Many opinions hold that scrutinizing and tightening capital credit for project development enterprises is essential to ensure the healthy development of the real estate market. Based on this, some experts have proposed setting a limit on the bank loan ratio for real estate enterprises.

Commenting on this issue, Dr. Nguyen Tri Hieu stated that real estate businesses often use financial leverage four to five times their equity. Of course, a real estate business using financial leverage twice its equity is already considered high, and if it is three, four, or five times, it is very high. The higher the ratio, the greater the risk of bankruptcy. However, according to Mr. Hieu, in the Vietnamese context, setting a limit on the financial leverage ratio for real estate businesses will create significant difficulties for this sector.

“Let the enterprises operate autonomously and negotiate with each other. Each bank will formulate its own reasonable real estate lending policy. There are enterprises that use high financial leverage but can still repay their debts because they sell their products and have cash flow. Conversely, there are enterprises with low financial leverage but cannot sell their products, resulting in a lack of cash flow to repay debts.”

The real estate market largely depends on bank capital (illustrative image)

Dr. Le Xuan Nghia, an economic expert, shared that the real estate sector in Vietnam heavily relies on bank capital. In Vietnam, the stock market is not robust enough to provide capital, so long-term and short-term capital from banks is the primary source, accounting for 75%. Meanwhile, real estate projects require capital over an extended period, typically ranging from ten to fifteen years. The expert assessed that lending to the real estate sector is characterized by high risk but also high profitability. Nevertheless, this is a market that most joint-stock commercial banks want to participate in. In the future, bank capital will continue to play a dominant role in developing real estate projects.

Regarding the issue of tightening credit in the real estate sector, Mr. Nghia added that in developed countries, statistics from 2015 in the common market of 16 European countries showed that the real estate lending ratio was 19%, while consumer lending was 41%. Production lending across Europe was only 8%, but in the Vietnamese market, production lending is higher.

“Gradually, we need to change our perception and recognize that there are foundational markets, and I believe that real estate is one of them. The second foundational market is commercial and personal transportation, accounting for 14% of the market in European countries, following consumer and real estate markets,” Mr. Nghia asserted. He also argued that, in reality, by indirectly lending to the real estate sector, bank credit has contributed to the increase in GDP. Therefore, we need to have an objective view of banks lending to real estate businesses.

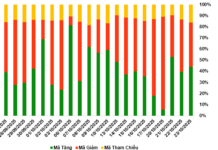

According to a report published by the Vietnam Real Estate Research Institute, capital for the real estate market in the past has come from six main sources, including credit capital, equity capital of real estate enterprises (including capital from the stock market), FDI, corporate bonds, capital from investment funds, and capital from the state budget. Among these, credit capital accounts for the majority.

The institute predicted that by 2030, credit capital would continue to play a dominant role and is expected to grow by about 10-12% per year. Specifically, the growth of real estate credit (including housing and real estate business loans) is expected to remain at a level equivalent to the general credit growth of the economy (approximately 10-12% per year). The scale of credit capital for real estate investment and business is estimated to reach about VND 2,000 trillion (about USD 86 billion) by 2030, while housing credit is expected to reach VND 3,000-3,500 trillion (about USD 147 billion).