Vietnam Petroleum Power Corporation – JSC (PV Power, code: POW) has just released its estimated business results report for July 2024.

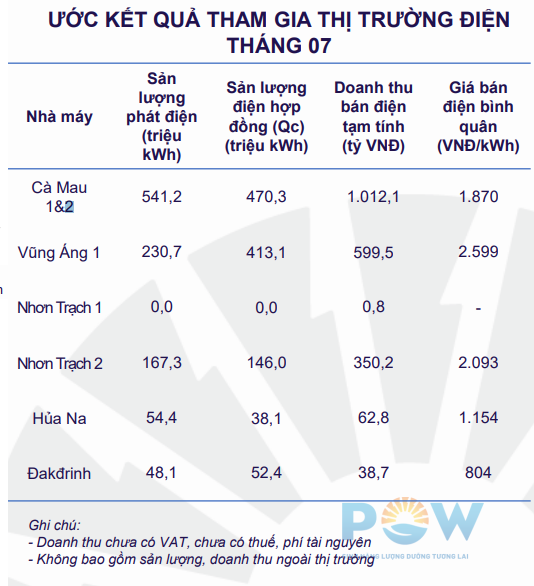

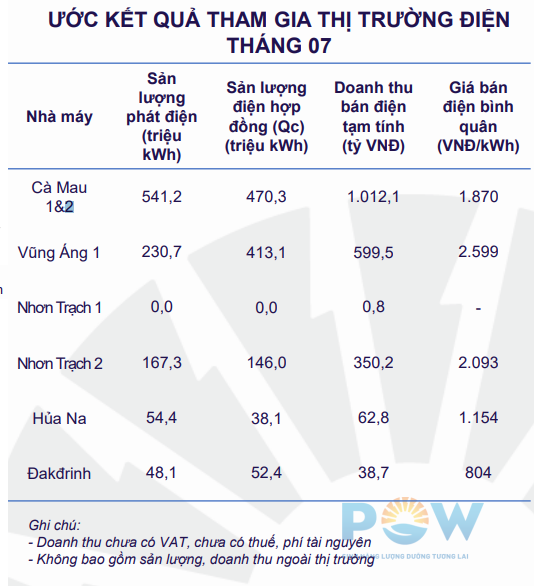

Specifically, the total electricity output of PV Power’s power plants (PPs) is estimated at approximately 1,042 million kWh. Electricity revenue in July is estimated at VND 2,064 billion, of which Ca Mau 1&2 PP contributed VND 1,012 billion, accounting for 49% of revenue; Vung Ang 1 PP brought in nearly VND 600 billion, accounting for 29% of revenue.

As of the first seven months of the year, the total electricity output of the company’s PPs is about 9,412 million kWh, with estimated revenue reaching VND 17,997 billion.

PV Power stated that hot weather continued across the country in July, with average temperatures nationwide generally 0.5-1% higher than the multi-year average. From the middle of July, heavy rains caused flooding in the northern provinces, leading to a decrease in electricity prices, with the full-month average market price (FMP) reaching VND 1,135/kWh.

Regarding the production situation of the power plants in July, Ca Mau 1&2 PP was assigned a contracted electricity output (Qc) of 470 million kWh, and the actual gas supply from PV Gas currently meets the operating requirements. Ca Mau PP offered prices that closely followed Qc and considered operating output beyond Qc to reduce the potential for advance gas payment obligations.

Due to the low market prices, Vung Ang 1 PP offered prices aiming to closely follow Qc and increase output during periods of high market prices to optimize efficiency. However, Vung Ang 1 PP was not fully mobilized by A0 to operate at the entire assigned Qc.

With low market electricity prices and limited gas supply in the Southeast region, Nhon Trach 1 PP was not mobilized to operate. Meanwhile, Nhon Trach 2 PP offered prices that closely followed the assigned Qc to ensure efficiency.

In the group of hydroelectric plants, July marked the transition to the rainy season in the Hua Na reservoir basin. The reservoir water level is currently at MNC, and the plant is offering prices to maximize output to take advantage of the water inflow at the beginning of the flood season to prepare for water storage for the next operating year. Dakdrinh PP was assigned a Qc of over 52 million kWh. Dakdrinh PP offered prices to maximize output to bring the reservoir water level back to MNC and optimize the efficiency of the reservoir at the end of the dry season.

Regarding the progress of new investment projects, PV Power signed a land lease contract with Tin Nghia Corporation on May 27 for an area of 30.8 hectares and was granted a red book by the Department of Natural Resources and Environment on May 29.

As of the end of July, the overall progress of the EPC package is estimated to have reached 90% completion. PV Power will continue to arrange capital, negotiate gas and power purchase agreements for the project according to the schedule.

For the plan in August, the company sets a target output of 1,012 million kWh for the power plants, corresponding to a revenue of VND 2,193 billion.

In the first six months of 2024, PV Power achieved net revenue of VND 15,650 billion and after-tax profit of VND 667 billion. As of June 30, 2024, the company had total assets of nearly VND 81,000 billion.

Joining the ‘game’ of building charging stations

In a related recent update, POW stated that the company is researching and proceeding with the investment in building a pilot electric vehicle charging station.

Accordingly, the company has signed a memorandum of agreement with EN Technologies Inc. to research and develop a charging system in Vietnam. The first pilot electric vehicle charging station will be located on Huynh Thuc Khang Street, Hanoi. The total investment cost of the project is estimated at over VND 1.8 billion.

The fast-charging station has a total capacity of 100-120kW. The area for the station is approximately 30-35m2. The station includes two cabinet-type chargers, each equipped with two charging ports with a capacity of 50-60kW/port.

Charging revenue is calculated based on the estimated charging volume and the expected charging price, which is divided into three levels according to off-peak, normal, and peak hours. The average charging price is expected to be around VND 3,858/kWh, equivalent to the charging stations operated by VinFast and lower than some other units such as EverCharge, EV One…

Through the construction of this pilot charging station, PV Power will have a basis for formulating plans to invest in and expand the charging station system.

Tracodi (TCD) earns 163 billion VND profit in 2023

Throughout the year 2023, Tracodi achieved a consolidated net revenue of VND 1,784.5 billion and a post-tax profit of VND 163.3 billion.