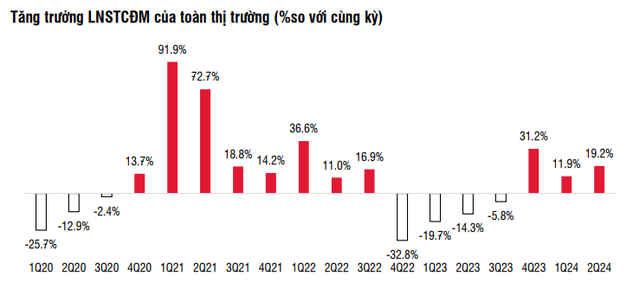

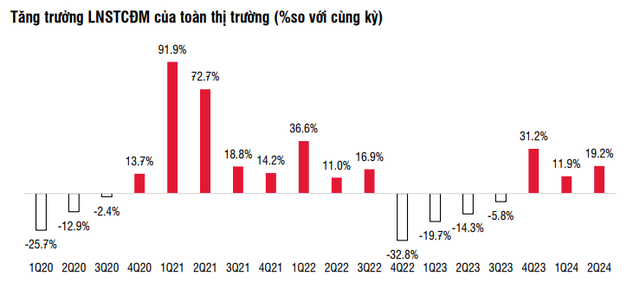

According to a recent report from SSI Securities, the cumulative after-tax profits of 1,111 listed companies on three stock exchanges as of August 7 increased by 19.2% year-on-year and 7.5% from the previous quarter, pushing profits to the highest level in nine quarters and close to the peak of Q1/2022.

The recovery trend is becoming more apparent, especially in the non-financial sector. Excluding the Banking and Real Estate sectors, the remaining industries recorded profits 2.12 times higher than the bottom recorded in Q4/2022. However, there is still a divergence among industries.

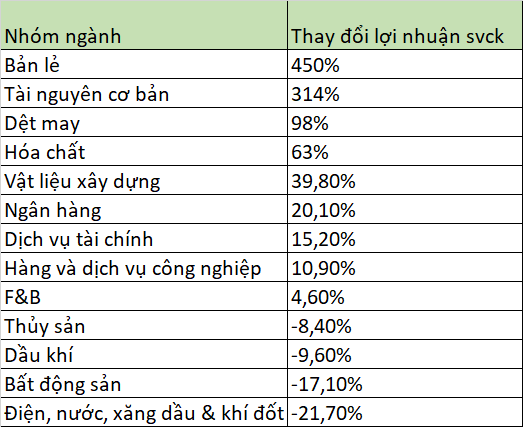

The consumer and manufacturing sectors accelerated their recovery and achieved the highest profits in two years. Notably, the retail industry surged by more than 400%, and the natural resources sector increased by 314%. The groups that maintained stable growth compared to the previous year and continued to peak in profits were Banking (up 20.1%) and Information Technology (up 26.6%).

Some groups slowed down after a strong increase in the previous quarter, such as Financial Services (up 15.2% year-on-year but down 9.1% from the previous quarter) and Tourism and Entertainment (down 61.7% from the previous quarter). The groups that have not returned to the growth trajectory include Real Estate (down 17.1% year-on-year) and Electricity, Water, Oil, and Gas (down 21.7%), and Oil and Gas (down 9.6%).

THE BANKING SECTOR MAINTAINS PROMISING GROWTH WITH POSITIVE SIGNALS FROM CREDIT EXPANSION

According to SSI Research, credit growth rebounded strongly compared to the previous quarter (5.8% quarter-on-quarter or 7.9% year-to-date) across all banks. Listed banks’ net profit in Q2/2024 increased by 20.1% year-on-year and 5% from the previous quarter.

This result stems from the recovery of NIM (up 11 basis points from the previous quarter), net fee income (up 14% from the previous quarter), and income from written-off bad debts (up 133% from the previous quarter). Notably, income from written-off bad debts unexpectedly recovered when there was not much improvement in real estate market liquidity.

The non-performing loan ratio as of the end of June remained stable at around 1.94%, unchanged from the previous quarter. However, the formation rate of non-performing loans and credit costs were higher than expected, mainly at BID, CTG, VPB, and OCB.

Overall, SSI Research observed some positive signals from credit demand, which is expected to continue in the second half of 2024. However, there are still some potential credit risks related to renewable energy, real estate (from investors and homebuyers), while NIM heavily depends on the pace of credit demand recovery in the last months of the year.

NON-FINANCIAL SECTORS SHOW MANY IMPROVEMENTS

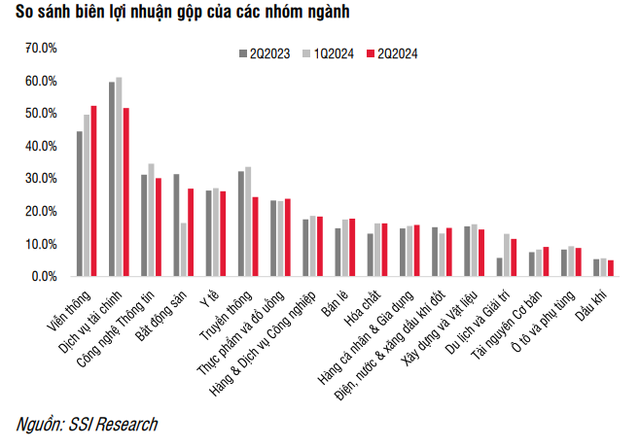

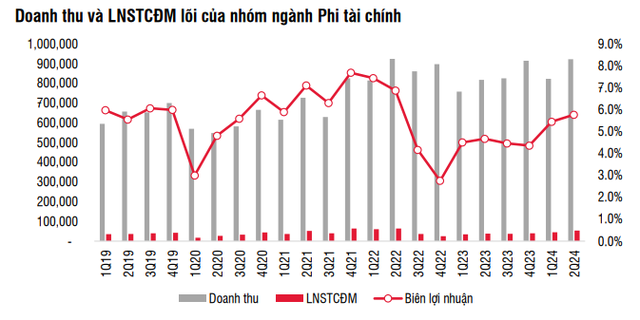

Total revenue from non-financial sectors surpassed the peak, and core profits showed positive developments. SSI Research observed improved revenue in all industries except Real Estate. Total revenue from non-financial sectors increased by 14% year-on-year and 13.2% from the previous quarter, surpassing the peak in Q2/2022 by 0.9%.

Excluding financial and other income, the after-tax profit of non-financial sectors rose sharply by 36% year-on-year and 15.4% from the previous quarter, reaching the highest level in two years, although it was still 23% lower than the peak in Q2/2022.

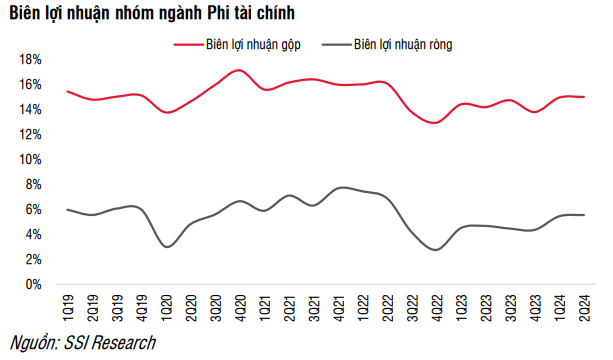

The gross profit margin of non-financial sectors continued to improve to 15.0% from 14.9% in Q1/2024 and 14.2% in Q2/2023. The average net profit margin also increased to 5.5%, the highest in eight quarters. The industries with the most significant improvements were Tourism & Entertainment, Telecommunications, Chemicals, Retail, and Basic Resources.

The ratio of interest expense to total debt (non-financial sectors) decreased to 5.7% from a peak of 7.8% in Q2/2023. Total interest expense also declined from VND 19,700 billion in Q2/2023 to VND 15,300 billion in Q2/2024, despite a stable debt-to-equity ratio.

Overall, while some sectors like Real Estate and Electricity, Water, Oil, and Gas have not returned to a growth trajectory, most other sectors are gradually recovering with significant improvements in financial health. With more positive signals in consumer industries, profit recovery is expected to continue in the second half. According to our forecast, the total after-tax profit of the stocks in SSI Research’s coverage universe may increase by 22.3% year-on-year in the second half of 2024.

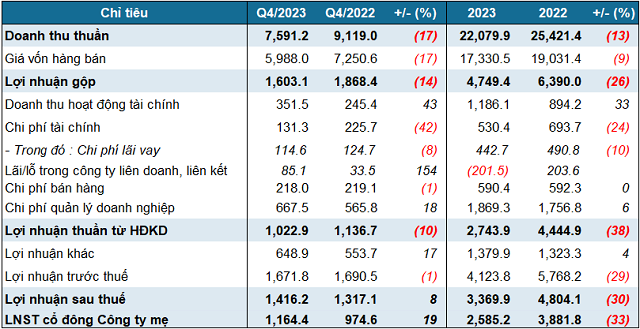

REASONS FOR THE DECLINE IN PROFITS IN THE REAL ESTATE SECTOR

The Real Estate sector recorded a notable recovery in revenue, with a 78% increase from the previous quarter, only 9% lower than the peak in Q2/2023. The net profit of the Real Estate sector decreased by 7.1% year-on-year, mainly due to a loss of VND 3,400 billion from Vingroup, primarily related to its electric vehicle business.

Excluding Vingroup, the industry’s profit increased by 17.6% year-on-year, reaching the highest level since Q4/2022. However, excluding financial and other income, the sector’s profit decreased by 16% year-on-year.

Change in industry profits according to SSI Research’s calculations.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.