The market surprised many with a powerful rally in the last three sessions, ending a period of sluggish performance. Major indices surged, with most stocks, especially those that had been deeply discounted, experiencing a strong rebound. This impressive stimulation of cash flow left behind investors who sold too soon or those who remained doubtful and hesitant.

The skepticism of the past few days was not without reason. From a technical perspective, the market had been hovering at the MA20 level for both the VNI and VN30 indices. The upward trend, accompanied by low trading volume, resembled the typical technical recovery pattern seen during a downward trend. Consequently, successful bottom-fishing investors often realized their profits early and waited for a price drop to buy again. If the VNI were to adjust and retest the bottom, it would be consistent with standard technical factors.

However, the market always holds surprises, and technical analysis doesn’t always capture the complexities of human psychology. Sentiment is the most changeable factor and can shift overnight. Today’s rally will shift the focus away from carry-trade yen or war concerns to the brighter prospects ahead, such as the Fed’s potential rate cut in September and the overdone discounts on many quality stocks during the recent correction.

Market assessments are often influenced by subjective psychology, which is determined by one’s position. Today’s performance, which initially seemed like a simple upward trend breaking through the MA20 level, ended up attracting impatient waiting cash flow, resulting in a price-chasing frenzy. Prolonged pessimism often leads to either a sharp drop to create a sense of bargain or a strong upward push to induce a sense of missing out. Both scenarios aim to exert pressure on the conservative cash flow that is still on the sidelines.

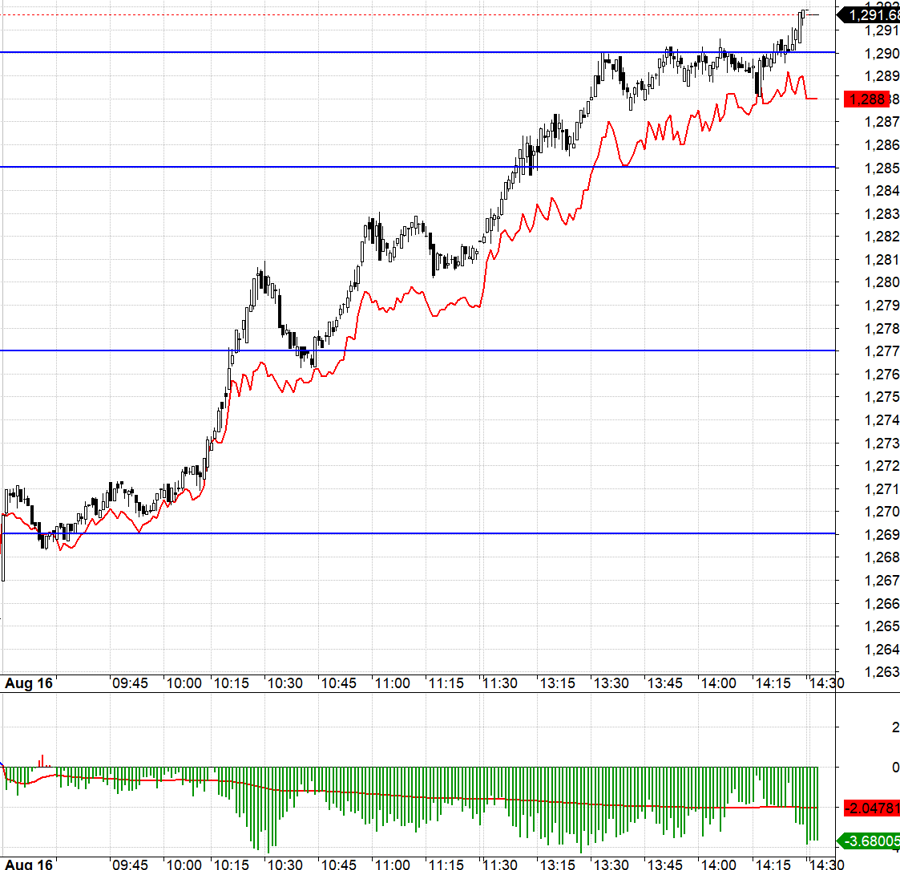

Today’s session started slowly but quickly picked up pace in terms of trading volume. From around 10 am onwards, the volume surged, resulting in a “cash infusion” race. Now, everyone will find reasons to justify their buying decisions, despite the previously discouraging red prices. After this cash flow bait, the simple task is to sit back and watch the latecomers do what is necessary to join the rally.

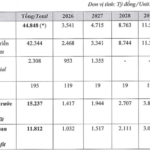

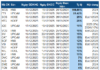

Today’s matched trading volume on the HSX and HNX exchanges was approximately VND 23.2 trillion, a remarkable outburst in the current phase. The average matched volume for the previous ten sessions was around VND 14 trillion per day. Typically, after an explosive session like today, the market is likely to continue climbing for another three to five sessions, with the range narrowing gradually. The volume held around the bottom during the recent short-term corrections may reappear, establishing a higher volume foundation.

In today’s futures market, the term structure inverted, with F1 maintaining a narrow negative basis, which widened as VN30 climbed higher. This skepticism is typical when the underlying market surges too rapidly. However, the entry points were appropriate, and the resistance levels showed an early response in F1, followed by successful validations in VN30. The index struggled around the 1290.xx level but eventually closed above it. The two consecutive range openings from 1269.xx to 1277.xx and 1285.xx were the most effective Long zones.

Following today’s strong rally, it is highly likely that the market will exhibit strong inertia tomorrow, continuing the upward momentum for another session before stabilizing. The odds of an increase are certainly higher than a decrease, but the range may narrow, and volatility could persist. The recommended strategy is to be flexible with Long/Short positions, favoring Long.

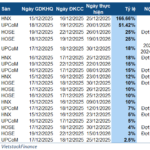

VN30 closed today at 1291.68. The nearest resistance levels for the next session are 1298, 1307, 1316, 1219, and 1329. The support levels are 1290, 1279, 1269, and 1260.

“Blog chứng khoán” reflects the personal views of the author and does not represent the opinions of VnEconomy. The assessments and opinions expressed herein are solely those of the individual investor, and VnEconomy respects the author’s perspective and writing style. VnEconomy and the author are not responsible for any issues arising from the investment assessments and opinions presented in this blog.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.