Platinum Victory Pte. Ltd. (Singapore), an investment fund related to Mr. Alain Xavier Cany, a member of the board of directors of Vinamilk (Vietnam Dairy Products Joint Stock Company, stock code: VNM), has recently reported to the Ho Chi Minh City Stock Exchange regarding a transaction of VNM shares.

Specifically, the fund registered to purchase 20.89 million VNM shares from July 15 to August 13, but the transaction was unsuccessful due to unfavorable market conditions. Notably, this was the sixth time since the beginning of 2024 that Platinum Victory Pte. Ltd. has registered to buy the aforementioned number of shares without actually purchasing any.

Undeterred, the foreign fund continues its pursuit by registering to purchase the same amount of 20.89 million VNM shares from August 19 to September 17, intending to use either matched orders, auction transactions, or through the Securities Depository Center.

If successful, Platinum Victory Pte. Ltd. will increase its ownership in Vinamilk from 10.62% to 11.62% (equivalent to 242.7 million VNM shares).

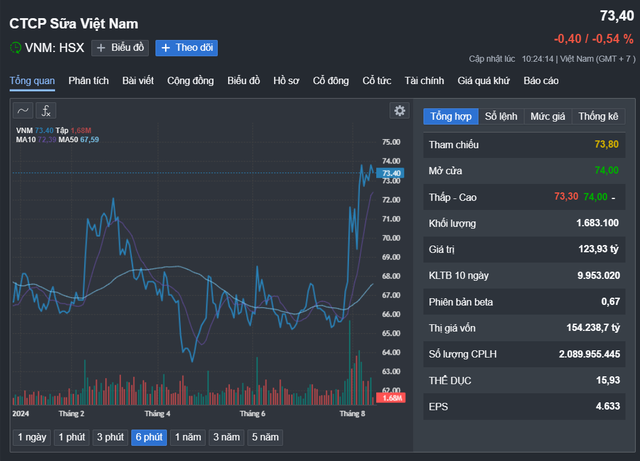

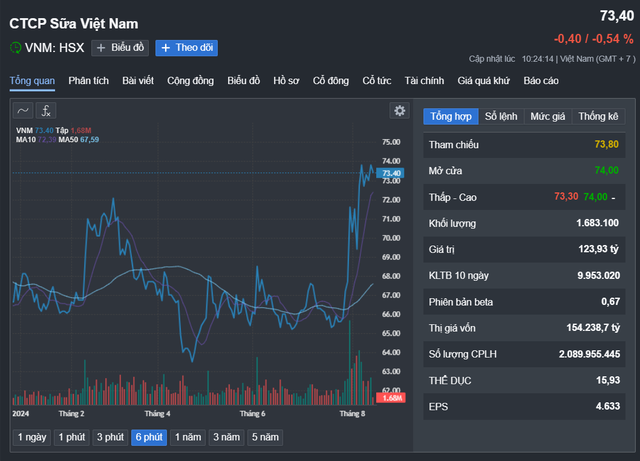

VNM stock price movement since the beginning of 2024.

Interestingly, Platinum Victory Pte. Ltd. is not the only investor with a keen interest in Vinamilk’s shares. F&N Dairy Investment Pte. Ltd., owned by Thai billionaire Charoen Sirivadhanabhakdi, has also repeatedly registered to purchase 20.89 million VNM shares for investment purposes but has been unsuccessful. So far this year, the Thai billionaire has made five attempts to acquire VNM shares, all of which have failed due to market conditions not being conducive.

These persistent attempts to acquire a significant number of VNM shares come amidst a backdrop of the stock’s dramatic rise and subsequent plunge earlier this year. Following this, the stock traded sideways at the 60,000 VND level before surging from 65,600 VND per share to nearly 74,000 VND per share in late July and holding steady since then.

Regarding Vinamilk’s performance, the second quarter of 2024 saw impressive results, with revenue reaching nearly VND 16,700 billion (a 9.6% increase year-on-year) – the highest quarterly revenue in the company’s history. Notably, Vinamilk also gained an additional 1.2% market share during this quarter.

After expenses, net income for the second quarter stood at VND 2,695 billion, a nearly 21% increase compared to the same period last year.

For the first six months of 2024, Vinamilk’s cumulative revenue and net income were nearly VND 30,800 billion (a 5.7% increase year-on-year) and VND 4,900 billion (an 18.6% increase year-on-year), respectively, completing 49% and 52% of the full-year plan.

In a recent report, SSI Securities Company estimated Vinamilk’s revenue and net income for the year to reach VND 64,000 billion and VND 10,000 billion, respectively, representing a 6% and 14% increase compared to the previous year.

Additionally, given that VNM stock has no foreign ownership limit and enjoys high liquidity, SSI believes that Vinamilk will benefit from FTSE Russell’s expected upgrade of the Vietnamese market.