The US stock market staged a strong recovery in the previous trading week, ending with only minor losses; however, the net inflow trend for US ETFs weakened as outflows from Southeast Asian markets cooled down.

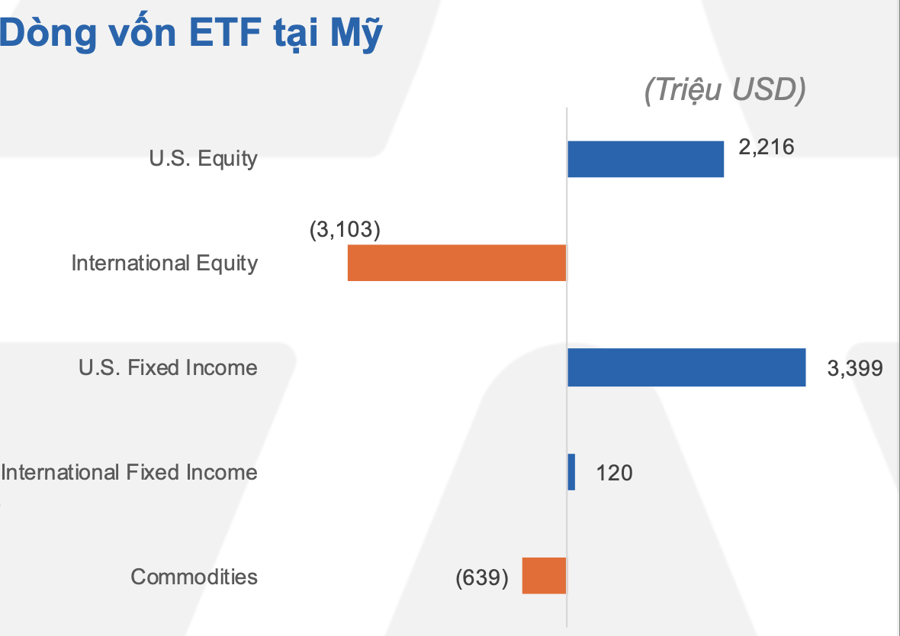

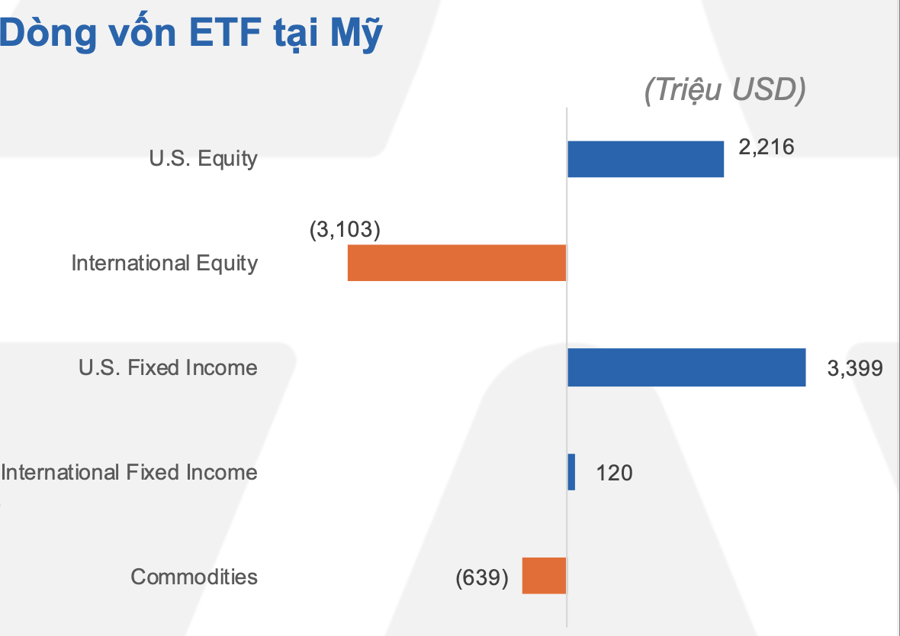

Specifically, the net inflow trend for US ETFs decreased by 73% compared to the previous week, recording only $4.4 billion. Domestic equity funds attracted an additional $2.2 billion, a 75% decrease, while bond funds netted $3.4 billion, a 51% drop.

A similar pattern occurred in foreign markets, with foreign bond ETFs still attracting funds but slowing to $120 million, an 89% decrease week-on-week. However, foreign equity funds experienced significant outflows, with investors withdrawing an additional $3.1 billion, 2.2 times the outflows of the previous week. Commodity-focused ETFs also saw outflows of $639 million this week.

This trend was anticipated by experts. According to SSI Research, after a volatile July, especially towards the end of the month, capital inflows into equity funds are likely to be more cautious in August to assess recession risks in the US market.

Global equity funds maintained their positive momentum in July. Inflows into equity funds continued to surge, with a net inflow of $91 billion—nearly double the previous month and the highest since March 2021.

Investor sentiment remained optimistic due to the impact of monetary policies following actions by major central banks worldwide. Inflows into developed markets ($68.4 billion) outperformed emerging markets ($22.7 billion).

Bond funds and money market funds continued to attract capital, with inflows of $75 billion and $58 billion, respectively. Notably, inflows into bond funds reached their highest level since June 2020, driven by the US market.

In the first seven months of 2024, financial asset inflows remained positive, with equity funds attracting $316.6 billion, bond funds $366.8 billion, and money market funds $285 billion.

Developed market equity funds recorded net inflows of $68.4 billion in July, the highest since October 2021. Capital continued to flow into the US market in July ($62.9 billion) as expectations of interest rate cuts drove money towards small-cap stocks or interest rate-sensitive sectors.

July also saw the Russell 2000 index outperform the Nasdaq 100 significantly. In the seven-month period, developed market equity funds recorded inflows of $233 billion, mainly in the US market ($195 billion).

Meanwhile, emerging market equity funds benefited from positive investor sentiment and capital rotation in July. Inflows reached $22.7 billion, nearly double the previous month, mainly due to multi-country ETF inflows into the Chinese market ($19.9 billion). The Indian market maintained its net inflow streak for the 16th consecutive month, attracting $2.6 billion, not far off from previous months.

However, political uncertainties, elections, and recession risks in the US began to surface towards the end of July, causing capital inflows to slow down in the final days of the month. A survey by BofA also indicated a cooling of optimism among fund managers in July, with cash allocations inching up to 4.1% from 4% in June.

In Southeast Asia, except for Malaysia, which saw a positive inflow of $25 million, other countries experienced significant outflows in July.

In the first week of August, Taiwan led the outflows in Asia, with $2.2 billion withdrawn, followed by South Korea and India, with outflows of $1.2 billion and $1.1 billion, respectively. Conversely, the Indonesian stock market attracted $69.5 million in inflows.

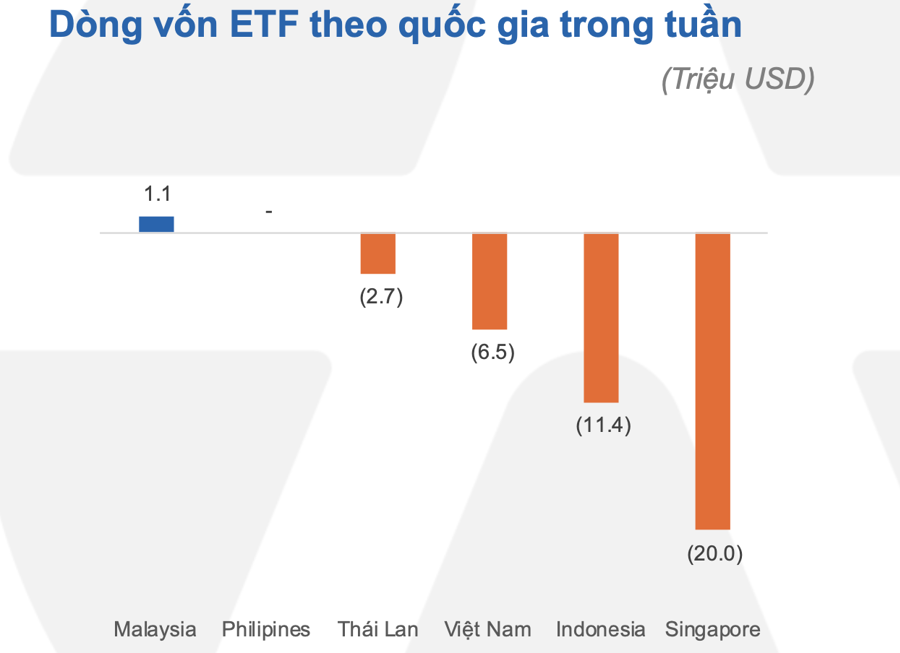

For Southeast Asian ETFs, the outflow trend continued, with a further withdrawal of $39.6 million. However, the positive sign was that the outflow value decreased by 7.4% from the previous week in most markets.

Singapore-focused funds experienced the largest outflows of $20.0 million, followed by Indonesia ($11.4 million) and Vietnam ($6.5 million).

In Vietnam, the main outflow was driven by the Fubon FTSE fund, with a withdrawal of $4.1 million, a 45.9% decrease from the previous week.

One of the reasons for the renewed optimism in Vietnam’s stock market is its attractive valuation.

While global stocks have risen, the VN-Index has lagged, partly due to a low tech sector weight, making it less attractive to capital. The market has also been impacted by the real estate and banking sectors, which hold high weightings. Concerns about the real estate sector not meeting market expectations have caused deep corrections, while the banking sector’s second-quarter results, revealing rising non-performing loans, have pressured the market.

However, according to Mr. Minh, global capital is currently in a state of profit-taking in markets that have already risen. It is likely that capital will quickly flow into markets with attractive valuations and cooling exchange rates, including Vietnam, as the US dollar weakens.