According to Mr. Binh, the law’s recent enforcement has not significantly impacted investors’ land-buying decisions. This is because investors had already been buying land at high prices before this, and those with financial readiness had already snapped up the truly good deals. Currently, the market observes a higher demand for residential land, and new investors are also looking for well-priced plots for long-term investment.

“The market for subdivided land on the outskirts of Ho Chi Minh City remains subdued but has shown more stability. There has been a noticeable decrease in investors cutting their losses or deeply discounting their properties. Instead of offloading at all costs, they are now holding on to their assets, anticipating price increases,” said Mr. Binh.

On the ground, real estate agents are actively returning to the market to seek out clients. Buyers are concerned about potential price increases as the market shows positive signs. However, transaction activities remain uneven, and liquidity mainly comes from previously listed old inventory. Buyers fall into two categories: those actively seeking deals better than market prices and those who continue to observe without any indication of committing.

The recent enforcement of the law, which tightens the subdivision and sale of land in 105 urban areas, has boosted the confidence of investors holding subdivided land. They anticipate a supply shortage and subsequent price increases in the future. Despite the positive market sentiment, buyers are much more cautious after a prolonged period of market volatility.

Notably, areas on the outskirts of Ho Chi Minh City that were once hot spots for subdivided land, such as the former District 9 (now Thu Duc City, Ho Chi Minh City), Hoc Mon and Cu Chi districts, Tan Uyen and Bau Bang districts (Binh Duong), and Long Thanh (Dong Nai), have not seen a significant increase in demand.

After multiple market fluctuations, land prices in these areas are already relatively high. Investment demand is limited due to modest profit potential. Meanwhile, actual residential demand only surfaces for secondary products that offer significantly better prices than the market rates at the beginning of 2022.

Recently, a potential buyer looking for land to build a house in District 9 shared their concern about the high prices. Although they liked a particular product, the high cost hindered their purchasing decision.

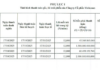

Astonishingly high price for old and dilapidated apartment buildings reaching nearly 200 million VND/m2, rivaling the most luxurious condominiums in Hanoi

Old collective apartments with prices starting from 100 million VND/m2 are usually the first-floor units that can be used for commercial purposes, while the upper-floor units are priced at 60-80 million VND/m2 for residential purposes.