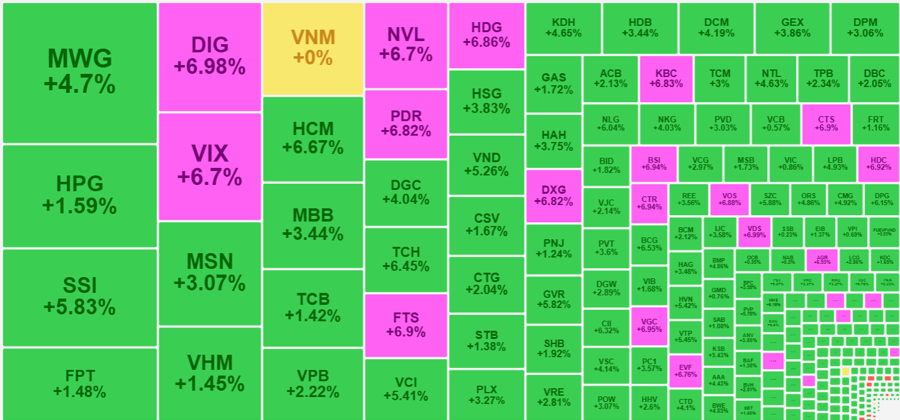

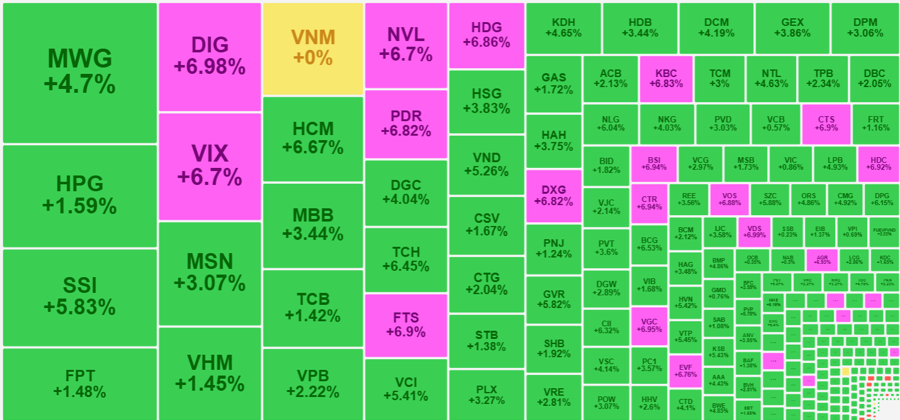

The cash flow continued to fuel the upward momentum in the afternoon session, although there wasn’t a significant surge in the index, the stock prices performed impressively. The breadth of advancing stocks was tenfold that of declining ones, with the VN-Index closing 2.34% higher (+28.67 points), the strongest performance since November 8, 2023 (+3.1%). Across the three exchanges, 83 stocks hit their daily limit-up, with 28 on the HoSE alone.

Looking at the afternoon session in isolation, the VN-Index climbed by approximately 8.3 points. The bulk of today’s gains were already in place from the morning session. This can be attributed to the limited room for further gains among the large-cap stocks. VCB, the largest stock by market capitalization, retreated by about 0.34% from its morning closing price, while VIC remained unchanged and GAS slipped by 0.48%. Some other large-cap stocks, such as TCB, FPT, and BID, saw only modest gains.

Nonetheless, the vast majority of blue-chip stocks in the VN30 basket continued to climb. The VN30-Index ended the day 2.08% higher, with 16 stocks posting gains of 2% or more, double the number from the morning session.

Leading the charge in pushing the VN-Index higher were GVR, up 5.82%; BID, up 1.82%; MWG, up 4.7%; MBB, up 3.44%; and LPB, up 4.93%. Notably, not all of these stocks are among the top market capitalizations. VCB, the largest stock, registered only a modest gain of 0.57%. BID also showed strength but was outperformed by several other stocks such as SSI, HDB, PLX, and POW, benefiting from a combination of price gains and higher market capitalization. This dynamic excludes VNM, which closed at the reference price, and VIC, which managed a meager gain of 0.86%. A more concerted push from the large-cap stocks could have resulted in an even more explosive index performance.

Today’s session marked the strongest gain for the VN-Index in nine months. The upward momentum was broad-based and gained momentum toward the closing bell. The HoSE closed with 28 stocks hitting their daily limit-up, and several stocks witnessed substantial trading volumes in the hundreds of billions of VND, including DIG, BSI, FTS, CTS, HDG, KBC, DXG, PDR, NVL, and VIX. From 145 stocks posting gains of 2% or more in the morning session, the number swelled to 205 by the closing bell. The market breadth remained robust throughout the day, starting with 368 gainers to 65 decliners in the morning and ending with an even stronger showing of 413 gainers to just 41 decliners. More than 70% of the exchange’s stocks closed the day with gains exceeding 1%, underscoring the widespread upward momentum.

The inflow of cash into the market during the afternoon session remained robust, with an additional 11,348 billion VND in matched transactions across the two exchanges, a slight decrease of 4.4% compared to the morning session. HoSE, in particular, witnessed a trading volume of 10,546 billion VND, a 3.8% dip. Today’s vibrant trading activity, both in the morning and afternoon sessions, propelled HoSE and HXN to their best liquidity in 22 sessions. Of the 11 stocks on HoSE that crossed the 500 billion VND threshold, all except VNM, which closed at the reference price, recorded substantial gains. The weakest performer among them, VHM, still managed a gain of 1.45%, while the rest saw increases in the range of 3-6%.

On the downside, although there were 41 declining stocks, they carried little significance. Several stocks that were in negative territory in the morning session staged impressive turnarounds: CSV went from a 0.51% loss to a 1.67% gain, KDC reversed a 0.37% loss to a 1.65% gain, and VJC erased a 0.1% loss to post a 2.14% gain. By the end of the session, the total trading volume of the declining stocks on HoSE barely reached 20 billion VND, with the vast majority of them recording meager trading volumes in the hundreds of millions of VND.

Today’s standout features were the exceptional liquidity and the impressive magnitude of stock price increases. Investors, eager to join the rally, actively chased rising prices. Stocks that had experienced sharp declines in the previous period became attractive targets for bottom-fishing. The VN-Index closed the week at 1252.23, completely erasing the losses incurred in the first three sessions of August.