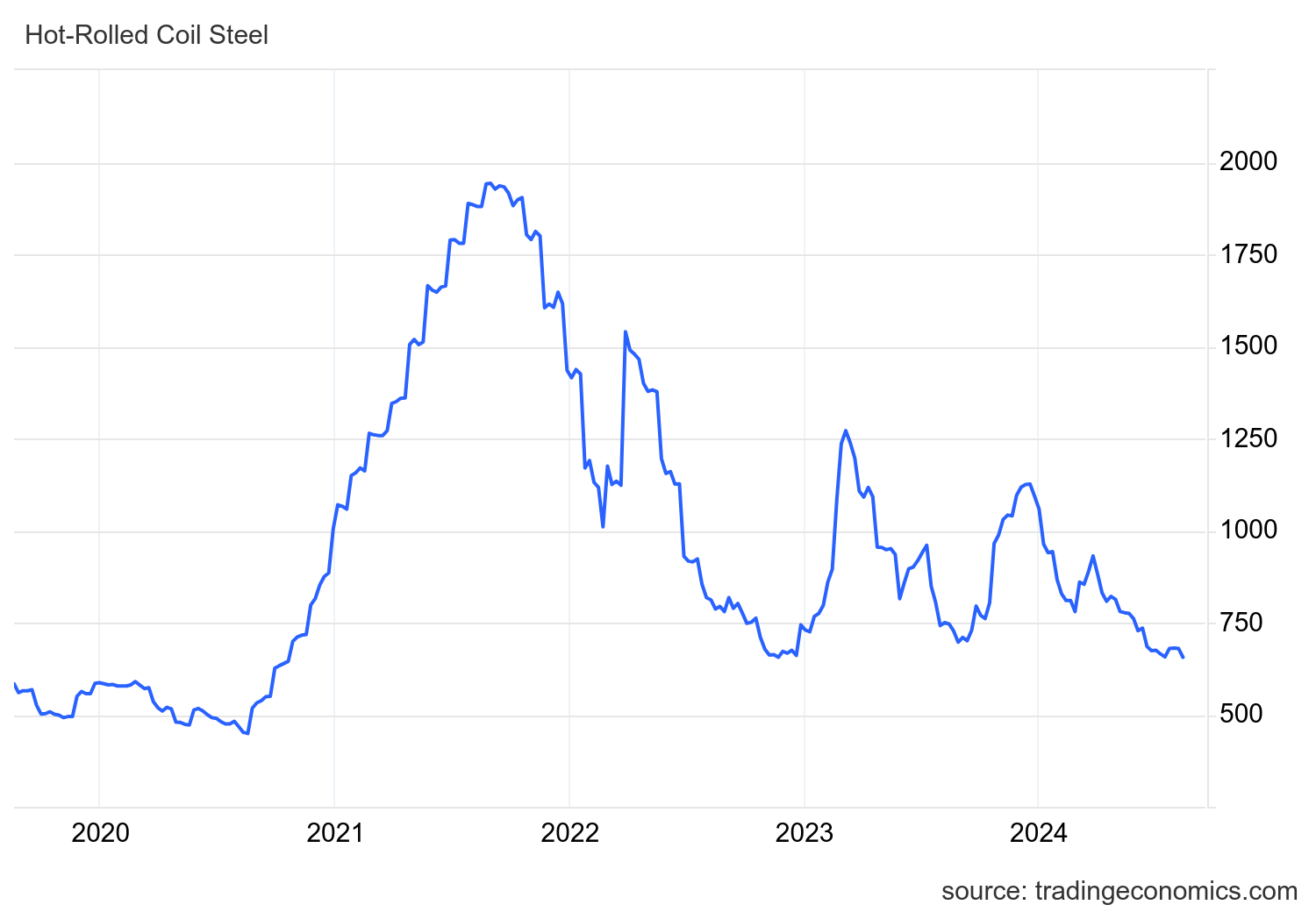

“A Brutal Winter” – this is how the head of China Baowu Steel, the world’s largest steel producer, describes the current state of the Chinese steel industry, likening it to an even greater challenge than the major shocks of 2008 and 2015. The warning signals from the world’s largest steel market are clearly reflected in steel price movements.

After a slight rebound in the second quarter of this year, steel bar futures plummeted, falling below 2,800 CNY/ton for the first time in eight years, since 2016. Similarly, hot-rolled coil (HRC) futures also dropped to their lowest level in nearly four years, since the middle of October 2020.

The decline in global steel prices is attributed to weak demand, while supply from the Chinese market continues to increase. Widespread housing oversupply has led the Chinese government to curb support for major real estate developers, significantly impacting steel consumption prospects.

Chinese mills have turned to foreign customers to offset domestic demand. The Chinese government issued new quality standards for steel bars in September last year, prompting mills and traders to flood the market with old inventory. This added further downward pressure on prices.

Inventory Pressure Mounts, Shareholders Feel the Heat

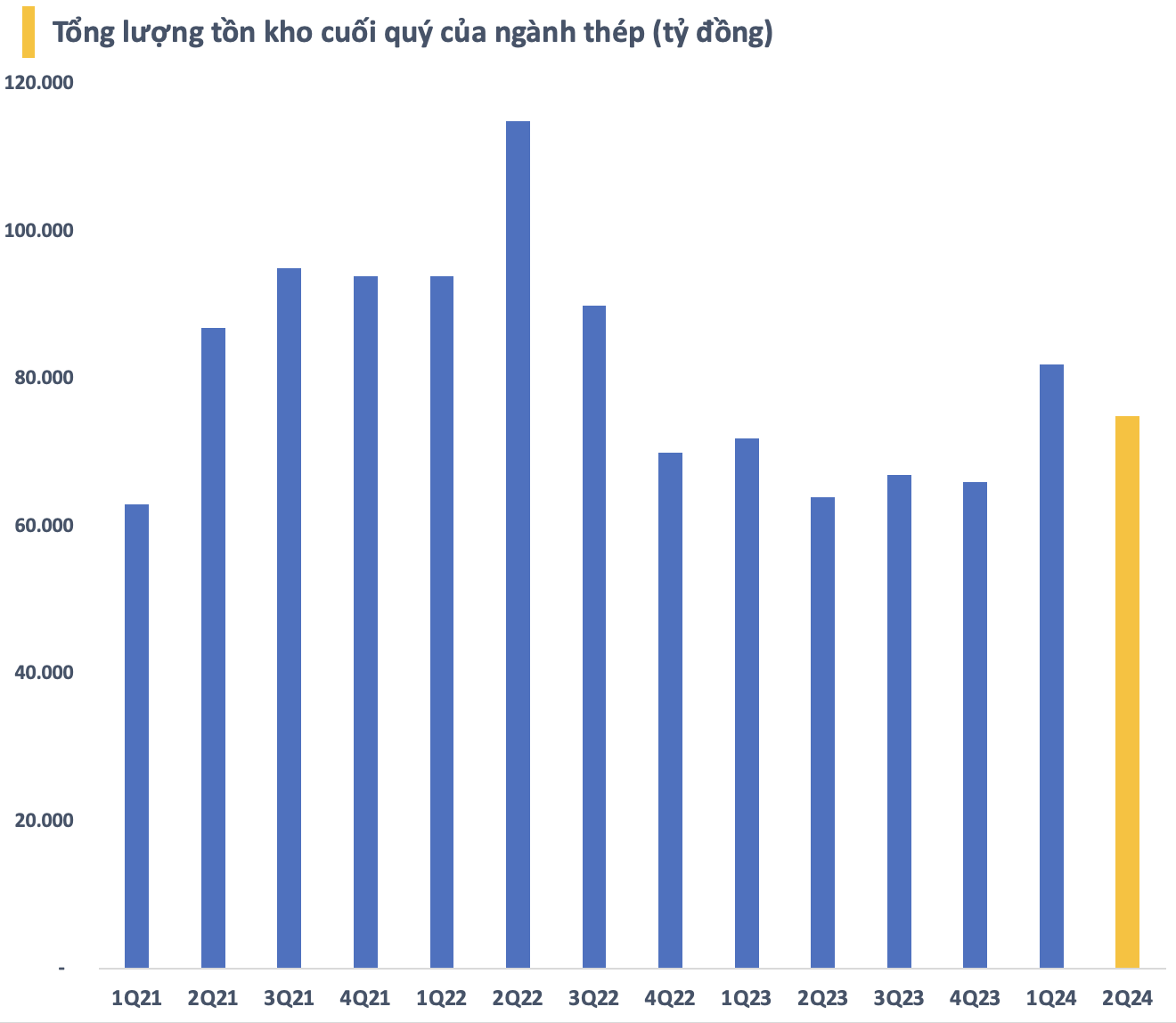

Steel prices have fallen sharply even as steel companies continue to hold significant inventories, which decreased after the second quarter. As of June 30, the total inventory value of the steel industry on the stock market was estimated at VND 75,000 billion, a decrease of about VND 7,000 billion from the previous quarter, but the second-highest level in the last seven quarters.

Five companies, Hoa Phat, Hoa Sen, Nam Kim, VNSteel, and Ton Dong A, account for nearly 90% of the total inventory value of the steel industry on the stock market. Of this, Hoa Phat alone accounts for more than 53% with an inventory value of over VND 40,000 billion as of the end of the second quarter (including provisions for inventory devaluation). While most listed steel companies reduced their inventory after the second quarter, the current inventory levels remain significantly higher than the average in 2023.

The downward trend in global steel prices is expected to impact the profits of the steel industry, putting considerable pressure on steel stocks in recent times. Since their recent peaks, HPG (-15%), HSG (-22%), NKG (-26%), TVN (-25%), GDA (-27%), and SMC (-50%) have all fallen by double-digit percentages in less than two months, erasing all the gains made at the beginning of the year. This has left many steel industry shareholders feeling the heat.

With a bleak outlook, the pressure on steel stocks is immense, especially from foreign investors. HPG, for instance, has seen net foreign selling of nearly 80 million shares since the beginning of June, equivalent to nearly VND 2,200 billion. The intensity of net selling increased significantly in the first half of August and shows no signs of abating, while domestic money remains cautious, leaving steel stocks struggling to find a balance.

The Headache of Anti-Dumping Measures

At present, there are few indications that the downward trend in steel prices will reverse in the short term. As a result, domestic steel companies are likely pinning their hopes on anti-dumping measures to alleviate some of the pressure from Chinese steel on the domestic market.

The focus of the investigations is on HRC imports from China and India and galvanized steel imports from China and South Korea. However, Vietcap believes that the likelihood of anti-dumping duties being applied to HRC is quite low due to insufficient domestic supply to meet HRC demand. Vietnam’s annual HRC demand is 12-14 million tons, far exceeding domestic supply (4-5 million tons) and maximum domestic capacity (8-9 million tons).

According to Vietcap, the risk to galvanized steel manufacturers is significant, and the likelihood of anti-dumping duties being applied to these products is higher. If sufficient evidence of dumping is found, Vietcap expects temporary anti-dumping measures to be applied as early as mid-September 2024. Hoa Phat would be the biggest beneficiary if anti-dumping duties were applied to both HRC and galvanized steel. Galvanized steel manufacturers, including Hoa Sen and Nam Kim, would only benefit from anti-dumping duties on galvanized steel.

As the industry awaits a decision from the Ministry of Industry and Trade, Vietnam’s steel industry recently received more bad news. On August 8, the European Commission (EC) issued a notice initiating an anti-dumping investigation into certain hot-rolled steel products originating from Egypt, India, Japan, and Vietnam, imported into the European Union (EU).

In conclusion, any anti-dumping decisions, if passed, will have an impact on steel prices and the business operations of companies in the industry. At this point, it is challenging to predict the final decision, and businesses must prepare for all possible scenarios.

How to counter the wave of imported steel?

The domestic market share loss of domestic hot rolled coil steel industry is real. The loss of 1/3 of the market share in less than a year is one of the worrying signs, experts said.

April 18 Market: Oil slumps 3%, Iron ore at 5-week high, Robusta coffee hits record high

Oil prices fell 3% to settle at $100.18 a barrel on April 17, 2024, amid concerns that demand worries would outweigh supply risks from the Middle East. Gold prices dipped but held near record highs. Iron ore rose to its highest in more than five weeks on improving steel demand and restocking ahead of a holiday.