Illustrative image

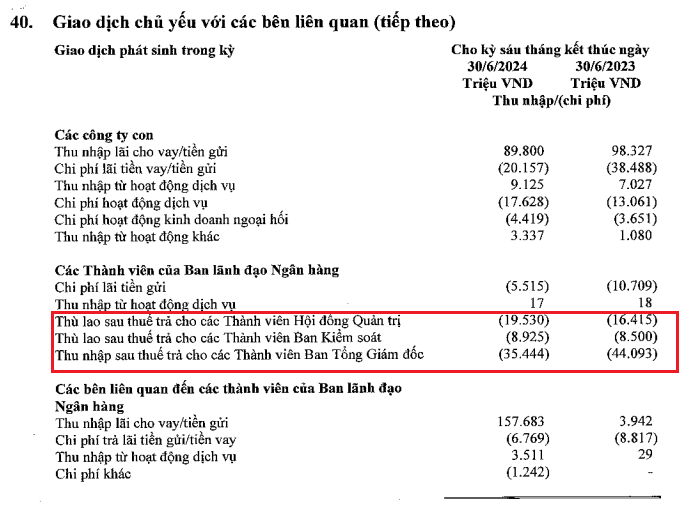

According to Sacombank’s recently published audited semi-annual standalone financial report, in the first six months of the year, the bank paid over VND 63.8 billion in post-tax remuneration to its Board of Directors.

Specifically, the remuneration for the Board members increased by more than VND 3 billion compared to the first half of 2023, reaching over VND 19.5 billion. Currently, Sacombank’s Board comprises seven members: Chairman Mr. Duong Cong Minh; two Vice Chairmen, Ms. Nguyen Duc Thach Diem and Mr. Pham Van Phong; and four Board members, Mr. Phan Dinh Tue, Mr. Nguyen Xuan Vu, Mr. Vuong Cong Duc, and Ms. Pham Thi Thu Hang.

With this total expenditure, each Board member received, on average, nearly VND 2.8 billion, equivalent to VND 466 million per person per month.

For the Supervisory Board, the four members received a total remuneration of VND 8.9 billion in the first six months, corresponding to over VND 2.2 billion per person. This equates to an average monthly income of approximately VND 370 million for each Supervisory Board member.

Sacombank’s Supervisory Board for the 2022-2026 term consists of Chairman Tran Minh Triet and three members: Nguyen Van Thanh, Lam Van Kiet, and Ha Quynh Anh.

Source: Sacombank’s Audited Semi-Annual Standalone Financial Statements

In the first half of the year, Sacombank’s Board of Directors received a total post-tax remuneration of over VND 35.4 billion, a decrease of VND 8.7 billion compared to the first half of 2023. With a total of ten members, each member of the Board of Directors received an average remuneration of VND 3.5 billion in the first six months.

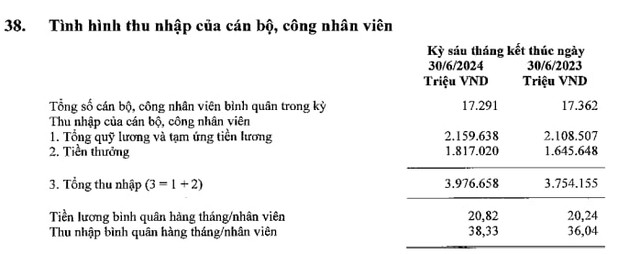

According to Sacombank’s financial statements, the average monthly salary of the bank’s employees in the first half was VND 20.8 million per person, slightly higher than the VND 20.2 million per person per month in the same period last year. The average monthly income reached VND 38.33 million per person, an increase of VND 2.3 million compared to the previous year.

As of June 30, the number of employees working at Sacombank’s head office was 17,212, a decrease of 200 from the beginning of the year. The total number of employees across the entire system, including subsidiaries, was 18,260, a reduction of over 250 compared to the start of the year.

Source: Sacombank’s Audited Semi-Annual Standalone Financial Statements

In the first six months, Sacombank recorded a pre-tax profit of VND 5,342 billion, an increase of 12.3%, and a post-tax profit of VND 4,288 billion, up 12.1%. Thus, after the first half, Sacombank has achieved 50.4% of the pre-tax profit plan approved by the General Meeting of Shareholders (VND 10,600 billion).

As of the end of June 2024, Sacombank’s total assets exceeded VND 717,300 billion, a 6.4% increase from the beginning of the year. This includes a 7% rise in customer loans to VND 516,600 billion and a 15.7% increase in loan loss provisions to VND 8,752 billion. Customer deposits also increased by 7.5%, reaching nearly VND 549,200 billion.

The bank’s on-balance sheet bad debt stood at VND 12,548 billion at the end of the second quarter, a 14.2% increase, mainly due to an uptick in debt groups 4 and 5. The bad debt ratio to total loans also increased to 2.43%, higher than the figures at the end of the first quarter and in 2023.