According to a report by Vietnam Investment and Rating Joint Stock Company (VIS Rating), the recovery in stock market value and improved market sentiment amid low-interest rates have boosted profits for securities companies.

MARGIN LENDING PROFITS ROSE BY UP TO 70%

In the first six months of 2024, Vietnam’s stock market recorded a positive growth rate of 10.2% compared to the end of 2023, outperforming many regional markets.

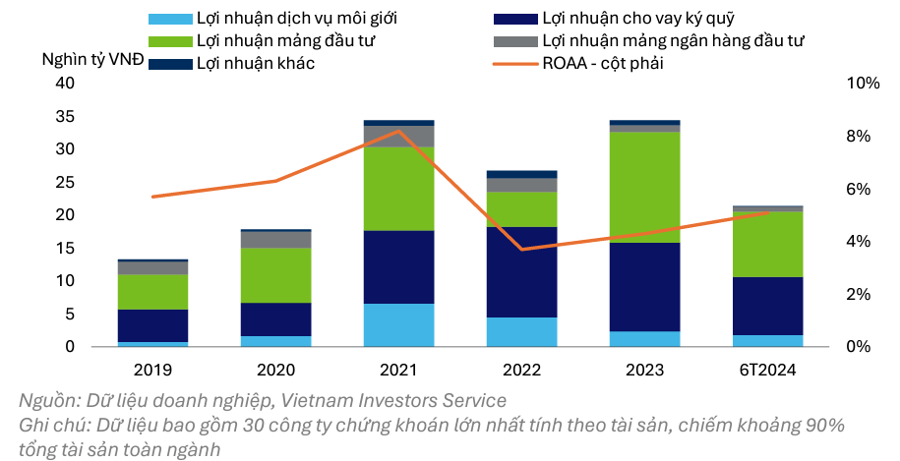

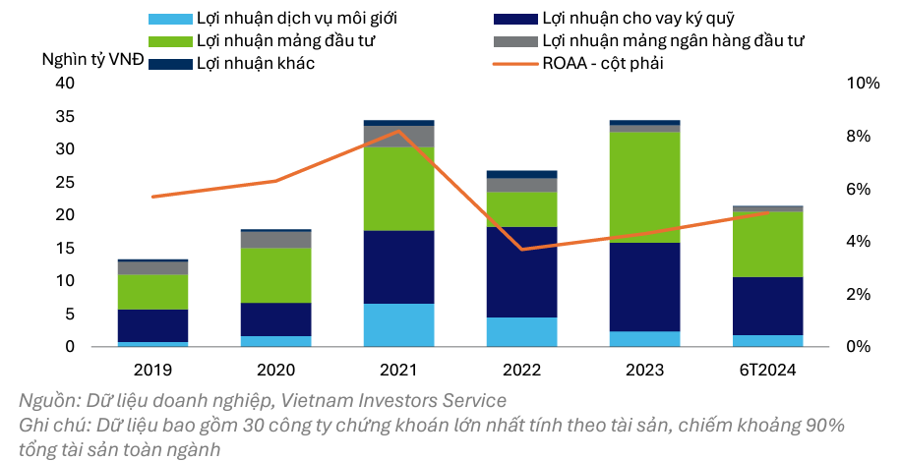

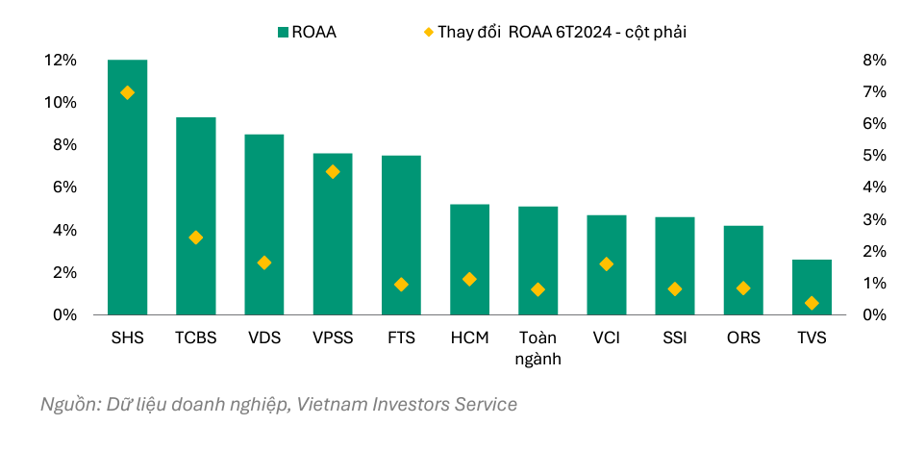

As a result, the return on average total assets (ROAA) for the industry increased from 4.3% in 2023 to 5.1% in the first half of 2024. Strong market sentiment in the context of low-interest rates and a decreasing rate of new bond principal/interest defaults boosted trading volume, stock valuations, and encouraged more investors to engage in margin lending.

Profits from margin lending by large securities companies increased by 40-70% compared to the same period last year, while profits from investment activities rose by 25% year-on-year.

Notably, securities companies actively involved in bond underwriting and distribution (TCBS, ORS) witnessed significant profit increases from distribution, underwriting, and bond custody, with an average growth of 160% compared to the same period in 2023.

Securities companies with large stock investment portfolios (VCI, SHS, VDS) recorded substantial growth in investment profits in Q2 2024.

Given this development, in the second half of 2024, VIS Rating expects that profits from margin lending and investing in fixed-income assets will help securities companies maintain a stable ROAA, despite a decline in stock market values from the peak in Q1 2024.

LIQUIDITY RISK WELL MANAGED DESPITE CHALLENGES

Regarding the recent actions of some securities companies, VIS Rating believes that those focusing on bond underwriting and distribution still face high risks due to their increased investment in corporate bonds and buyback commitments for the bonds they distribute.

Some securities companies, such as TCBS, VPBANKS, and VNDirect, have increased their holdings of bonds issued by large enterprises and continue to broker buyback commitments for the bonds they sell to investors. VNDirect recorded overdue receivables in Q2 2024 from a large customer in the renewable energy field, which recently defaulted on bond principal and interest payments.

Therefore, margin lending to large customers could increase the risk for securities companies if they are forced to sell collateral during a market downturn, as witnessed in Q4 2022.

However, VIS Rating assesses that asset risks will gradually stabilize in the second half of 2024, as new bond defaults remain low. Additionally, the capital-raising plans announced in the first half of 2024 by several large securities companies and those affiliated with banks will help strengthen their risk buffers.

While securities companies have increased short-term borrowing to finance margin lending and investment activities, liquidity risk remains well-managed due to a large volume of liquid assets. With liquid assets like cash and certificates of deposit accounting for 30% of total assets, VIS Rating considers the industry’s liquidity risk manageable, despite the higher leverage.

Nevertheless, some companies, including KAFI, FTS, MBS, and VNDirect, which typically source 20-50% of their funding from institutional and individual customers, may face refinancing risks. Negative events could trigger a wave of withdrawals by these customers, potentially leading to liquidity issues for the securities companies.